Broker tips big things from Nova and its Alaskan gold play

Getty Images

Special Report: Nova Minerals can expect its market valuation to increase substantially as it delineates additional resources and progresses development studies at its Estelle Gold Project in Alaska, according to a new research report.

Sydney-based broker Evolution Capital Advisors, which produced the report, has put a price target of 20c on Nova (ASX: NVA), almost four times its current value, saying that there were multiple catalysts looming for the stock including drilling results, resource upgrades and potential new discoveries.

“While it is still early days for NVA, we can see a relatively low risk, high growth potential for the value of the company,” Evolution said. “Subject to further likely exploration success, our price target is supported by the current market value of peer companies.”

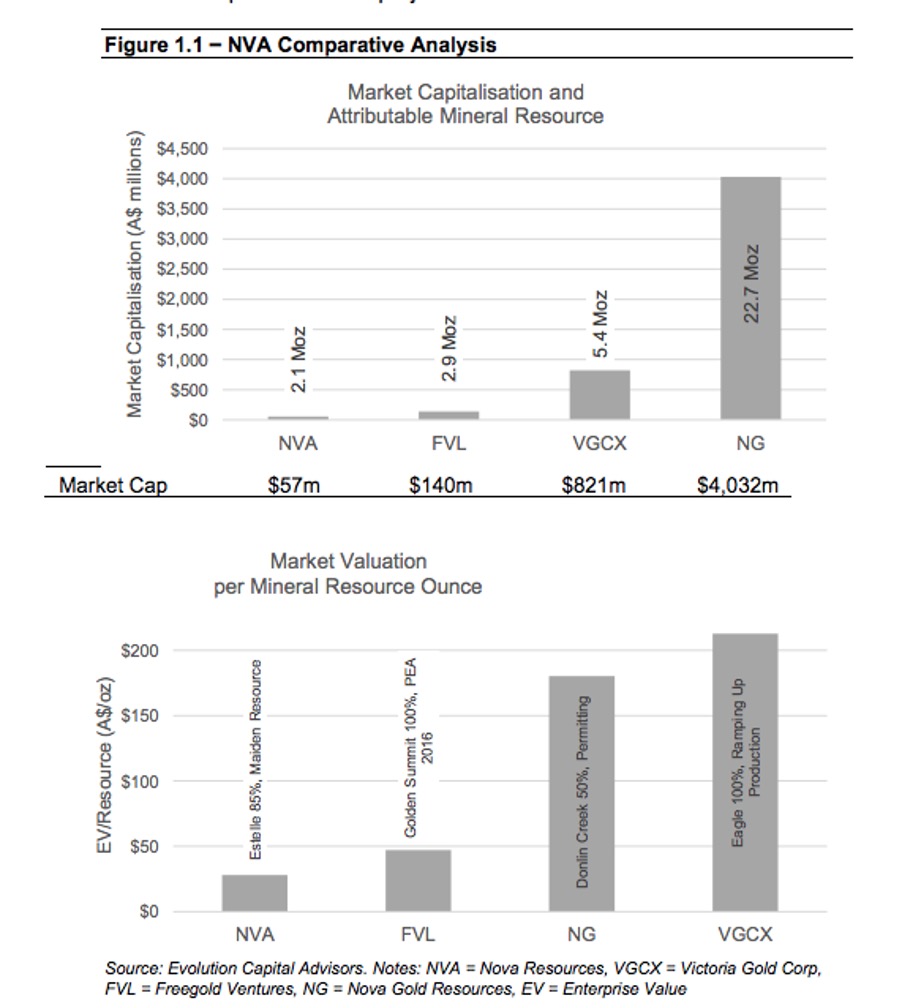

In reaching the price target, the broker conducted a comparison with other companies with assets on Alaska’s Tintina Belt that have similar geology and mineralisation to Estelle and with expected similar project economics.

The analysis included North American companies Freegold Ventures, which owns 100% of the 2.9Moz Golden Summit project; Victoria Gold Corp, which owns 100% of the 5.4Moz Eagle Project; and Nova Gold, a 50% partner in the 45Moz Donlin Creek project.

As seen in the charts below, it showed a clear correlation between market capitalisation and resource size and between enterprise value per resource ounce and progress towards production/stage of project studies.

Nova currently owns 85% of Estelle, where the Korbel deposit hosts a shallow inferred resource of 2.5 million ounces. The company expects to upgrade the resource, while there are an additional 14 known targets within the camp ready to test with drilling.

“The Nova market valuation should increase substantially with the delineation of additional resources and the progress of development studies,” Evolution said.

“Over the next 12 months, the company has the opportunity to at least double the mineral resource at Korbel (and increase its confidence level), delineate additional resources at RPM and discover some new deposits while confirming project economics.”

Evolution pointed to Victoria Gold Corp’s Eagle operation, which started production in September 2019, as a guide for project economics for a future mine development at Korbel or other deposits discovered at Estelle.

Key features of the Eagle feasibility study included a reserve of 3.15Moz at 0.66 g/t Au, a strip ratio of 0.9:1, recovery rate of 76.9%, production of 210,000 ounces per annum at an all-in sustaining cost of US$775/oz, capex of US$365 million and an NPV at a 5% discount rate of US$756 million using a gold price of US$1300/oz.

“It is not so much about the grade, but rather the full set of physical and financial parameters delivering the project economics,” the broker said.

“Low grade bulk mining projects can deliver long-life, low-cost, low-risk mining operations appreciated by majors and mid-caps or can be company makers.”

Nova recently secured up to $6 million in funding through highly regarded fund manager and shareholder Collins St Asset Management and can expect a further injection of about $14 million from the imminent exercise of listed options that expire on 31 August 2020 and are well in the money.

This level of funding will allow the company to accelerate its exploration programs and start to consider development studies.

This story was developed in collaboration with Nova Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.