Brightstar Resources drilling outlines large, bulk tonnage gold potential at Bull Oak

Thick gold intercepts highlight the large, bulk tonnage potential of the Bull Oak camp. Pic: Getty Images

- Brightstar Resources drilling highlights large, bulk tonnage gold potential of the Bull Oak camp at Sandstone

- Assays returned wide zones of gold that demonstrate classic Bull Oak type mineralisation

- Company will follow up with larger RC and diamond drilling programs in the coming months

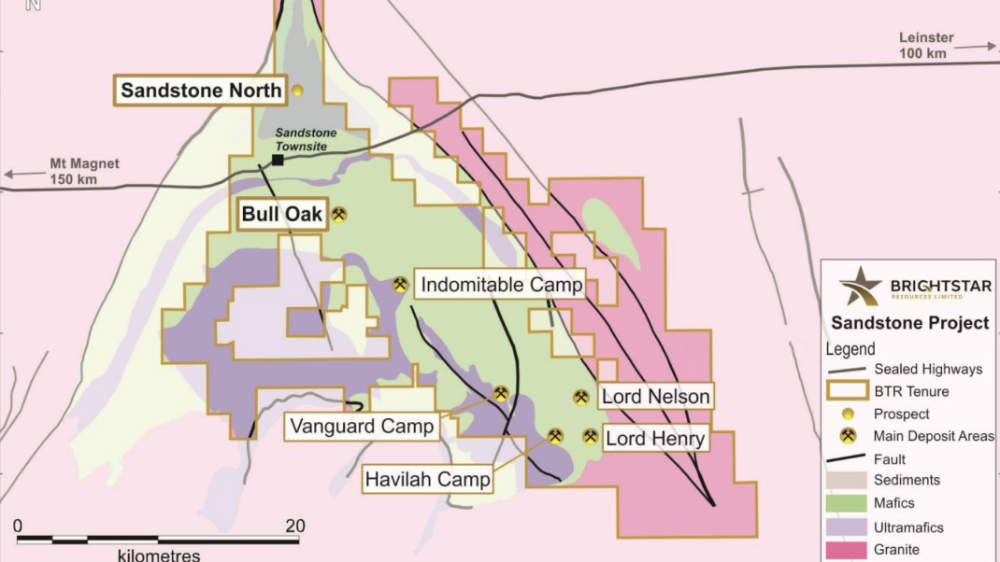

Special Report: Brightstar Resources’ ongoing infill and extensional drill campaign at the 1.5Moz Sandstone hub in WA’s East Murchison region has highlighted significant potential for bulk-tonnage gold in the Bull Oak camp.

The now-completed maiden reverse circulation drill program of five holes targeting extensions of the Bull Oak deposit at depth below the current resource has returned a final assay of 178m grading 0.7g/t gold from a down-hole depth of 16m including 1m at 20.4g/t from 165m and 1m at 8.94g/t from 179m.

Bull Oak currently has a deposit of 2.5Mt at 1.1g/t gold, or 90,000oz of contained gold including 1.9Mt at 1.1g/t, or 65,000oz contained gold, within the conceptual pit shell optimised at a conservative gold price of $2500/oz.

Earlier assays had returned results such as 106m at 0.6g/t gold from 134m including 1m at 10.1g/t from 192m (BORC25001) and 167m at 0.59g/t gold from 11m including 1m at 13.7g/t from 112m (BORC25002).

Brightstar Resources (ASX:BTR) says the results confirm the previously reported exploration target of between 4.6Mt and 8.8Mt at a grade range of 1-1.3g/t gold for Bull Oak and supports the resource growth potential of the broader Sandstone hub.

Assays were also received from an early-stage exploration drilling program to test below and in close proximity to historical workings at the Sandstone North prospect.

Notable results from this program include:

- 2m at 7.54g/t gold from 27m including 1m at 13.3g/t gold from 28m and 5m at 3.17g/t from 33m (SNRC25004)

- 6m at 2.26g/t gold from 88m (SNRC25006); and

- 5m at 1.55g/t gold from 181m (SNRC25010).

Large, bulk tonnage feed

Managing director Alex Rovira said the results from the Bull Oak deposit highlight its real potential to provide large, bulk-tonnage feed for a substantial mining operation at Sandstone.

“These wide zones of gold mineralisation, hosted in granodiorite, demonstrate classic Bull Oak type mineralisation and we are excited to follow-up with larger RC and diamond drilling programs in the coming months,” he noted.

“Additionally, it is especially encouraging to intersect narrow, high-grade lodes within the wide, lower-grade mineralised haloes.”

Rovira added the deposit is one of a number of known mineralised felsic intrusives within the Bull Oak camp that present a compelling opportunity to add materially to the current resource.

Touching on Sandstone North, which is currently at a much earlier stage of exploration, he said the consistent widths and grades intersected in the initial program suggest that it has genuine resource potential.

“Further drilling will be planned as part of the continuing RC drilling program at the Sandstone Hub, with a diamond rig also due later in the year,” he added.

RC drilling at Sandstone is continuing with a rig completing extensional and exploration drilling targeting resource growth at the Montague East project.

Watch more from Brightstar: BTR’s Musketeer drills unearth Sandstone Hub riches

Other drilling

Rovira also noted that a second reverse circulation rig is on site at the Laverton Hub where it is drilling pre-collars at Fish ahead of the arrival of diamond rigs.

“Once these deep diamond drillholes are completed, both rigs will move down to Menzies, to fast-track the next stage of drilling at the Yunndaga deposit,” he added.

BTR had recently flagged that first ore production from stoping at the Fish underground mine was expected in the September 2025 quarter.

This will add a second source of high-grade gold to the ore processed under its Laverton Hub ore purchase agreement (OPA) with Genesis Minerals.

Meanwhile, Yunndaga is expected to be the company’s third underground mine.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.