Bringin’ TSXy Back: Canada’s top mining and exploration stocks for 2023

Picture: Александр Ирбэ, iStock / Getty Images Plus

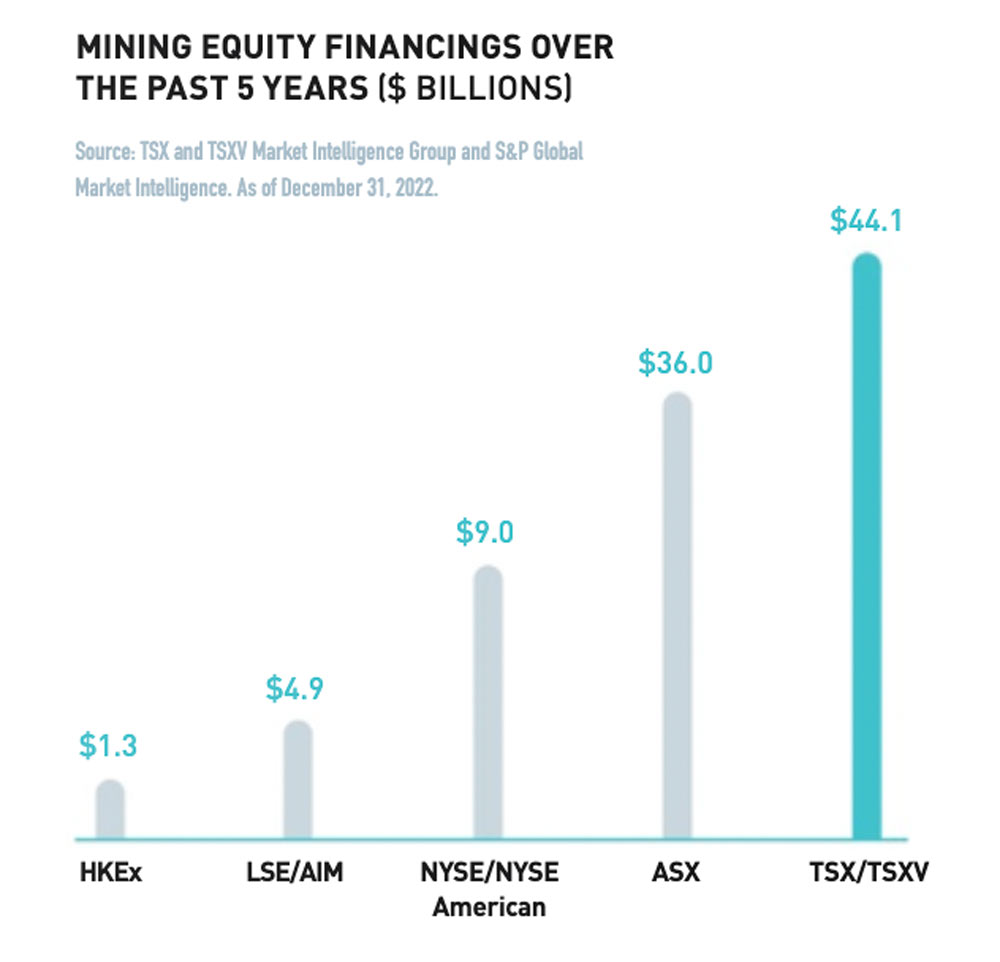

The TSX and the TSX/V (V stands for ‘venture’) are a fertile breeding ground for mining and exploration stocks.

In fact, they are home to more resource companies – 40% — than any other market in the world, including the ASX.

The ASX has ~650 mining and exploration stocks. On the TSX/TSXV that number is closer to 1200.

This is resources speccy heaven, unknown outside a few of the biggest names to most investors in Australia.

How can Aussies invest on the TSX?

If you want to buy Canadian shares from Australia, you’ll need to sign up with a broker that has access to the Canadian market – simple as that.

Many licensed brokers in Australia have direct trading access to the TSX, and the process of opening an account is fairly quick and easy.

At the moment, brokers providing that service include CommSec, Westpac Trading, IG, Saxo Markets, and CMC Markets.

