Bulk Buys: Forrest targets ‘value over volume’ as he flags ramp up of African iron ore project

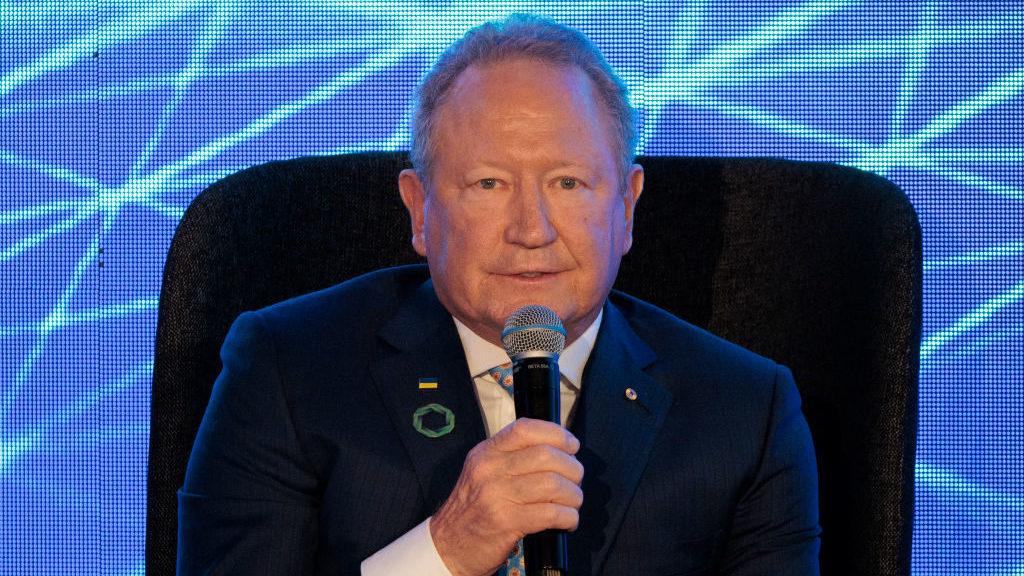

Pic: Brook Mitchell/Getty Images

- Fortescue Metals Group boss Andrew Forrest says green energy focused FMG will pursue value over volume in flagship iron ore business

- Actually also looking to increase volumes, with new high grade mine in Pilbara and African exploration push

- Coal miners shelter from accusations of doctored export certificates

Fortescue Metals Group’s (ASX:FMG) iconoclastic and bombastic executive chairman Andrew Forrest has revived the value over volume mantra once rolled out by the world’s biggest iron ore miners to characterise their chastened recovery from the mining downturn.

The $60 billion ASX 20 company paid little attention to its iron ore business, the world’s fourth largest, at its AGM in Perth yesterday.

The focus was all on Twiggy’s green energy arm Fortescue Future Industries and its aim to use green hydrogen and renewables to save the world from climate change.

But hidden in the margins were some tidbits on the future of the iron ore business.

Fortescue came to market over a decade ago, plugging a hole to deliver discounted lower grade iron ore for a hungry China rapidly growing its steel industry.

With the world’s largest manufacturer now hitting a plateau, that flight to quality has taken even larger precedence, even as falling margins for Chinese steel factories has seen discounts and premiums attached to lower and higher grade iron ore fines shrink.

FMG has its own expansion plans in train, the first concentrate from the 22Mtpa, US$3.6-3.8 billion Iron Bridge magnetite mine near Port Hedland is due to be shipped in the March quarter.

Fortescue last year topped a financial year record by shipping 189Mt into Asia, with plans to sell 187-192Mt this year.

It also has applications out with WA’s enviro department to increase its hematite shipping rate (not including Iron Bridge) to 210Mtpa and is exploring for high grade iron ore at the Belinga concession in West Africa’s Gabon (more on that later).

But Forrest said plans for the iron ore business, where it is spending US$6.2 billion to decarbonise its Pilbara mines by 2030, are not about growth.

Value over Volume?

“The recorded first quarter shipments of 47.5 million tonnes sets ourselves up for a cracking year, but we will not slavishly produce more and more tonnes, like our competitors seem hellbent on doing,” Forrest told shareholders.

“We’ll improve the value of each tonne, lower our operating costs, increase our margins and your profitability.”

