Build Your Own Portfolio – Critical Minerals: Four experts say tuck these 12 stocks away

Picture: Getty Images

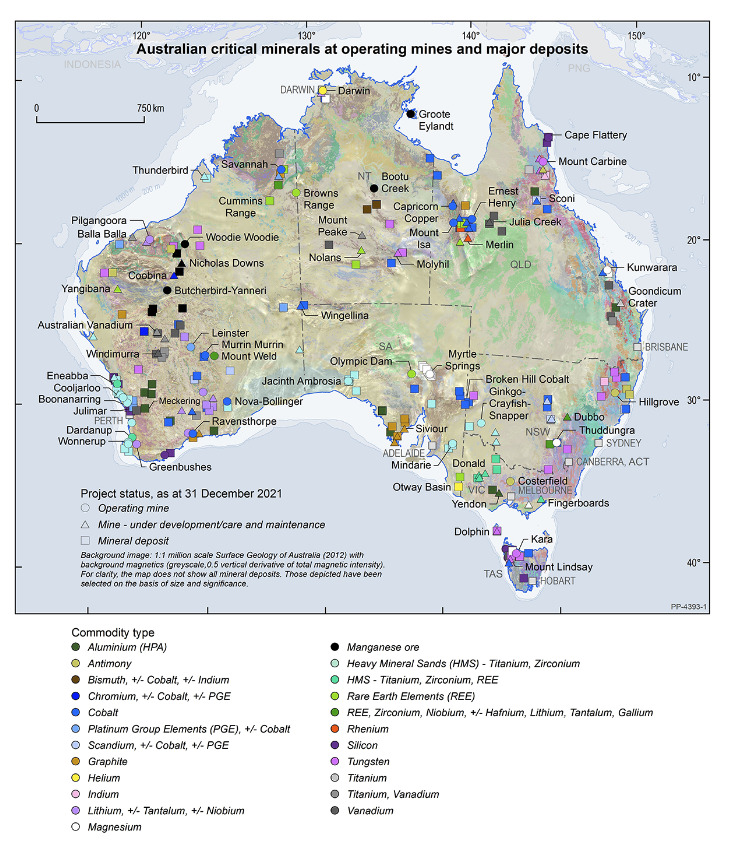

- Australia has a list of 26 critical minerals

- Critical minerals are minerals essential for modern-tech but supply chain is at risk

- There is also a growing awareness of minerals that aren’t critical but just as essential

In Australia, we have a list of 26 minerals that we regard as ‘critical’ which is best described by Geoscience’s Allison Britt as a mineral or element essential for modern technologies, economies, and even our national security – but the supply chain may be at risk.

“Different countries have different economic needs so they might have slightly different critical mineral vulnerabilities and the other interesting thing too is that these lists change over time,” she said.

“For example, new technologies that come online may require different minerals and so that changes the critical mineral needs.

“Another factor is when circumstances of the world change just like how we have seen recently with Russia’s invasion of Ukraine – that disrupts supply chains so in that instance minerals can become critical.”

It is also important to note that while Australia has a list of 26 ‘critical minerals’, there is a growing awareness of a whole bunch of minerals that are just as essential, like nickel and copper.

“Nickel and copper don’t strictly meet the definition of a critical mineral for some countries, mostly because their supply chains have been relatively stable until recently, but they are just as necessary,” Britt added.

According to John Mavrogenes, professor of economic geology at the Australian National University in Canberra, rare earths are becoming particularly critical for two reasons – their importance for magnets and batteries, and the fact that most of their supply is controlled by one country, China.

“Lithium is important as well but it is well distributed around the world, many countries have lithium so we are less worried about it being a monopoly.”

China currently controls about 85pc of global refined supply and that means a risk of supply pricing spikes.

“Control is what we are worried about and even though we are mining rare earths elsewhere, we are still mainly processing these minerals in China as well,” Mavrogenes said.

Australia is in a position where we have a lot of these minerals, and what we do them could make a big difference in terms of CO2 emissions globally and also for our economic security.

Stockhead asked four experts which critical mineral they are watching and why, plus their favourite stocks picks in the sector.

