Brightstar’s maiden Laverton underground gold reserves to underpin FY26 production

Maiden ore reserves for the Second Fortune and Fish underground mines will underpin FY2026 gold production. Pic: Getty Images

- Brightstar outlines maiden reserves of ~24,000oz for Second Fortune and Fish underground mines

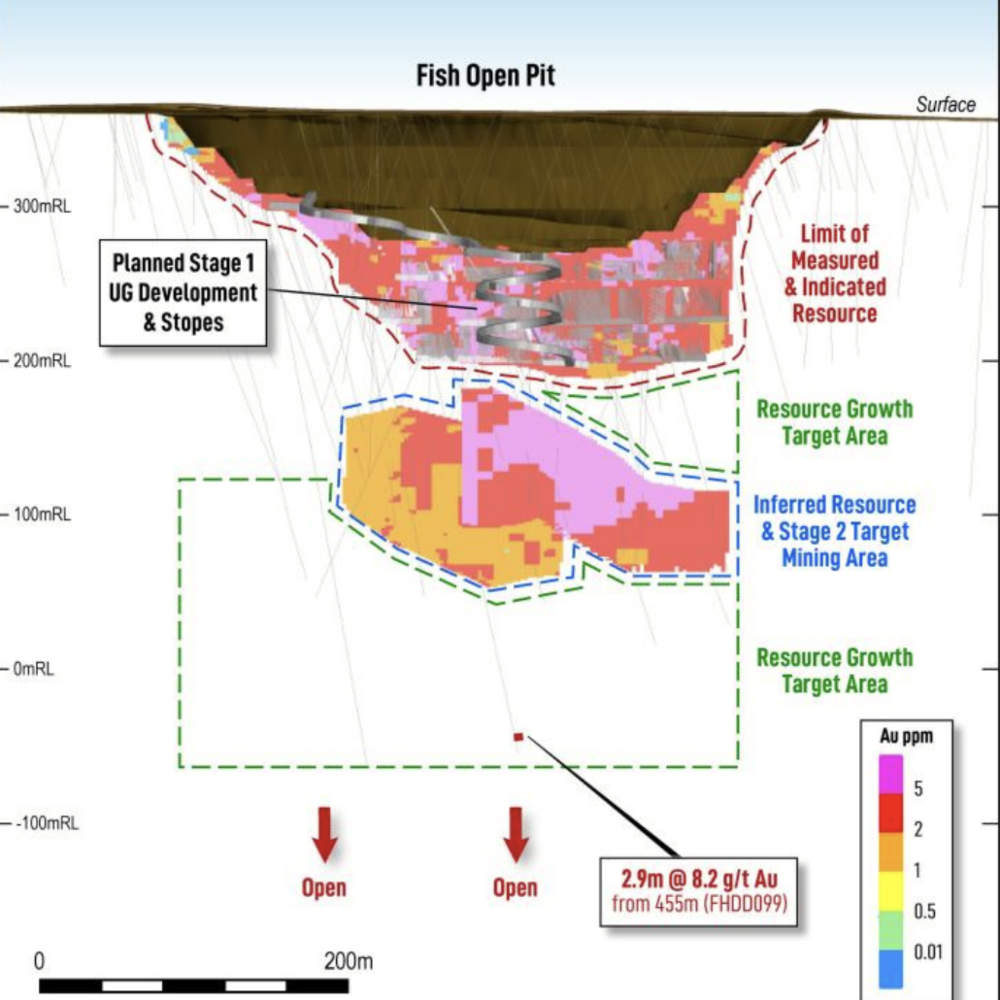

- Both mines remain open at depth and along strike, raising the potential for further resource and reserve growth

- Surface and underground drilling is imminent at both mines while Fish will start ore production next week

Special Report: Brightstar Resources has ore reserves of ~24,000oz of gold for its Second Fortune and Fish underground mines that underpin FY2026 production through the Laverton Hub ore purchase agreement with Genesis Minerals.

The establishment of maiden reserves of 52,000t grading 3.36g/t gold for 6000oz at Second Fortune and 175,000t at 3.23g/t for 18,000oz at Fish follows a recent upgrade to resources for both mines.

Cut-off grades for underground ore reserves are based on a relatively conservative gold price of $3500/oz to ensure that the focus remains on the conversion of higher margin ounces.

Second Fortune has a resource of 40,000oz at 13.4g/t while Fish has a resource of 49,000oz at 4g/t. Higher confidence measured and indicated resources make up a tidy 68% of the material at both mines.

This contributes to Brightstar Resources’ (ASX:BTR) belief that there is significant potential to increase ore reserves and mine life at the two mines by carrying out more surface and underground drilling, which is due to start imminently.

Mining is continuing at Second Fortune and Fish with first ore from Fish expected within the next week to generate significant revenue in the September 2025 quarter.

Managing director Alex Rovira said the maiden ore reserves for the two mines underpinned the FY2026 production target under the ore purchase agreement.

“It’s important to note that these two ore bodies are open at depth and along strike, and to date have lacked deeper drilling to convert known mineralised intercepts into mineral resources and potential ore reserves,” he added.

“Second Fortune has operated consistently over four years, highlighting the reliability of the gold mineralisation which shows continuity at depth with wide-spaced drilling.”

Ore purchase agreement

Under the Laverton agreement, the company can deliver, sell and process up to 500,000t of ore to Genesis Minerals’ (ASX:GMD) Laverton mill over 2025 and Q1 2026.

This is hedge free, allowing BTR to benefit from current high gold prices of more than US$3380 ($5220) per ounce.

Ore is currently sourced from high-grade material from the Second Fortune underground mine and existing lower-grade stockpiles from the Laverton Hub.

This is poised to change shortly with the introduction of further higher grade material from Fish underground mine, which will increase the head grade of ore feed.

Revenue generated by the purchase agreement will help support the company’s exploration and development initiatives across its Menzies, Laverton and Sandstone Hubs.

Watch: Brightstar executes MoU for Menzies gold ore

Next steps

Besides the imminent start of drilling at Second Fortune and Fish as well as the start of ore mining at Fish, BTR also expects a material increase in overall group ore reserves shortly.

This will be accompanied by the finalisation and release of a definitive feasibility study which outlines the development and expansion of Brightstar’s production across the Menzies and Laverton hubs.

“We are excited to be mobilising surface and underground diamond drilling rigs to Fish and Second Fortune, and the company will continue to allocate investment into exploration and resource definition drilling to continue to expand these mineralised systems to extend mine life,” Rovira said.

“These underground ore reserves and the targeted FY26 gold production profile are expected to complement the open pit ore reserves and proposed mine plans that are to be released as part of Brightstar’s definitive feasibility study into the Menzies and Laverton gold projects, due for release next week.

“The company has been steadfast in its approach to derisking our assets and advancing them towards development, with multiple production centres and mining operations to underpin a growing production profile.”

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.