Brightstar’s high-grade hits point way to resource update at Pericles

High-grade gold intersections point the way for a resource update at Brightstar’s Pericles deposit. Pic: Getty Images

- Brightstar Resources’ infill drilling has returned high-grade hits including 1m at 80.4g/t gold

- Results show consistent mineralisation within and below the planned pit shell at the Pericles deposit

- Company to start resource update for deposit to build confidence in DFS mine design

Special Report: The Lady Shenton system within Brightstar Resources’ Menzies project in WA continues to shine with infill drilling returning significant intersections with grades topping up at 80.4g/t gold.

Notable assays from drilling within the 287,000oz Pericles system were:

- 4m grading 22.4g/t gold from 74m including 1m at 80.4g/t from 75m, and 6m at 2.3g/t from 92m (LSRC24014)

- 4m at 14.9g/t gold from surface and 12m at 1.87g/t from 129m (LSRC24042); and

- 19m at 7.1g/t gold from 129m including 1m at 55.4g/t from 132m (LSRC24039).

Brightstar Resources’ (ASX:BTR) infill drilling program is part of a broader reverse circulation and diamond drilling campaign across its 2Moz portfolio, which is set to grow to 3Moz on the completion of the acquisition of Sandstone-based Alto Metals.

The explorer targeted gold mineralisation within delineated pit shells and underground designs outlined within the scoping study, along with some extensional drilling to grow the current resource.

“The high grade and wide intercepts received from this drilling campaign builds on our existing knowledge of the Lady Shenton System, with these results showing consistent mineralisation within and immediately below the $2750/oz pit shell generated during our scoping study,” managing director Alex Rovira said.

“At the time, this gold price was considered conservative and even more so given that the current spot gold price is over $4100/oz. We intend to immediately commence a mineral resource estimate update for this deposit, with the view to building high levels of confidence in our DFS mine design in parallel with other workstreams currently underway.”

Drilling isn’t the only newsflow catching the eye for BTR today.

Outside of Pericles, BTR is already looking at ways to consolidate its position in the Sandstone district further, revealing it had issued a non-binding and indicative offer to enter a JV at nearby Aurumin’s (ASX:AUN) Central Sandstone project.

Central Sandstone is adjacent to Alto’s ground and contains a significant resource of 881,3000oz of gold as of its last upgrade.

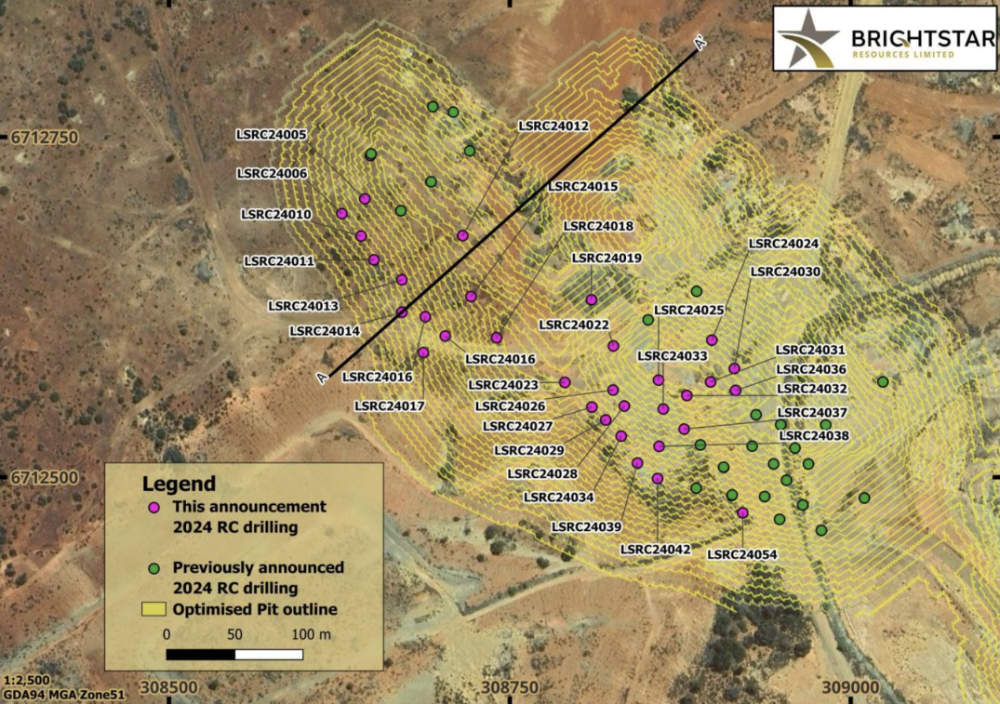

Pericles infill drilling

The company drilled 54 holes in two campaigns at the Pericles deposit during 2024, with assays from 26 drill holes released in July returning results such as 5m at 15.62g/t gold from 104m and 2m at 22.32g/t gold from 95m while the latest assays were received from the remaining holes.

These campaigns were designed to confirm mineralised lode positions within the pit shell with the intent of infilling key areas to increase resource confidence to support the potential declaration of an ore reserve as part of the definitive feasibility study.

BTR notes that the high-grade domains remain open down plunge, presenting an opportunity to undertake further drilling to potentially outline mineralisation for future open pit cutbacks or underground mining scenarios.

Gold prepayment facility

Separately, the company has been issued terms for a US$11.5m gold prepayment debt facility from Ocean Partners.

This contracts ~4600oz of gold to be delivered to OP over 2025 with repayment to be made at an interest rate proposed to be based on the 3 month term SOFR + 11% per annum.

These funds will be used for general working capital though the company plans to use part of the funds to develop the Fish underground project.

BTR also has on-going negotiations with multiple parties in the Eastern Goldfields for processing ore from its Menzies and Laverton gold projects by way of a toll milling agreement or ore purchase agreement, which could meaningfully increase its gold production in 2025.

Other activities

Rovira said the company is currently progressing approvals for Menzies, with proactive environmental planning and community engagement ongoing to facilitate mining operations, which are targeted to start in 2025.

“With these Menzies RC assays now received, we look forward to receiving the outstanding Fish and Lord Byron diamond hole assays from the Jasper Hills Project over the coming weeks, along with re-commencing RC drilling at our newly acquired Montague East Gold Project located north of Sandstone in the Murchison region,” he added.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.