That could be read as a knock on Vale, Rio and BHP, all three of whom have set modest growth targets for the coming years.

Vale has persistently fallen short of its stated aim of producing 400Mtpa, especially in the face of lower iron ore prices and weather issues earlier this year.

It is expected to produce 310-320Mt in 2022, but could fall short. Rio wants to ramp up from a maximum capacity of ~335Mt to 360Mt but has some debottlenecking to do and its new mines are largely replacement tonnes.

BHP has won approval to increase shipments through Port Hedland from 290 to 330Mtpa, but the latter is a longer term target, with more modest growth to 300Mt in its medium term planning.

Rio does have a big share in two of four blocks in a JV with Chinalco at Simandou in Guinea, regarded as the world’s largest and highest grade undeveloped hematite orebody.

FMG was rumoured to have bid for the other two blocks which the former government there awarded to a Chinese-backed consortium.

Instead it has centred its attention on the Belinga project in Gabon, which BHP walked away from in 2013 amid sagging iron ore prices.

Forrest was gushing about the project, which FMG is exploring and holds 80% of.

He says ties with the Gabon Government are good and a preliminary mining licence is close.

“I have to say ladies and gentlemen, I’ve walked over so many orebodies. This one, I’ve walked over and through the samples, I took home and tested … we’ve got the highest iron ore samples of my career,” Forrest said.

“The third mapping campaign is happening right now in country, and as we speak significant areas of new mineralisation have been identified already.

“Results are very promising and we plan to commence drilling early in 2023.

“So your Belinga project continues to surprise on the upside, we didn’t waste billions and billions of dollars to get 50% of 50%.”

Is Fortescue getting value over volume and, as Forrest claims, “leaving the ego behind”? We will wait on those drilling results with bated breath.

Out of Africa

FMG is not quite a first mover in Gabon, with Anglo American linked junior Genmin (ASX:GEN) announcing a “positive” PFS on the Baniaka deposit in inland Gabon last week.

Genmin has put a post-tax NPV of $601m and IRR of 38% on the developing a 5Mtpa operation at an initial capital cost of US$200 million.

That will be built off an indicated resource of 168Mt and maiden detrital iron and soft oxide probable ore reserve of 101Mt and could be mined at a cash cost of US$59/dmt including mine gate, road haulage, rail and port as well as transhipment costs.

The target is to enter production in mid-2024, with a final investment decision due in Q2 2023.

Utilising hydropower, Genmin says the mine would sell upgraded lump and fines out of free dig, contract mined open pits. There could be opportunities to expand further to 10Mtpa down the line if debt funding permits, and produce higher value products like pellets.

Genmin signed an agreement with Anglo American on an exclusive right to negotiate to provide up to US$75 million in finance, a 1% royalty on the first 75Mt sold from Baniaka and 100% of the offtake from Baniaka for a US$10m cash payment in July.

“Pivoting from the PFS, our target is to achieve first production in mid-2024,” Genmin MD Joe Ariti said.

“To this end, we will be supporting Anglo American in finalising its due diligence and negotiating documentation in respect of debt financing and offtake, completing the social and environmental impact assessment by the end of the year, and lodging a large-scale mining permit application.

“Concurrently, we also plan to complete several pre-development work streams like the detailed design and engineering of the processing facility that is already underway.”

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.025 | 0% | 0% | -58% | -55% | $ 11,650,682.08 |

| ADY | Admiralty Resources. | 0.008 | 0% | 0% | -43% | -47% | $ 10,428,633.22 |

| AKO | Akora Resources | 0.17 | -11% | -11% | -32% | -24% | $ 11,429,449.92 |

| BCK | Brockman Mining Ltd | 0.025 | 0% | 0% | -39% | -38% | $ 232,005,803.28 |

| BHP | BHP Group Limited | 43.48 | -1% | 14% | 4% | 33% | $ 217,576,992,880.20 |

| CIA | Champion Iron Ltd | 6.08 | 0% | 24% | -19% | 44% | $ 3,129,018,412.30 |

| CZR | CZR Resources Ltd | 0.015 | 20% | 7% | 2% | 120% | $ 57,198,801.57 |

| DRE | Dreadnought Resources Ltd | 0.094 | -6% | -6% | 135% | 100% | $ 295,076,308.90 |

