Bulk Buys: BHP says green tech replacing property in bullish take on China steel market

Mining

Mining

Beset by activists, campaigned against by the Mining and Energy Union and lambasted by Norway’s sovereign wealth fund, BHP’s (ASX:BHP) Brisbane AGM went off with few fireworks yesterday, as investors backed the most controversial measure put to shareholders of the mining giant – its climate transition plan – alongside the formalities of signing off its executive remuneration and board appointments.

Despite flashpoints, including intense questioning on a $70 billion class action filed in UK courts on behalf of victims of the Samarco dam collapse – which this week BHP and its partner Vale said they had reached a US$31.7bn settlement with Brazilian authorities to be paid out by the JV and its participating companies – the voting showed little in the way of unhappiness from its large institutional and retail investor base.

For the purposes of Bulk Buys, we’re of course extremely interested interested in what chair Ken Mackenzie and CEO Mike Henry had to say on the steel market, critical to BHP’s iron ore and met coal businesses. It’s the third largest exporter of iron ore in the world from the WAIO business in the Pilbara and the largest shipper of seaborne steelmaking coal through its BMA assets in Queensland.

BHP thinks both will see continued demand despite concerns about the steel market in China, where only stimulus hopes seem to have propped up prices in the face of a lagging real estate sector and waning economic growth.

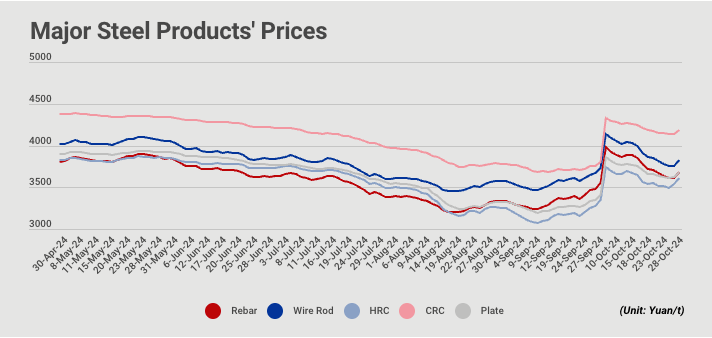

The latest stats from MySteel show prices for finished steel products in China, where almost 60% of the world’s crude output is delivered, have plateaued since a stunning bump in late September attributable to major stimulus measures delivered by the People’s Bank.

On the plus side capacity utilisation at blast furnaces has lifted from 84.45% last month to 90.73% this month, with electric arc furnace utilisation also back above 50%. Rebar production, according to MySteel, hit a year high in the week of October 17-23.

Longer term, BHP remains confident demand for iron ore has not merely walked out the door with China’s evacuating property sector.

“The vast majority of that iron ore is going to China and what’s interesting is this is the fifth consecutive year that China’s done more than 1Bt of steel,” Mackenzie said.

“It’s interesting what’s happened in the Chinese market in terms of where that steel’s going.

“A tiny fraction of that steel is being exported, it’s all going into domestic consumption and less and less of that steel’s going into housing.

“Probably five or six years ago that would have been 40% of steel consumption, now it’s probably 20% of steel consumption.

“What’s taken its place is actually a lot of green consumption, electric vehicles, solar panels, wind turbines, have sort of taken the place and China is dominant in that market.

“We’re pretty optimistic, there’s a mutual dependency between Australia and China. We need them and and they need us.

“They don’t have iron ore of the scale and quality that we have … we are still optimistic going forward and I have to say through all of the geopolitical turbulence of the last decade our relationships with our Chinese customers just continue to go from strength to strength.”

Meanwhile, chair Mackenzie said BHP had moved on from its bid for Anglo American, which would have netted its prized copper and met coal mines, despite reports this month that CEO Henry had flown into South Africa, where discussions with the country’s government would be key to securing a deal to merge with the company – 8% owned by the country’s public investment fund.

