Bulk Buys: Enthusiasm for coking coal could keep Glencore business whole

Pic: Getty Images

- Glencore will produce up to 21Mt of steelmaking coal in 2024 after completing its acquisition of Teck’s Elk Valley Resources

- In just a week, investors will find out whether Glencore plans to keep or demerge its coal assets

- Iron ore looks week, but MySteel thinks there are reasons to be optimistic in Chinese steel complex’s despair

Fresh off the US$7bn acquisition of a 77% stake in one of the world’s top coal businesses, Glencore is facing a fork in the road.

It has long been one of the world’s top thermal coal producers, most of that delivered by the $100 billion capped London-listed mining and trading giant’s network of Australian mines.

It will produce between 98-106Mt of the fossil fuel in 2024, weighted to the back half of the year after producing 47Mt in the first six months of 2024, down 7% on the same period in 2023.

Glencore produced just 3.4Mt of steelmaking coal, down 8% from a year earlier.

But that all changes with the Elk Valley transaction.

Teck’s high quality British Columbia coal mines made almost C$2.5bn in profit for the Canadian miner in the first half of 2024, ~2.5x the copper division that is so attractive to Teck and its potential suitors such as Rio Tinto (ASX:RIO).

Glencore will produce 19-21Mt of steelmaking coal in 2024 with the Elk Valley mines (12Mt in H2) in its stable.

Unlike thermal coal, they rake in premium prices associated with the tightly supplied high end of the steelmaking coal market.

The deal had been an attempt to make Glencore’s spinoff of a standalone coal business bulkier and more attractive.

But after engagement with shareholders, CEO Gary Nagle left the door open to an alternative outcome at next week’s interim results release.

“As announced earlier this month, post the acquisition of EVR, we are now in the process of consulting with shareholders to assess their views regarding the potential demerger of our coal and carbon steel materials business,” he said.

“We expect to be able to announce the outcome of such engagement and the decision of the Board regarding the potential demerger alongside our interim results next week.”

Pressure points

Analysts now view the demerger, long mooted as Glencore mulls how to reduce its CO2 emissions by 15% against a 2019 baseline by 2026, 25% by 2030 and 50% by 2035 en route to net zero in 2050, as unlikely.

Reuters said Jefferies, UBS and Bank of America analysts had all poured cold water on the idea.

“Investors appreciate the strong cash flow from coal, particularly if it is channelled to capital returns/buybacks,” BoA analysts said, as quoted by Reuters.

Glencore is facing pressure from multiple angles here.

Earlier this year influential mining fund manager Ben Cleary of Tribeca Global Natural Resources Fund (ASX:TGF), led an activist campaign for Glencore to both halt the demerger and shift its main listing to the ASX.

While diversified majors have long faced pressure to sell or demerge their coal assets – Rio, Vale and South32 (ASX:S32) have sold out of the space while BHP (ASX:BHP) has traded away its lower quality met coal and promised to run down its Mt Arthur thermal coal mine – the ESG shift has faced pushback from investors focused only on yield.

Battery metals have also proven fragile compared to steelmaking raw materials in the past couple years, with many of Glencore’s other major commodities like cobalt, zinc and nickel facing oversupplied markets, weaker than expected demand and sliding prices.

The addition of a higher proportion of coking coal in its product mix after the Elk Valley deal could prove crucial, with bankers and instos starting to take a more conciliatory approach to funding coking coal mines than thermal.

The idea of hiving off coal assets into separate vehicles has proven unpopular with green groups as well, given standalone coal miners have little motivation to rundown assets over time.

Front month premium hard coking coal futures were fetching US$218/t yesterday in Singapore while Newcastle grade thermal coal was paying US$140.10/t.

ASX coal stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | WEEK RETURN % | MONTH RETURN % | 6 MONTH RETURN % | YEAR RETURN % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.004 | 14% | 33% | -20% | -20% | -33% | $ 7,175,595.64 |

| CKA | Cokal Ltd | 0.085 | -1% | -7% | -19% | -26% | -29% | $ 94,947,510.24 |

| BCB | Bowen Coal Limited | 0.038 | -21% | -27% | -46% | -65% | -62% | $ 122,464,236.41 |

| SVG | Savannah Goldfields | 0.022 | -37% | 69% | -41% | -75% | -56% | $ 7,027,122.90 |

| GRX | Greenx Metals Ltd | 0.815 | -1% | -8% | -26% | -12% | -11% | $ 227,304,341.08 |

| AKM | Aspire Mining Ltd | 0.3 | 0% | -9% | 36% | 285% | 186% | $ 152,291,095.50 |