These brokers allow you to open CAD brokerage accounts, and you can practically trade on day one after funding your account.

Who’s hot on the TSX?

Only 12 resources stocks on the ASX have made gains of more than 100% year-to-date.

Meanwhile, the Canadians boast over 52 baggers, all coming from the TSX/V.

TSX Top 50 2023

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| CODE | COMPANY | YEAR TO DATE RETURN | 12 MONTH RETURN | SHARE PRICE | MARKET CAP |

|---|---|---|---|---|---|

| CXB | Calibre Mining Corp. | 79% | 50% | 0.0161 | $752,113,382 |

| XAM | Xanadu Mines Ltd | 76% | 96% | 0.051 | $83,529,035 |

| SMT | Sierra Metals Inc. | 66% | -65% | 0.0039 | $64,191,297 |

| PPTA | Perpetua Resources Corp. | 63% | 67% | 0.0643 | $425,511,487 |

| NHK | Nighthawk Gold Corp. | 62% | 20% | 0.006 | $73,040,509 |

| COG | Condor Gold plc | 54% | -6% | 0.0047 | $94,011,229 |

| TNX | TRX Gold Corporation | 53% | 82% | 0.0069 | $207,667,479 |

| CGG | China Gold International Resources Corp. Ltd. | 49% | 51% | 0.0589 | $2,374,518,381 |

| FDY | Faraday Copper Corp. | 48% | 10% | 0.008 | $147,205,231 |

| DPM | Dundee Precious Metals Inc. | 47% | 32% | 0.096 | $1,870,820,955 |

| EQX | Equinox Gold Corp. | 47% | -7% | 0.0652 | $2,138,920,156 |

| FVL | Freegold Ventures Limited | 44% | 75% | 0.0064 | $272,674,365 |

| ARA | Aclara Resources Inc. | 42% | -5% | 0.00455 | $73,450,431 |

| CMMC | Copper Mountain Mining Corporation | 41% | -3% | 0.0241 | $521,772,678 |

| WRX | Western Resources Corp. | 40% | -21% | 0.00295 | $122,547,144 |

| GMTN | Gold Mountain Mining Corp. | 40% | -77% | 0.00175 | $14,941,883 |

| NCF | Northcliff Resources Ltd. | 40% | -22% | 0.00035 | $8,950,279 |

| MIN | Excelsior Mining Corp. | 39% | -4% | 0.0023 | $65,143,027 |

| CCM | Canagold Resources Ltd. | 39% | -14% | 0.0025 | $34,906,796 |

| ORA | Aura Minerals Inc. | 36% | 19% | 0.108 | $787,551,040 |

| MNO | Meridian Mining UK Societas | 35% | -36% | 0.0046 | $111,429,700 |

| LN | Loncor Gold Inc. | 35% | -11% | 0.00405 | $60,491,950 |

| PRB | Probe Gold Inc. | 35% | -6% | 0.0171 | $274,895,927 |

| ERO | Ero Copper Corp. | 34% | 71% | 0.25 | $2,315,576,306 |

| CNT | Century Global Commodities Corporation | 33% | -43% | 0.001 | $9,850,458 |