| EFE | Eastern Resources | 0.043 | -7% | 10% | 10% | -43% | $ 49,846,832.07 |

| CUF | Cufe Ltd | 0.015 | -6% | -6% | -42% | -50% | $ 14,491,685.48 |

| FEX | Fenix Resources Ltd | 0.23 | -4% | -4% | -22% | 0% | $ 134,254,201.60 |

| FMG | Fortescue Metals Grp | 19.2 | -1% | 17% | -5% | 22% | $ 59,146,916,074.78 |

| FMS | Flinders Mines Ltd | 0.53 | 20% | 2% | 29% | -18% | $ 85,268,531.39 |

| GEN | Genmin | 0.21 | -16% | -16% | 5% | 31% | $ 59,490,448.50 |

| GRR | Grange Resources. | 0.78 | -3% | 8% | -50% | 64% | $ 879,577,410.48 |

| GWR | GWR Group Ltd | 0.064 | 3% | 3% | -51% | -36% | $ 20,557,865.92 |

| HAV | Havilah Resources | 0.315 | 2% | 11% | 11% | 66% | $ 102,907,743.25 |

| HAW | Hawthorn Resources | 0.092 | 7% | 2% | -23% | 5% | $ 30,683,436.40 |

| HIO | Hawsons Iron Ltd | 0.11 | -4% | 5% | -82% | 38% | $ 77,810,559.75 |

| IRD | Iron Road Ltd | 0.135 | 0% | 4% | -25% | -29% | $ 107,981,276.04 |

| JNO | Juno | 0.096 | 3% | -20% | -13% | -23% | $ 12,344,878.09 |

| LCY | Legacy Iron Ore | 0.018 | 13% | -10% | -25% | -23% | $ 115,322,871.58 |

| MAG | Magmatic Resrce Ltd | 0.093 | -15% | -19% | 37% | -5% | $ 25,486,732.61 |

| MDX | Mindax Limited | 0.059 | 0% | 0% | 0% | 26% | $ 115,533,663.12 |

| MGT | Magnetite Mines | 0.018 | 0% | -10% | -28% | -22% | $ 66,356,142.34 |

| MGU | Magnum Mining & Exp | 0.024 | -14% | -38% | -59% | -73% | $ 17,743,091.05 |

| MGX | Mount Gibson Iron | 0.435 | -6% | 10% | -36% | 13% | $ 528,272,409.86 |

| MIN | Mineral Resources. | 85.33 | 6% | 15% | 43% | 103% | $ 15,747,969,294.00 |

| MIO | Macarthur Minerals | 0.13 | -4% | 0% | -64% | -67% | $ 21,534,953.44 |

| PFE | Panteraminerals | 0.125 | -14% | 19% | -11% | -44% | $ 6,437,640.00 |

| PLG | Pearlgullironlimited | 0.02 | -20% | -26% | -58% | -78% | $ 1,098,046.16 |

| RHI | Red Hill Iron | 4.24 | 6% | 18% | 19% | 65% | $ 268,716,507.29 |

| RIO | Rio Tinto Limited | 105 | -1% | 15% | -3% | 14% | $ 38,580,501,121.02 |

| RLC | Reedy Lagoon Corp. | 0.012 | 9% | -8% | -56% | -73% | $ 7,246,549.86 |

| SHH | Shree Minerals Ltd | 0.009 | 0% | 20% | -14% | -10% | $ 11,146,382.03 |

| SRK | Strike Resources | 0.095 | -5% | -10% | -49% | -10% | $ 25,650,000.00 |

| SRN | Surefire Rescs NL | 0.012 | -8% | -8% | -68% | 0% | $ 18,976,361.72 |

| TI1 | Tombador Iron | 0.023 | 0% | -12% | -28% | -28% | $ 47,013,612.21 |

| TLM | Talisman Mining | 0.135 | 4% | 0% | -7% | -27% | $ 25,344,832.10 |

| VMS | Venture Minerals | 0.027 | 13% | 10% | -41% | -45% | $ 44,061,439.80 |

| EQN | Equinoxresources | 0.13 | 4% | 4% | -32% | -35% | $ 6,525,000.15 |

| AMD | Arrow Minerals | 0.0045 | -10% | -10% | 29% | -36% | $ 9,151,942.92 |

Have coal miners been duping customers for years?