62% Fe iron ore prices remained stable yesterday, fetching US$103.90/t in Singapore.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | WEEK % | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| ACS | Accent Resources NL | 0.006 | 0% | 0% | -14% | -25% | -25% | $ 2,838,763.70 |

| ADY | Admiralty Resources. | 0.007 | 0% | -22% | 0% | 0% | 0% | $ 11,406,317.58 |

| AKO | Akora Resources | 0.14 | 4% | -10% | -7% | -12% | -6% | $ 16,868,232.64 |

| BCK | Brockman Mining Ltd | 0.014 | 0% | -7% | -42% | -52% | -50% | $ 129,923,249.83 |

| BHP | BHP Group Limited | 43.11 | 2% | -6% | 0% | -4% | -14% | $ 218,380,707,131.52 |

| CIA | Champion Iron Ltd | 5.89 | -4% | -20% | -18% | -16% | -30% | $ 3,057,680,905.90 |

| CZR | CZR Resources Ltd | 0.24 | -3% | -13% | -14% | 33% | 14% | $ 54,448,968.81 |

| DRE | Dreadnought Resources Ltd | 0.015 | -6% | -6% | -12% | -50% | -50% | $ 56,291,250.00 |

| EFE | Eastern Resources | 0.004 | 0% | 0% | -43% | -50% | -50% | $ 4,967,785.84 |

| CUF | Cufe Ltd | 0.008 | -11% | 0% | -43% | -33% | -43% | $ 10,693,398.92 |

| FEX | Fenix Resources Ltd | 0.27 | 4% | -8% | -4% | 17% | -5% | $ 194,566,838.40 |

| FMG | Fortescue Ltd | 19.19 | -3% | -7% | -26% | -14% | -34% | $ 59,916,657,304.28 |

| RHK | Red Hawk Mining Ltd | 0.695 | -5% | -11% | -1% | 11% | 18% | $ 138,868,977.91 |

| GEN | Genmin | 0.05 | 2% | -36% | -52% | -69% | -69% | $ 42,811,805.10 |

| GRR | Grange Resources. | 0.25 | -4% | -11% | -40% | -40% | -46% | $ 289,334,674.50 |

| HAV | Havilah Resources | 0.205 | -2% | 0% | -11% | -13% | 5% | $ 69,547,540.68 |

| HAW | Hawthorn Resources | 0.059 | 2% | -3% | -21% | -38% | -37% | $ 19,765,921.17 |

| HIO | Hawsons Iron Ltd | 0.021 | -5% | -19% | -40% | -60% | -55% | $ 21,346,528.73 |

| IRD | Iron Road Ltd | 0.065 | -3% | -7% | -17% | -8% | -3% | $ 54,088,097.96 |

| JNO | Juno | 0.027 | 4% | -13% | -56% | -66% | -75% | $ 4,912,522.02 |

| LCY | Legacy Iron Ore | 0.013 | 0% | 0% | -24% | -24% | -24% | $ 100,276,127.41 |

| MAG | Magmatic Resrce Ltd | 0.051 | -11% | -20% | -49% | -20% | 4% | $ 21,269,586.41 |

| MDX | Mindax Limited | 0.037 | 0% | -18% | 9% | -27% | -38% | $ 75,804,999.86 |

| MGT | Magnetite Mines | 0.165 | -6% | -13% | -39% | -56% | -47% | $ 19,032,943.55 |

| MGU | Magnum Mining & Exp | 0.012 | 20% | 0% | -20% | -48% | -57% | $ 9,712,336.84 |

| MGX | Mount Gibson Iron | 0.31 | -3% | -7% | -30% | -39% | -44% | $ 376,737,856.79 |

| MIN | Mineral Resources. | 36.08 | 0% | -31% | -50% | -40% | -48% | $ 7,271,188,348.00 |

| MIO | Macarthur Minerals | 0.055 | 6% | -8% | -27% | -64% | -56% | $ 10,981,603.05 |

| PFE | Panteraminerals | 0.024 | -14% | -10% | -35% | -59% | -52% | $ 9,096,641.06 |

| PLG | Pearlgullironlimited | 0.018 | 0% | -10% | -31% | -28% | -40% | $ 3,681,752.22 |

| RHI | Red Hill Minerals | 3.98 | -1% | 5% | -24% | 7% | -1% | $ 255,227,947.50 |

| RIO | Rio Tinto Limited | 120.31 | 2% | -7% | -8% | 2% | -11% | $ 44,954,283,515.40 |