| AVM | Advance Metals Ltd | 0.027 | -7% | -7% | -21% | -79% | -27% | $ 3,520,723.52 |

| YAL | Yancoal Aust Ltd | 6.86 | 0% | 4% | 16% | 34% | 39% | $ 9,177,054,087.15 |

| NHC | New Hope Corporation | 4.7 | 1% | -4% | -11% | -12% | -9% | $ 3,998,436,744.72 |

| TIG | Tigers Realm Coal | 0.003 | -14% | 0% | -45% | -40% | -45% | $ 39,200,107.10 |

| SMR | Stanmore Resources | 3.62 | -2% | 2% | -8% | 27% | -10% | $ 3,407,260,376.52 |

| WHC | Whitehaven Coal | 7.63 | -4% | 0% | -8% | 9% | 3% | $ 6,383,263,981.92 |

| BRL | Bathurst Res Ltd. | 0.805 | -1% | -1% | -11% | -19% | -16% | $ 154,044,622.90 |

| CRN | Coronado Global Res | 1.355 | 6% | 14% | -16% | -19% | -23% | $ 2,321,888,416.05 |

| JAL | Jameson Resources | 0.06 | 0% | 62% | 82% | 18% | 33% | $ 29,343,847.32 |

| TER | Terracom Ltd | 0.205 | 3% | -7% | -42% | -51% | -51% | $ 164,198,078.18 |

| ATU | Atrum Coal Ltd | 0.004526 | 0% | 0% | 0% | 0% | 0% | $ 11,966,853.96 |

| MCM | Mc Mining Ltd | 0.14 | 0% | -7% | 0% | -15% | -7% | $ 57,961,868.86 |

| DBI | Dalrymple Bay | 3.03 | 0% | 2% | 9% | 9% | 13% | $ 1,507,115,467.68 |

| AQC | Auspaccoal Ltd | 0.096 | 1% | 23% | -4% | -36% | -4% | $ 50,711,087.78 |

Fortescue, hey

And now on to iron ore, where a 2.4% drop in Singapore prices to US$99.30/t was compounded by the sentiment shattering selldown of $1.9bn of Fortescue (ASX:FMG) stock by the Capital Group in a block trade.

No longer a substantial shareholder, the sale will raise concerns from investors institutions are no longer bullish on iron ore and at least specifically, the FMG story.

Andrew Forrest’s iron ore miner narrowly missed guidance last week and sunk 10.2% yesterday, the latest in a string of bad days for the company, which this month announced plans to cut 700 jobs after scaling back its green energy ambitions.

We’ll get a real flavour of the big end of town’s belief in iron ore and the Chinese steel market with Rio Tinto’s financial results this morning, coming hot on the heels of news it had approved major investments in the Simandou mine in Guinea, a high grade collection of iron ore deposits which could eventually export 120Mtpa and to which Rio Tinto alone will commit US$6.2bn in capital.