| NGD | New Gold Inc. | 33% | 7% | 0.0177 | $1,216,892,841 |

| AKE | Allkem Limited | 33% | 27% | 0.1365 | $8,606,595,412 |

| MUX | McEwen Mining Inc. | 32% | 65% | 0.1054 | $504,155,219 |

| OR | Osisko Gold Royalties Ltd | 32% | 57% | 0.2159 | $4,126,739,456 |

| LUG | Lundin Gold Inc. | 30% | 73% | 0.1715 | $4,122,051,718 |

| SGQ | SouthGobi Resources Ltd | 29% | 22% | 0.0022 | $67,902,160 |

| SMC | Sulliden Mining Capital Inc. | 29% | -40% | 0.00045 | $5,772,420 |

| GATO | Gatos Silver, Inc. | 28% | 88% | 0.0711 | $493,818,273 |

| NCM | Newcrest Mining Limited | 28% | 10% | 0.2418 | $22,257,402,920 |

| TXG | Torex Gold Resources Inc. | 27% | 58% | 0.1976 | $1,721,909,159 |

| LUN | Lundin Mining Corporation | 26% | 3% | 0.1048 | $8,074,119,052 |

| AR | Argonaut Gold Inc. | 25% | -49% | 0.0065 | $545,242,453 |

| K | Kinross Gold Corporation | 25% | 25% | 0.069 | $8,715,697,443 |

| AGI | Alamos Gold Inc. | 25% | 90% | 0.1711 | $6,826,900,760 |

| ELD | Eldorado Gold Corporation | 25% | 38% | 0.1416 | $2,704,907,549 |

| MARI | Marimaca Copper Corp. | 24% | 3% | 0.04 | $357,316,528 |

| WPM | Wheaton Precious Metals Corp. | 22% | 27% | 0.6459 | $29,988,718,275 |

| FURY | Fury Gold Mines Limited | 21% | -7% | 0.007 | $101,883,216 |

| LAC | Lithium Americas Corp. | 20% | 2% | 0.3092 | $4,932,571,316 |

| CCO | Cameco Corporation | 20% | 25% | 0.3683 | $15,887,950,942 |

| VGCX | Victoria Gold Corp. | 20% | -33% | 0.0858 | $590,825,029 |

| ERD | Erdene Resource Development Corporation | 19% | -9% | 0.0034 | $117,096,129 |

| TLG | Troilus Gold Corp. | 19% | -15% | 0.0056 | $128,308,329 |

| CS | Capstone Copper Corp. | 18% | 23% | 0.0582 | $4,120,514,029 |

| VGZ | Vista Gold Corp. | 18% | -15% | 0.008 | $95,782,059 |

TSX/V Top 50 2023

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| CODE | COMPANY | YEAR TO DATE RETURN | 12 MONTH RETURN | SHARE PRICE | MARKET CAP |