| RLC | Reedy Lagoon Corp. | 0.002 | 0% | -33% | -33% | -50% | -60% | $ 1,523,413.35 |

| CTN | Catalina Resources | 0.003 | -14% | -25% | 0% | -25% | -33% | $ 4,953,947.57 |

| SRK | Strike Resources | 0.036 | 0% | 9% | -18% | -35% | -27% | $ 10,215,000.00 |

| SRN | Surefire Rescs NL | 0.005 | -17% | -29% | -50% | -66% | -41% | $ 9,931,539.07 |

| TI1 | Tombador Iron | 0.35 | 0% | 0% | 0% | 0% | 0% | $ 30,213,639.40 |

| TLM | Talisman Mining | 0.24 | -2% | -2% | -9% | 50% | 2% | $ 45,196,883.76 |

| EQN | Equinoxresources | 0.145 | -34% | -46% | -33% | -12% | -52% | $ 17,958,250.44 |

| AMD | Arrow Minerals | 0.002 | 0% | 0% | -60% | 0% | -60% | $ 26,047,255.57 |

| CTM | Centaurus Metals Ltd | 0.48 | 7% | 0% | 16% | 1% | -10% | $ 238,416,582.24 |

| LM1 | Leeuwin Metals Ltd | 0.073 | 0% | -13% | -3% | -71% | -48% | $ 3,420,171.98 |

| QXR | Qx Resources Limited | 0.005 | -17% | -29% | -64% | -80% | -78% | $ 5,550,389.27 |

| M4M | Macro Metals Limited | 0.009 | -40% | -61% | -47% | 157% | 125% | $ 32,607,962.30 |

| CLE | Cyclone Metals | 0.001 | 0% | 0% | 0% | -33% | -33% | $ 12,738,964.46 |

Whitehaven Coal (ASX:WHC), similarly, avoided any severe embarrassment at its AGM where it faced criticism from activist group Market Forces and proxy advisors over exec bonuses linked to growing coal output.

After a major strike to its remuneration report in 2023, which came off the back of a campaign from a London hedge fund against its $6.4bn acquisition of BHP’s Daunia and Blackwater coal mines in Queensland, WHC avoided a second strike that would have forced an embarrassing spill motion of its board.

Around 13% of shares were voted against the remuneration report this year. Share appreciation rights for MD Paul Flynn copped a ~41% vote against but still passed.

It came as the miner doubled down on its decision to bolster its portfolio and shift its production mix from mainly NSW thermal to half-half energy and met coal.

WHC boss Flynn told shareholders, citing estimates from analysis firms Wood Mackenzie and Commodity Insights, that there would be large imbalances in the years ahead as demand grows for both types of coal while a lack of investment in new deposits and approval risk stifles supply.

“Demand for seaborne high-CV thermal coal is forecast to grow by ~20% from 2024 to 2040, while supply falls by ~33% due to the limited expansion projects in the pipeline, resulting in a shortfall of around 139Mt by 2040,” Flynn said.

“With several large mines nearing their end of mine-life and underinvestment in development projects, volumes necessary to meet demand may no longer be available.

“This outlook is consistent with Whitehaven’s position that our high-quality NSW thermal coal operations remain strategically important to our business and indeed the world, and that they will continue to support global energy security for decades to come, particularly in Asia.

“A structural shortfall in the production of metallurgical coal for seaborne markets is also forecast. Commodity Insights forecasts demand for seaborne metallurgical coal to grow by ~22% from 2024 to 2040, while supply is expected to fall by ~8%, resulting in a 74 million tonne shortfall by 2040.

“Commodity Insights’ research is backed up by Wood Mackenzie, which also forecasts demand for seaborne metallurgical coal into Asia to grow by ~29% to 2050, with India’s demand to grow ~110%.”

Thermal coal is trading at around US$145/t, with premium hard coking coal futures at US$208/t.