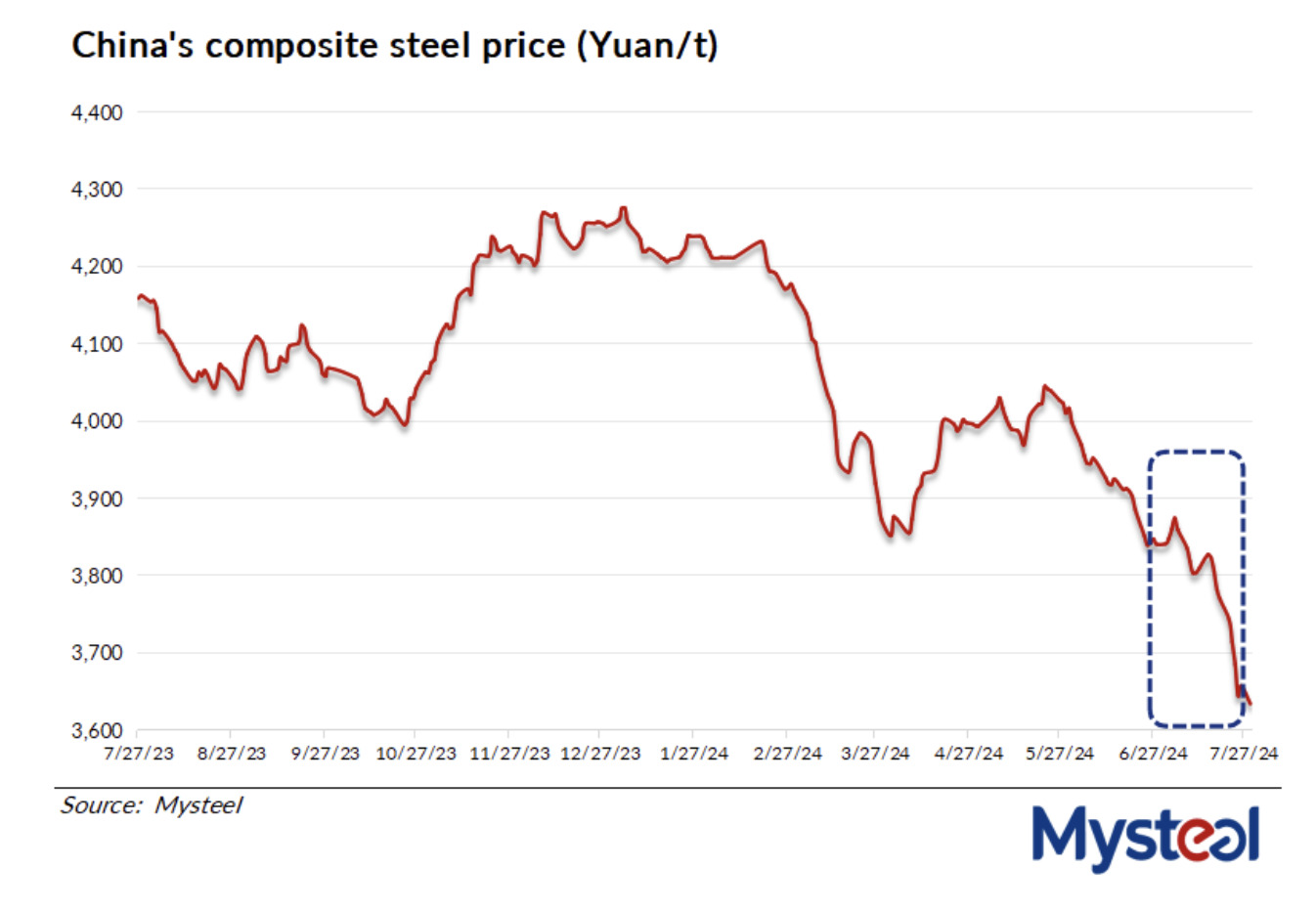

Composite steel prices in China recently hit their lowest level since April 2020, according to MySteel, falling 5.4% month on month to July 29.

Just 15.15% of blast furnace steel mills assessed by MySteel were making a profit at July 25, the worst result since mid-November 2022, the consultancy reported, with rebar producers losing an average of around US$57/t (418RMB).

But the price plunge is partly seasonal and partly government enforced. A lot of rebar is about to become non-compliant with regulatory standards, prompting an “everything must go” style sale featuring sick discounts from non-compliant producers.

Wet weather and heat has also cut into construction work.

But MySteel chief analyst Wang Jianhua thinks a production slowdown caused by weak prices could provide support for the steel sector, already dealing with a lame Chinese property market.

“In another way, pessimism isn’t all bad,” MySteel quoted Wang as saying. “The significant losses among steelmakers due to falling steel prices have prompted many to cut production, which will help alleviate the prolonged supply-side pressure.”

ASX iron ore stocks

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | WEEK RETURN % | MONTH RETURN % | 6 MONTH RETURN % | YEAR RETURN % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.007 | 0% | 0% | 0% | -36% | -13% | $ 3,311,890.98 |

| ADY | Admiralty Resources. | 0.012 | 9% | 9% | 71% | 100% | 71% | $ 19,553,687.28 |

| AKO | Akora Resources | 0.145 | -3% | -3% | 17% | -27% | -2% | $ 16,868,232.64 |

| BCK | Brockman Mining Ltd | 0.024 | 26% | 26% | -11% | -23% | -14% | $ 222,725,571.14 |

| BHP | BHP Group Limited | 41.54 | 0% | -3% | -12% | -9% | -18% | $ 213,359,301,471.19 |

| CIA | Champion Iron Ltd | 6.03 | 1% | -6% | -26% | 3% | -28% | $ 3,191,502,166.16 |

| CZR | CZR Resources Ltd | 0.25 | -6% | -12% | -19% | 72% | 19% | $ 58,933,661.50 |

| DRE | Dreadnought Resources Ltd | 0.0215 | -7% | 8% | 2% | -61% | -28% | $ 74,256,000.00 |

| EFE | Eastern Resources | 0.004 | -20% | -20% | -43% | -67% | -50% | $ 6,209,732.31 |

