Brightstar Resources unlocks high-grade gold at Laverton hub

Lord Byron could be a treasure trove at depth if today’s drill result is anything to go by. Pic: Getty Images

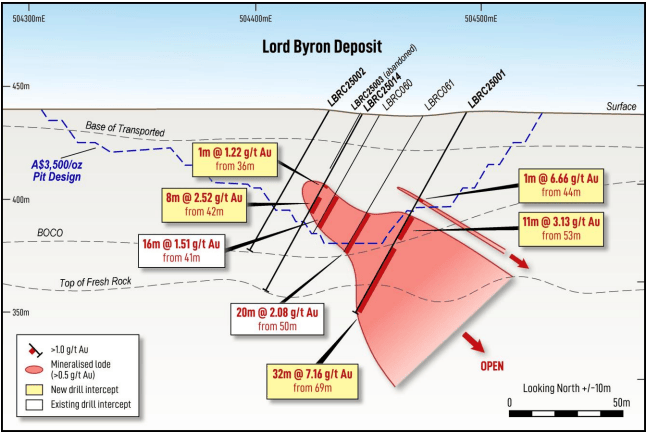

- Brightstar Resources hits 32m at 7.16g/t gold beneath the planned open pit at its Lord Byron deposit near Laverton

- Located just 50km from proposed plant site, high-grade result will be followed up

- Resource growth on the cards after “exceptional” drill hit

Special Report: Brightstar’s future is looking … brighter at its Laverton hub, with fresh drilling finding exceptionally high-grade gold just metres below known resources.

Hole LBRC25001 at the Lord Byron deposit, beneath the modelled open pit, struck 32m at 7.16g/t gold from just 69m including 11m at 15.1g/t Au from 87m.It also struck 11m at 3.13g/t Au from 53m, with more assay results delivering a raft of highlights.

They include:

- 30m at 3.02g/t Au from 44m, including 1m at 15.2 g/t Au from 70m, and 2m at

5.04g/t Au from 78m (LRBC25005); - 8m at 2.52g/t Au from 42m (LBRC25014); and

- 6m at 2.27g/t Au from 47m (LBRC25009).

Brightstar (ASX:BTR) says the drilling is beneath the existing mineral resource of 251,000oz at 1.5g/t Au at Lord Byron and represents a compelling follow-up opportunity given its grade and width.

It’s a key deposit for the standalone Laverton Hub, part of a global resource of 900,000oz at 1.7g/t gold and sitting just 50km from the site of a proposed 1Mtpa CIL processing plant.

“These outstanding results from the Lord Byron deposit have surpassed our expectations. They include the best intercept ever drilled at the deposit, 32m @ 7.16g/t, which is completely open at depth,” Brightstar executive direction – operations Andrew Rich said.

“This zone is below the optimised open pit design detailed in the recent DFS, with the drilling designed to improve the confidence classification of the ore body in that area of the pit shell.

“A full interpretation of these results is underway, with follow-up drilling program currently being planned.

“A 200+ gram-metre intercept is rare at this deposit, so the Brightstar exploration team are eagerly awaiting the opportunity to complete further drilling at Lord Byron.”

Growth story

Brightstar is regarded as one of the major WA gold growth stories in the current market. It’s already producing in the order of 35-40,000ozpa via toll treatment at its Laverton and Menzies hubs.

And it has longer-term plans to grow into a 200,000ozpa mid-tier by expanding Laverton with its own milling infrastructure and via the redevelopment of the Sandstone gold district, where a PFS is due in H1 2026.

A major component of that strategy is a drilling assault across its three resource hubs.

“Elsewhere, three drill rigs are currently operating across the portfolio, with an RC and Diamond rig at the Sandstone Hub, and an underground diamond rig testing for mine-life extensions at the Fish Deposit,” Rich noted.

The latest results at Lord Byron came in a modest 1100m reverse circulation drill program to infill and upgrade the MRE to indicated.

But it’s clear there’s growth to come below the base of the proposed pit, which was optimised based on a gold price of just A$3500/oz against current price levels of over $5500/oz.

Further drilling is being planned to follow up the high-grade shoot.

Hayden Bairstow from Argonaut, which has a $1.10 price target and spec buy label on the $270m capped Brightstar (current share price of 47c), said the drilling would “likely build out further resources” via updated pit optimisation.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.