Brightstar sets scene for mammoth 2025 transformation with $30m raise

Funds will be applied towards ongoing activities across Brightstar’s portfolio. Pic: Getty Images

- Brightstar receives commitments to raise $30 million at A$0.023 per share

- Strong support received from leading domestic and international institutional investors

- Brightstar executes ore purchase agreement

Special report: One of 2024’s standout gold plays, Brightstar Resources has restocked in a $30 million raising to propel the company up the ranks of Australia’s junior gold miners.

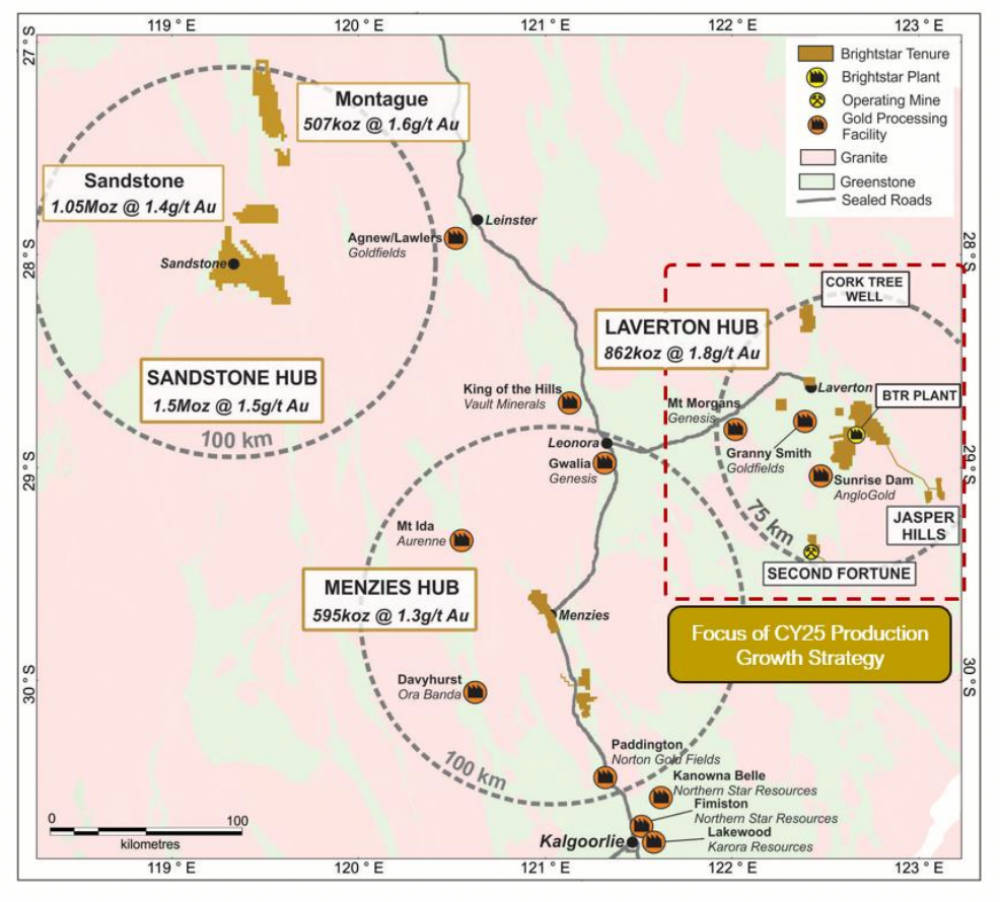

With an eye on rapid development, the $165m market cap explorer is now perfectly placed to accelerate production opportunities at the Laverton Hub in 2025 and launch expanded drilling initiatives.

The company will direct funds to ongoing activities including the 8000m reverse circulation drilling program currently taking place at the Montague and Sandstone gold projects, as well as a 50,000m drilling campaign earmarked for CY25.

Proceeds also strengthen Brightstar’s (ASX:BTR) balance sheet for more potential M&A opportunities following the merger with Alto Metals (ASX:AME) in August and the acquisition of roughly 1.5Moz resources around WA’s Sandstone district.

The deal made BTR the largest junior gold resource holder in WA after De Grey Mining (ASX:DEG), with three major acquisitions this year taking its inventory to ~3Moz.

Ore purchase agreement

An ore purchase agreement has been executed with a regional processing plant in the Laverton district, providing the company with a processing solution to monetise existing value in stockpiles.

Under the agreement, BTR will sell up to 500,000t of ore sourced from Brightstar’s Laverton Hub over the course of CY25 and Q1 CY26.

This sets Brightstar up to, subject to final approvals, construct its second underground mining operation at the Fish underground development project – in addition to existing production from Second Fortune, which will be monetised in CY25.

In light of these production activities, discussions between BTR and Ocean Partners has advanced for a US$11.5m revolving stockpile finance facility.

Ocean Partners has informed Brightstar on the completion of legal due diligence and is advancing the completion of technical due diligence and final documentation.

Organic growth

“Brightstar has ambitious plans for growth and this funding allows us to accelerate production opportunities across our Laverton Hub and undertake upsized drilling programs,” BTR managing director Alex Rovira said.

“We’re targeting organic growth in the mineable ounces which the company continues to prioritise as the basis for new mining developments.

“The execution of an ore purchase agreement for up to 500,000t of production within Laverton underwrites our production growth in CY25 and sees Brightstar increase its production profile as we expand on our goal to be a relevant participant in the WA gold sector,” Rovira added.

“On behalf of the board of directors I would also like to welcome a number of new offshore and local institutional investors as well as thank existing shareholders for their ongoing support.”

Fish underground development

The Fish underground development is expected to provide a step change in production and grade profile for BTR, boasting a 225,000t resource at 5.7g/t gold for 41,000oz.

A March 2024 scoping study included an underground development at Fish based on the upper levels of the orebody which delineated a mining inventory of 190,000t at 4.4g/t gold for 27,000oz gold.

Site works have kicked off, including haul road maintenance and preparation, and early works for camp and site establishment for which all approvals are in place.

Importantly, key capital works related to site establishment to facilitate mining at Fish is expected to deliver material synergies to future potential development of the Lord Byron open pit operation, currently subject of the company’s Laverton-Menzies DFS due for delivery in Q1 of CY25.

What else is on the cards?

BTR’s CY25 production strategy is expected to deliver benefits to the company’s wider development plans in the region with the Laverton-Menzies DFS remaining on track for delivery in Q1 CY25.

Benefits to DFS outcomes are expected through reduced peak funding requirements from earlier Laverton cash flows expected in Q1 CY25 and establishment of the Jasper Hills project site to leverage into future potential development of the Lord Byron open pit.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.