Reg Spencer

Mining analyst, Canaccord Genuity Group Inc

Critical mineral: lithium, second would be rare earths

Stock picks: Allkem, Firefinch, Piedmont Lithium

“Critical minerals is a bit of a misnomer – basically every mineral is critical in some way, shape or form, except probably gold,” Spencer said.

“All these metals have a utility, they are used for something and they are consumed whereas gold is dug up, melted down and is stuck back underground.

“I don’t necessarily like the term critical minerals, but if we think about that in the context of the minerals that are needed to facilitate the energy transition – things like copper, nickel, graphite, rare earths and lithium, lithium is my favourite.”

The transport sector currently contributes around 26pc of global carbon emissions – “if the world is going to achieve its decarbonisation goals, electrifying transport is a pretty easy way,” he said.

As well as EV batteries, lithium-ion batteries are also used in large-scale storage batteries and will play a key role in how quickly the world transitions to more renewable energy.

“As long as lithium-ion batteries are the predominant battery technology – and I can’t see anything on the horizon that is going to replace that in the near term – that kind of means we’re going to need a bucketload of lithium and that is why it’s my favourite critical mineral.”

Allkem (ASX:AKE)

Market cap: ~$6.9bn

AKE has two sizeable assets – a lithium brine and borax operation in Argentina and a hard-rock operation in Australia.

Spencer said by 2025, the company will be one of the world’s five largest lithium chemical producers.

“It has some of the best volume growth in the sector, it has excellent geographic and product diversification, it is currently in an earnings upgrade cycle because they’ve changed the way in which they sell their product, which means they get better pricing.

“And compared to its peers, it trades on substantially lower multiples.”

Firefinch (ASX:FFX)

Market cap: ~$271b

In the next few weeks Firefinch will be de-merging its lithium assets into a company called Leo Lithium whose portfolio includes the Goulamina lithium project in Mali.

Goulamina will be one of the largest hard rock lithium mines in the world once it enters production in 2024.

“The pricing and structure of that demerger would see a very, very attractive valuation being put on the lithium business,” Spencer said.

“But not only that, today if you are buying Firefinch you also get a goldmine in Mali that is currently ramping up, so FFX is attractive because it’s a very appealing valuation situation.”

Piedmont Lithium (ASX:PLL)

Market cap: ~$1.6bn

Piedmont has three key projects – a development asset in North Carolina called the Carolina Lithium Project and they have two offtakes on other spodumene projects in Canada and Ghana in Africa.

“The company’s capped at about $1.6 billion and that basically means that you are getting either the offtakes for free and those offtakes would help support the development of their own lithium conversion facility, or you’re getting the North Carolina project for free.

“So again, this is the market missing evaluation arbitrage in the stock – the sum of the parts is significantly greater than the whole.”

Ali Ukani

Sustainability and ESG Investments, Peak Asset Management

Critical mineral: graphite

Stock picks: Volt Resources, Castle Minerals, Metals Australia

“Graphite is the undervalued one of the lot, lithium has had quite a significant run – in fact prices are so high that they are forecast to cause massively supply chain issues and market contraction but when we look at graphite, it forms the largest component of the lithium-ion battery.

“It also has a variety of other applications in the aerospace, defence, and construction sectors.

“I think graphite is the one with the most runway.”

Volt Resources (ASX:VRC)

Market cap: ~$55m

“What you want to look at from an investor’s perspective is look at companies who have high-grade, high-quality graphite resources in cooperative jurisdictions that can be brought into production in the near term.

“If you look at VRC, they’ve got the Bunyu Graphite Project which is one of the largest, highest-grade resources over there.”

Castle Minerals (ASX:CDT)

Market cap: ~$26m

Castle owns the Kendenup Graphite Project in Ghana, where the company holds a substantial and contiguous tenure position in the country’s Upper West region.

The project area is also host to the open-ended Kambale graphite project for which test work on near-surface samples produced a 96.4% total carbon fine flake graphite concentrate.