| CUF | Cufe Ltd | 0.01 | -17% | -29% | -55% | -33% | -29% | $ 16,040,098.38 |

| FEX | Fenix Resources Ltd | 0.435 | 12% | 38% | 63% | 40% | 53% | $ 302,158,795.20 |

| FMG | Fortescue Ltd | 18.28 | -14% | -15% | -38% | -16% | -37% | $ 62,656,936,081.30 |

| RHK | Red Hawk Mining Ltd | 0.785 | -9% | 5% | 27% | 79% | 33% | $ 163,845,412.78 |

| GEN | Genmin | 0.125 | -7% | -4% | -22% | -22% | -22% | $ 82,227,532.32 |

| GRR | Grange Resources. | 0.315 | -7% | -13% | -33% | -40% | -32% | $ 370,348,383.36 |

| GWR | GWR Group Ltd | 0.077 | -4% | -10% | -18% | 0% | -19% | $ 24,733,682.44 |

| HAV | Havilah Resources | 0.195 | -5% | 3% | 26% | -17% | 0% | $ 63,327,842.00 |

| HAW | Hawthorn Resources | 0.067 | -3% | 14% | -29% | -48% | -28% | $ 23,786,108.52 |

| HIO | Hawsons Iron Ltd | 0.021 | -19% | -25% | -42% | -45% | -55% | $ 22,363,030.10 |

| IRD | Iron Road Ltd | 0.082 | 9% | 6% | 24% | -8% | 22% | $ 64,905,717.55 |

| JNO | Juno | 0.03 | -3% | -17% | -67% | -61% | -73% | $ 5,458,357.80 |

| LCY | Legacy Iron Ore | 0.018 | 0% | 38% | 6% | -5% | 6% | $ 131,130,320.45 |

| MAG | Magmatic Resrce Ltd | 0.055 | -11% | -7% | 45% | -26% | 12% | $ 24,188,941.41 |

| MDX | Mindax Limited | 0.052 | 0% | 21% | 2% | -21% | -13% | $ 112,683,107.90 |

| MGT | Magnetite Mines | 0.27 | -8% | 2% | 4% | -38% | -13% | $ 27,595,175.58 |

| MGU | Magnum Mining & Exp | 0.014 | 8% | 8% | -22% | -69% | -50% | $ 11,331,059.64 |

| MGX | Mount Gibson Iron | 0.355 | -5% | -13% | -35% | -24% | -35% | $ 438,607,991.88 |

| MIN | Mineral Resources. | 51.98 | -4% | -4% | -15% | -28% | -26% | $ 10,612,004,616.00 |

| MIO | Macarthur Minerals | 0.06 | -6% | 5% | -52% | -70% | -52% | $ 9,807,521.92 |

| PFE | Panteraminerals | 0.026 | -16% | -21% | -55% | -65% | -50% | $ 10,991,774.62 |

| PLG | Pearlgullironlimited | 0.015 | -12% | 0% | -53% | -50% | -50% | $ 3,681,752.22 |

| RHI | Red Hill Minerals | 5.44 | -2% | 2% | 32% | 51% | 35% | $ 352,060,661.25 |

| RIO | Rio Tinto Limited | 114.66 | 1% | -4% | -13% | -2% | -15% | $ 43,012,822,716.18 |

| RLC | Reedy Lagoon Corp. | 0.0035 | 17% | 17% | -30% | -55% | -30% | $ 2,168,392.56 |

| CTN | Catalina Resources | 0.003 | 20% | 0% | 0% | -25% | -33% | $ 3,096,217.23 |

| SRK | Strike Resources | 0.035 | 0% | -4% | -8% | -48% | -29% | $ 9,931,250.00 |

| SRN | Surefire Rescs NL | 0.008 | 14% | 0% | -20% | -47% | -6% | $ 15,890,462.50 |

| TI1 | Tombador Iron | 0.014 | 0% | 0% | 0% | -33% | 0% | $ 30,218,753.22 |

| TLM | Talisman Mining | 0.255 | -2% | 2% | 24% | 55% | 9% | $ 47,080,087.25 |

| EQN | Equinoxresources | 0.3 | -3% | -8% | 13% | 150% | 0% | $ 37,667,500.92 |

| AMD | Arrow Minerals | 0.003 | 0% | 0% | -40% | -25% | -40% | $ 31,618,095.29 |

| CTM | Centaurus Metals Ltd | 0.34 | -6% | -21% | 13% | -60% | -36% | $ 181,118,719.55 |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.