Independent government MP Andrew Wilkie released a massive you-know-what storm with allegations under parliamentary privilege that a string of coal miners have been implicated in leaks from a coal executive alleging widespread testing rorts in the coal industry.

It follows on from revelations a couple years ago that testing lab ALS, which will not be pursued any further by regulators, had turned itself in after finding a host of doctored coal export certificates stretching back over more than a decade.

These export certificates tell power companies that the energy value of their coal is what they paid for, allowing exporters to sell at higher prices.

It also may suggest coal shipped overseas from Oz may have been ‘cleaner’ (higher CV and therefore lower emissions) than what it really was.

Unsurprisingly, the public defence has begun, with the debate coming at a particularly fraught time for the industry.

Coal miners have already joined with the Minerals Council in a bid to stop in their tracks suggestions of a super profits tax on the industry.

The Albanese Government has been thrust into opposition against the powerful mining lobby, which is expected to throw millions behind a PR campaign targeting its new IR laws, and efforts to claw cash or cap prices to address rising power and cost of living pressures.

Thermal coal prices are moving up again after a few weeks of declines, paying an eye-watering US$351/t. La Nina weather on Australia’s east coast has risen concerns of more supply hits in the Hunter Valley and elsewhere.

Whitehaven (ASX:WHC) has already knocked down FY23 guidance due to bad weather.

| CODE | COMPANY | PRICE | 1 WEEK RETURN % | 1 MONTH RETURN % | 6 MONTH RETURN % | 1 YEAR RETURN % | MARKET CAP |

|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.008 | 0% | 0% | -20% | -27% | $ 10,051,292.37 |

| CKA | Cokal Ltd | 0.185 | -3% | -18% | 28% | 12% | $ 178,875,306.20 |

| NCZ | New Century Resource | 1.105 | -1% | 3% | -47% | -51% | $ 157,151,727.79 |

| BCB | Bowen Coal Limited | 0.25 | -9% | -23% | -32% | 52% | $ 468,278,474.56 |

| SVG | Savannah Goldfields | 0.19 | -12% | -5% | -5% | -17% | $ 33,656,695.41 |

| GRX | Greenx Metals Ltd | 0.395 | 5% | 34% | 108% | 84% | $ 95,107,674.00 |

| AKM | Aspire Mining Ltd | 0.082 | 1% | -13% | -7% | 6% | $ 39,595,684.83 |

| AVM | Advance Metals Ltd | 0.012 | 0% | -14% | 9% | -33% | $ 5,784,528.83 |

| AHQ | Allegiance Coal Ltd | 0.053 | 2% | 0% | -87% | -88% | $ 47,770,516.92 |

| YAL | Yancoal Aust Ltd | 5.22 | 5% | -12% | -12% | 100% | $ 6,443,744,452.56 |

| NHC | New Hope Corporation | 5.77 | 8% | -22% | 45% | 193% | $ 4,745,358,844.80 |

| TIG | Tigers Realm Coal | 0.012 | -14% | -14% | -33% | -48% | $ 169,867,130.78 |

| SMR | Stanmore Resources | 2.51 | 2% | -9% | -7% | 156% | $ 2,190,357,526.14 |

| WHC | Whitehaven Coal | 9.11 | 11% | -13% | 73% | 280% | $ 7,853,259,386.05 |

| BRL | Bathurst Res Ltd. | 0.815 | -8% | -11% | -41% | 21% | $ 153,087,824.00 |

| CRN | Coronado Global Res | 1.995 | 9% | 8% | 5% | 112% | $ 3,218,791,161.60 |

| JAL | Jameson Resources | 0.105 | 0% | 62% | 42% | 22% | $ 41,108,665.50 |

| TER | Terracom Ltd | 0.935 | 21% | -7% | 34% | 405% | $ 719,566,441.20 |

| ATU | Atrum Coal Ltd | 0.007 | 17% | -13% | -27% | -75% | $ 9,679,156.70 |

| MCM | Mc Mining Ltd | 0.225 | 13% | 2% | 104% | 218% | $ 77,547,909.86 |

| DBI | Dalrymple Bay | 2.51 | 2% | 5% | 21% | 21% | $ 1,239,404,167.50 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.