Metals Australia (ASX:MLS)

Market cap: ~$24m

Metals Australia owns the Lac Rainy Graphite Project in Quebec, Canada, which returned high-purity flake concentrate results up to 96.8pc total graphitic carbon (TGC) during the quarter.

ProGraphite GmbH has been engaged to conduct downstream testwork targeting 99.9pc TGC purification grade followed by battery testwork to determine the quality of the Lac Rainy graphite products for use in lithium-ion battery applications in the EV industry.

With the US set to become a big consumer of graphite, Ukani said the company is well positioned geographically speaking to leverage the natural offtake partners which will pop up in North America.

Tony Locantro

Investment manager, Alto Capital

Critical mineral: copper

Stocks: Eagle Mountain, Stavely Mining, Maronan Metals

Around 83kg of copper is used for each electric vehicle and 63kg of copper is used for plug-in hybrid vehicles.

“I look at which commodity has the best value share prices and there are good emerging copper companies that are undervalued,” he said.

“Lithium stocks are way overpriced – they are going to go broke, if you back to 2018 a lot of these lithium stocks lost 80% from their highs.

“I’m not jumping on that bandwagon, it is too late – copper stocks offer better value.”

Eagle Mountain (ASX:EM2)

Market cap: ~$110m

EM2 owns the Oracle Ridge Copper Project in Arizona and is focused on supplying the rapidly growing green energy market.

“They have a 17Mt resource in Arizona, which is backed by renowned mining entrepreneur Charlie Bass – he is best known as a co-founder and major shareholder of Aquila Resources,” Locantro said.

Stavely Mining (ASX:SVY)

Market cap: ~$82m

SVY has two cornerstone assets in Victoria, Australia within the Stavely Volcanic Belt – the Stavely and Arata Projects.

At Stavely, its Thursday’s Gossan holds an inferred mineral resource of 28Mta at 0.4% copper for 110,000t of contained copper.

“They also have the Caley Lode, which they have drilled extensively and are expecting a mineral resource estimate in early June and scoping study in July,” Locantro said.

Maronan Metals (ASX:MMA)

Commenced trading on the ASX back in April after its $15m IPO

The Red Metals spinout is focused on its namesake lead-silver-copper-gold project in Queensland, which has an existing 2 million tonne lead, 105Moz silver, 170,000t copper and 300,00oz gold resource.

MMA plans to drill for additional shallow, copper-gold, and lead-silver mineralisation as well as the potentially larger, higher-grade copper-gold and lead-zinc-silver extensions at depth.

“This is my preferred exploration story in Australia,” Locantro said.

“The resource – it is a great resource now but if they can extend it, it could turn into one of Australia’s largest undeveloped resources.”

Jessica Amir

Market strategist, Saxo Bank

Critical Mineral: lithium

Favourite stocks: Albemarle Corporation, Sociedad Química y Minera de Chile, Allkem, Pilbara Minerals

“I like lithium and the reason for that is because it is a key component in the electrification for electric vehicles as well as the household devices we rely upon such as laptops and mobile phones – a lot of people forget that.

“You only have to look at the ASX 200 and 300 to see the next group of companies that were added – 11 of those were lithium companies and many of those aren’t in production and come into production in 2024,” Amir said.

“And given the headwinds in the space, we are liking the larger companies who already have sales agreements in place because it’s the companies with the largest strongest balance sheets that will be able to weather the storm and continue to see share price earnings growth.”

Albemarle (NYSE: ALB)

Market cap: ~$28bn

“In the US you’ve got the world’s largest which is Albemarle; they have upgraded their earnings forecast twice in May, which is a really good indicator and kind of takes away the bad story that we’ve seen from Goldman Sachs and Morgan Stanley downgrading the lithium price for 2023.”

Sociedad Química y Minera de Chile (NYSE: SQM)

Market cap: ~$26.6bn

“I guess you could say I’m quite bullish on SQM and that is because it is not just in lithium but in fertilisers as well.

“If we pivot to the ASX the two largest that we like are Pilbara Minerals (ASX:PLS) and Allkem (ASX:AKE) – these are companies with growing earnings.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.