|---|---|---|---|---|---|

| FIN | European Energy Metals Corp. | 589% | 77% | 0.0062 | $12,232,875 |

| NOAL | NOA Lithium Brines Inc | 500% | 500% | 0.006 | $55,281,804 |

| IXI | Indigo Exploration Inc. | 371% | 230% | 0.00165 | $9,184,879 |

| FTJ | Fort St. James Nickel Corp. | 350% | 13% | 0.00135 | $3,273,515 |

| THM | Thunder Mountain Gold, Inc. | 340% | 10% | 0.0011 | $6,694,114 |

| VLT | Volt Lithium Corp. | 336% | 249% | 0.0048 | $45,749,646 |

| DLTA | Delta Resources Limited | 325% | 292% | 0.0051 | $37,456,699 |

| HMR | Homerun Resources Inc. | 300% | 105% | 0.004 | $19,902,346 |

| MLY | Multi-Metal Development Ltd. | 300% | -20% | 0.0004 | $10,054,388 |

| TCO | Transatlantic Mining Corp. | 275% | 400% | 0.00075 | $5,631,595 |

| IMM | International Metals Mining Corp. | 253% | 50% | 0.003 | $4,838,219 |

| MSR | Minsud Resources Corp. | 246% | 227% | 0.009 | $147,501,625 |

| STUD | Stallion Discoveries Corp. | 245% | 41% | 0.0038 | $32,810,938 |

| GLAD | Gladiator Metals Corp. | 235% | 235% | 0.0067 | $19,667,628 |

| LG | Lahontan Gold Corp. | 217% | 6% | 0.0019 | $23,050,401 |

| WMK | Whitemud Resources Inc. | 214% | 120% | 0.0011 | $3,742,893 |

| DYG | Dynasty Gold Corp. | 200% | 93% | 0.0027 | $16,042,057 |

| PE | Pure Energy Minerals Limited | 172% | 6% | 0.0106 | $32,033,176 |

| COR | Camino Minerals Corporation | 171% | 58% | 0.00095 | $18,199,657 |

| AALI | Advance Lithium Corp. | 167% | 100% | 0.0004 | $3,340,659 |

| RML | Rusoro Mining Ltd. | 160% | 100% | 0.0013 | $62,140,169 |

| PMX | ProAm Explorations Corporation | 150% | -29% | 0.0005 | $875,987 |

| QCX | QCX Gold Corp. | 150% | 25% | 0.0005 | $3,279,316 |

| EML | Electric Metals (USA) Limited | 146% | 25% | 0.00345 | $50,229,028 |

| MTU | Manitou Gold Inc. | 140% | 100% | 0.0006 | $22,396,906 |

| MQM | Metalquest Mining Inc. | 140% | 92% | 0.0012 | $3,364,349 |

| OLV | Olivut Resources Ltd. | 140% | 9% | 0.0006 | $4,130,437 |

| MAC | Themac Resources Group Limited | 140% | 0% | 0.0006 | $4,764,007 |

| PMET | Patriot Battery Metals Inc. | 139% | 572% | 0.1579 | $1,480,934,723 |

| DLP | DLP Resources Inc. | 135% | 116% | 0.0054 | $49,602,440 |

| AMMO | Bullet Exploration Inc. | 133% | -36% | 0.00035 | $749,576 |

| OOR | Opus One Gold Corporation | 133% | -13% | 0.00035 | $5,518,482 |

| AMO | Altan Rio Minerals Limited | 129% | -20% | 0.0008 | $7,416,692 |

| BRG | Brigadier Gold Limited | 129% | 433% | 0.0008 | $9,219,175 |

| GLI | Glacier Lake Resources Inc. | 129% | -47% | 0.0008 | $1,732,204 |

| VRR | VR Resources Ltd. | 129% | -14% | 0.0024 | $18,389,259 |

| CNL | Collective Mining Ltd | 126% | 83% | 0.0577 | $337,289,025 |

| ZBNI | Zeb Nickel Corp. | 125% | -22% | 0.0018 | $10,574,247 |

| CUI | Currie Rose Resources Inc. | 120% | 22% | 0.00055 | $9,598,888 |

| BLUE | Blue Thunder Mining Inc. | 113% | -47% | 0.0005 | $1,849,782 |

| SMRV | Smooth Rock Ventures Corp. | 113% | -15% | 0.00085 | $2,467,479 |

| CN | Condor Resources Inc. | 111% | 48% | 0.002 | $24,107,639 |

| RBZ | Arya Resources Ltd. | 110% | 91% | 0.00105 | $2,668,049 |

| NGEX | NGEx Minerals Ltd. | 108% | 147% | 0.0642 | $1,115,777,854 |

| HSTR | Heliostar Metals Ltd. | 108% | 138% | 0.005 | $70,931,334 |

| AORO | Aloro Mining Corp. | 100% | 0% | 0.0004 | $2,309,171 |

| DHR | Discovery Harbour Resources Corp. | 100% | -60% | 0.0001 | $945,093 |

| FGC | Frontline Gold Corporation | 100% | 0% | 0.0002 | $2,617,073 |

| NEW | New Target Mining Corp. | 100% | 7% | 0.0015 | $1,797,952 |

| PPM | Pacific Imperial Mines Inc. | 100% | -11% | 0.0004 | $2,372,324 |

Canada’s Top Speccies for 2023 (+CAD$10m MC)

EUROPEAN ENERGY METALS (TSX.V:FIN)

The explorer formerly known as Hilo Mining recently inked a farm-in deal over five lithium and rare earths projects in Finland.

FIN can earn up to 80% of these projects (or reservations), which cover a total area of 2,300 square kilometres.

Four of the reservations (Nabba, Lappajarvi W, Lappajarvi E and Kaatiala) lie immediately adjacent to, and to the south of, Keliber Oy’s advanced spodumene mine development project in the Kaustinen district.