Scroll or swipe to reveal table. Click headings to sort.

| CODE | COMPANY | PRICE | WEEK % | MONTH % | 6 MONTH % | YEAR % | YTD % | MARKET CAP |

|---|---|---|---|---|---|---|---|---|

| NAE | New Age Exploration | 0.006 | 0% | 0% | 71% | 9% | 0% | $ 10,763,393.46 |

| CKA | Cokal Ltd | 0.07 | -8% | -13% | -33% | -30% | -42% | $ 75,526,428.60 |

| BCB | Bowen Coal Limited | 0.008 | 14% | -33% | -86% | -93% | -92% | $ 23,443,917.62 |

| SVG | Savannah Goldfields | 0.022 | 5% | 5% | -21% | -61% | -56% | $ 5,902,783.24 |

| GRX | Greenx Metals Ltd | 0.795 | 4% | 18% | -10% | -15% | -14% | $ 222,507,516.06 |

| AKM | Aspire Mining Ltd | 0.265 | -17% | -12% | 29% | 244% | 152% | $ 134,523,801.03 |

| AVM | Advance Metals Ltd | 0.043 | 59% | 79% | 79% | -22% | 17% | $ 7,245,464.48 |

| YAL | Yancoal Aust Ltd | 6.56 | 1% | 7% | 18% | 32% | 33% | $ 8,767,717,861.68 |

| NHC | New Hope Corporation | 4.88 | -1% | -6% | 7% | -16% | -5% | $ 4,159,050,482.88 |

| TIG | Tigers Realm Coal | 0.003 | 0% | -25% | -33% | -40% | -45% | $ 39,200,107.10 |

| SMR | Stanmore Resources | 3.13 | 1% | -2% | -6% | -19% | -22% | $ 2,875,439,312.46 |

| WHC | Whitehaven Coal | 6.92 | 5% | -4% | -10% | -5% | -7% | $ 5,822,741,456.64 |

| BRL | Bathurst Res Ltd. | 0.7325 | -3% | -7% | -13% | -24% | -24% | $ 140,171,038.85 |

| CRN | Coronado Global Res | 1 | -5% | -17% | -20% | -43% | -43% | $ 1,651,306,924.05 |

| JAL | Jameson Resources | 0.05 | -22% | -12% | 61% | 22% | 11% | $ 31,147,399.42 |

| TER | Terracom Ltd | 0.17 | -15% | -17% | -31% | -60% | -60% | $ 136,164,259.95 |

| ATU | Atrum Coal Ltd | 0.004526 | 0% | 0% | 0% | 0% | 0% | $ 12,000,798.96 |

| MCM | Mc Mining Ltd | 0.125 | -4% | -14% | -22% | -4% | -17% | $ 59,514,418.88 |

| DBI | Dalrymple Bay | 3.35 | 1% | 4% | 20% | 24% | 25% | $ 1,640,971,117.77 |

| AQC | Auspaccoal Ltd | 0.135 | 8% | -15% | 60% | 0% | 41% | $ 90,592,460.24 |

Gina Rinehart and key lieutenant Gerhard Veldsman used her iron ore miner Roy Hill’s financial results to sink the boot, again, into politicians in an oft repeated claim that investment will head elsewhere if approvals timelines are not sped up.

It came as Roy Hill Holdings, 70% owned by Rinehart’s Hancock Prospecting, delivered a $3.2 billion NPAT after producing a record 64Mt of iron ore in FY24.

Veldsman said the mine would run out of life in the early 2030s without additional investment, timely and practical approvals.

“The threat of competition from other nations is real, particularly if they are able to operate with less government tape, less approvals systems, and less government cost burdens,” Rinehart said in her statement.

“Already the Minerals Council of Australia has warned that some 80 per cent of projects in the major projects pipeline will not proceed. This should be a wakeup call to all Australians. We should not take out standard of living for granted.”

These grandiose comments are par for the course with Hancock family releases, including renewed calls for the implementation of ‘special economic zones’.

According to The Australian, Hancock Prospecting has nabbed a $2.8bn payday on the Roy Hill results, with $4bn paid out to the mine’s owners, which also include POSCO (12.5%), Marubeni Corporation (15%) and China Steel Corporation (2.5%).

Last week Hancock’s wholly owned Atlas iron reported a $440m profit, but also saw the company defer a final investment decision on a magnetite project due to uncertainty around approvals and ground water access.

The miner will deliver its McPhee project later than expected in the second quarter of FY26 after receiving final approval on September 17, which came after what the company said were delays due to extended environmental and heritage approvals.

Roy Hill delivered a $2.7bn after tax profit in 2023.