Congratulations to our neighbour in Finland! – Stillwater lays foundation stone for Keliber lithium plant – Mining Magazine #Lithium #HardRock $FIN.V https://t.co/AjF1Agy4U5

— European Energy Metals (@FIN_TSXV) May 13, 2023

NOA LITHIUM BRINES (TSX.V:NOAL)

Lithium News

Activity is heating up in the lithium space! Allkem and Livent, major players in the same area of Argentina as @NOAlithium, announced a major merger last week. Click here to read more: https://t.co/EZFKKIjWfq #NOA #NOAL.V #Lithium pic.twitter.com/4VrGoJl60d

— NOA Lithium Brines Inc. (TSXV: NOAL) (@NOAlithium) May 15, 2023

NOA listed on the TSXV in March at $0.30 per share following a reverse takeover. All its projects are in the heart of the prolific Lithium Triangle, in the mining friendly province of Salta, Argentina.

NOA now boasts one of the largest lithium brine claim portfolios in this region not owned by a producing company, with key positions on three prospective salars: Rio Grande, Arizaro, Salinas Grandes.

The flagship is Rio Grande, where drilling is now underway. It has also bolstered the size of Arizaro via acquisition of the Nevasca project, where surrounding explorers are having success.

Recently, Lithium Chile, adjacent to NOA’s claims, drilled down to below 500m within a brine aquifer, intercepting grades up to 555mg/l lithium in brines.

Geophysical studies indicate the indicate the basement of the salar basin is below 600m, the company says.

VOLT LITHIUM (TSX.V:VLT)

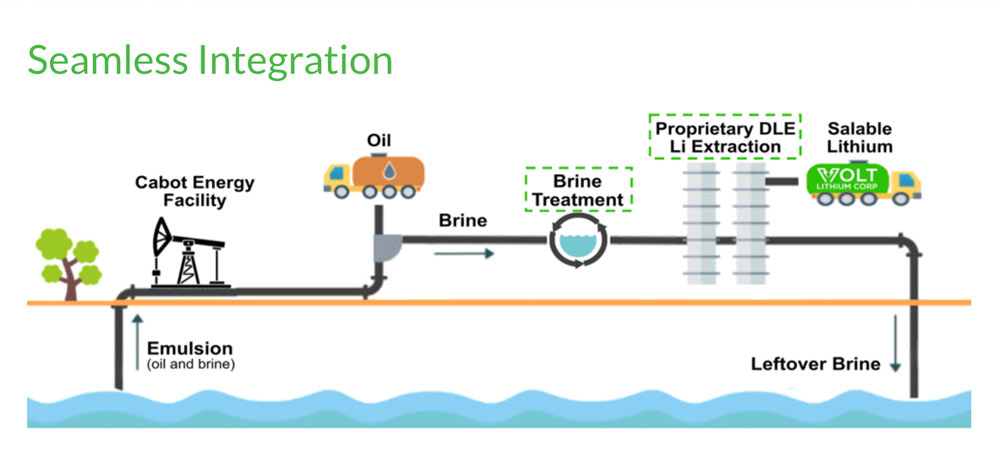

The stock formerly known as Allied Copper wants to become North America’s first producer of lithium chemicals from oilfield brine using a Direct Lithium Extraction (DLE) tech.

It will ostensibly look something like this:

It now has 4.3Mt of lithium (LCE) resources at the flagship Rainbow Lake property Alberta, Canada, at lithium concentrations as high as 121mg/L.

“The Inferred Mineral Resource equates to 215 times the estimated peak production of 20,000 tonnes per year, demonstrating the sheer size and scale of this lithium asset,” VLT says.

Results from a pilot project – a smaller version of the real thing — are anticipated before the end of Q2/23, it says.

DELTA RESOURCES (TSX.V:DLTA)

DLTA is hunting for giants with two main gold projects in Quebec and Ontario: Delta-1 and Delta-2.

Sitting in the same geological setting as Goldshore’s Moss Lake 4.1Moz gold deposit, DLTA says Delta-1 was essentially untouched for two decades.

A cavalcade of thick, high grade drill intersections from the project since March have done wonders for the stock price.

Highlights from the emerging Eureka gold zone include:

- 23g/t over 26.2m (within a broader interval of 2.06g/t over 65.8m)

- 29g/t over 97m

- 15g/t over 89.7m; and

- Bonanza grade 1636g/t and 697g/t over 1m intervals from ~60m depth.

There are all the ingredients here for a major gold deposit, it says.

“These Bonanza grades at Delta-1 are very impressive but more important is the fact that we are doing large, 100 metre step outs and are still consistently hitting strong alteration with higher-grade gold segments hosted within a broader zone of low to moderate grade gold,” president and CEO André Tessier says.

“This speaks to the strength of the mineralizing system and the upside potential as our drilling progresses eastward into the larger ‘Deep Blue’ target area.”

A new 5000m drilling campaign is now underway.

HOMERUN RESOURCES (TSX.V:HMR)

The silica play has a flagship in British Colombia called Tatooine (nice Star Wars reference), which is directly on trend and within the same high-purity quartzite unit as the past-producing Moberly mine, which produced high-purity silica grades of 99.67%.

Tatooine includes a few historical mines itself including Brisco, which was actively mined in 1964 and 1990, producing 2,450 tonnes and 60,000 tonnes, respectively.

Randomly selected samples from the Brisco pit assayed 98.66% SiO2, 0.47% Al2O3, 0.06% Fe2O3 and 0.08% CaO.

High purity silica sand is an in-demand commodity used for glass-making and, increasingly, high tech products such as semiconductors, solar panels and electronics.

Silica is quickly becoming the go-to material for both solar technology and smart screen technology. With its ability to efficiently convert sunlight into energy and its remarkable durability and transparency, silica is leading the way toward a cleaner, more sustainable future. pic.twitter.com/1ZgLdolE91

— Homerun Resources (@HomerunRes) May 19, 2023

MINSUD RESOURCES (TSX.V:MSR)

MSR has a two main projects in Argentina: Chita Valley (copper-moly-gold-silver) and La Rosita (gold-silver).

Chita Valley is a porphyry system with a current resource of 386 million pounds of copper (175,000t) which is subject to an earn in with mining giant South32 (ASX:S32).

S32 (50.1% ownership) is spending C$9.1m this year to drill 21,700m to expand resource and test other targets.

So far, drilling has expanded the ‘Chinchillones’ porphyry-epithermal system to 2km x 2km.

The zone is open to more than 850m depth, which was the limit of previous drilling equipment.

MSR recently announced its best drill hole to date from the target — 786m at 0.43% Cu, 0.23g/t Au, 15.78g/t Ag from 456m to 1,242m (open at depth).

This includes a high grade 166.3m at 1.35% Cu, 0.54g/t Au and 26.63g/t Ag.

GLADIATOR METALS (TSX.V:GLAD)

GLAD inked a deal late last year to acquire the historical Whitehorse copper project in the Yukon, where ~10Mt @ 1.5% Cu was mined via open pit (1967-1971) and underground (1972-1982).

Whitehorse came with 30 known prospects within a 35km x 5km area, plus over 10,000m of unassayed core from previous exploration drilling.

In April, GLAD embarked on ~3000m drilling program at the advanced Cowley Park target, which will lay the foundations for a future copper resource.

We’re on location at the Cowley Park #copper prospect, preparing for our upcoming drill program. Beautiful conditions and great terrain!

Learn more about the historically producing, high-grade, near-surface Whitehorse Copper Project: https://t.co/lX4hpbAA5e$GLAD.V | $GDTRF pic.twitter.com/7lIseF6C1U

— Gladiator Metals (@GladiatorMetals) April 12, 2023

Meanwhile, that old core is returning remarkable copper grades and widths at Cowley Park like 32.92m @ 2.08% Cu from 73.76m (including: 8.11m @ 5.35% Cu from 80.16m), plus 34.75m @ 0.94% Cu from 117.65m in a single drillhole.

There are also juicy targets along the nearby Cub Trend, where old drilling pulled up numerous hits like 34.75m @ 1.65% Cu from 8.84m; 3.47m @ 2.91% Cu from 41.76m; and 74.98m @ 1.51% Cu from surface.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.