Brightstar deals will consolidate Sandstone district into its third gold hub

The addition of Sandstone will give Brightstar a stable platform for growth. Pic: Getty Images

- Brightstar’s acquisition of Alto Metals and the Montague East gold rights consolidates the Sandstone district

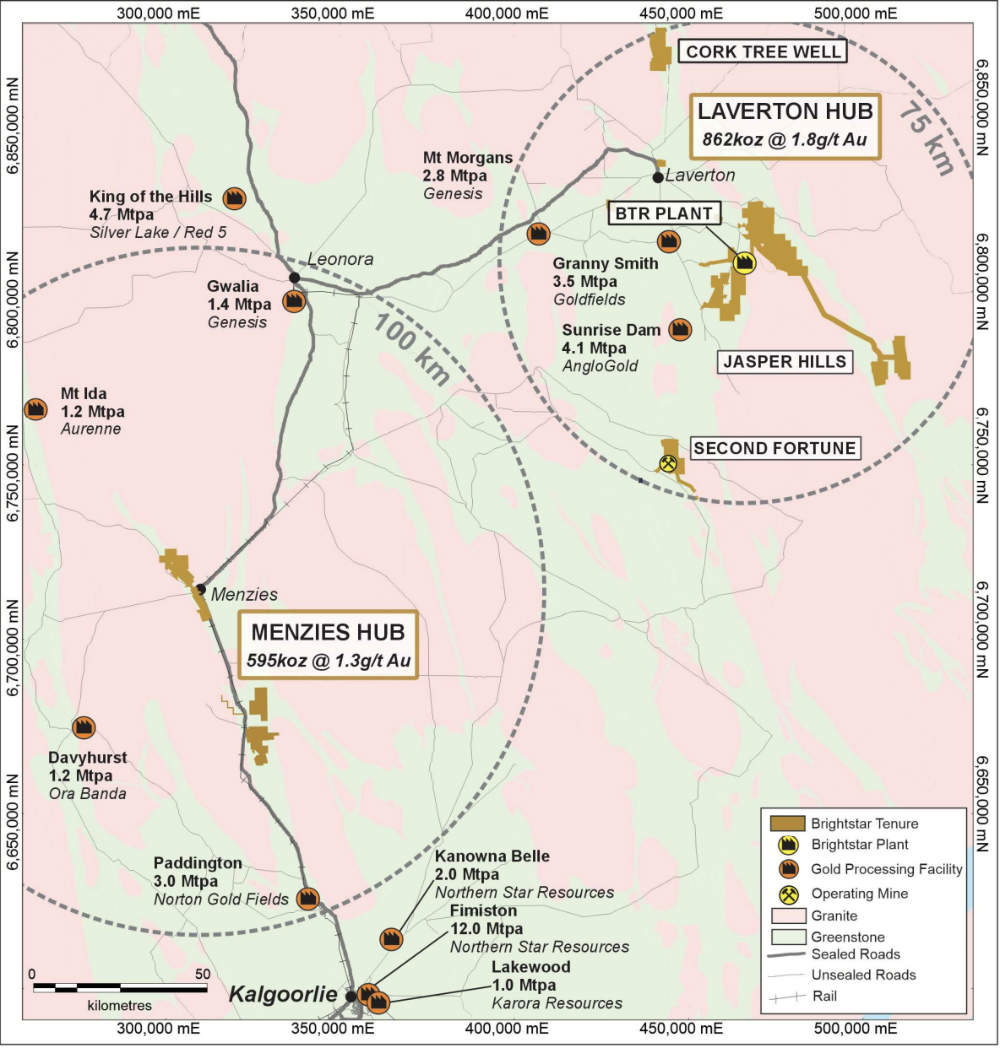

- Acquired Sandstone assets will act as the foundation for a third production hub, adding to its existing Laverton and Menzies hubs

- Combined company will have resource of ~3Moz gold and a significant growth pipeline

Special Report: Brightstar Resources is poised to secure a commanding position in the gold-rich Sandstone district of Western Australia by acquiring Alto Metals and the gold rights to Gateway Mining’s Montague East project.

The first – and most significant – part will see Brightstar Resources (ASX:BTR) offer Alto Metals (ASX:AME) shareholders four BTR shares for every AME share they hold.

This values AME at about $44.4m or ~6c per share, a hefty 81% premium to its 30-day volume weighted average price (VWAP) of 3.3c up to and including July 30, 2024.

AME directors have unanimously recommended the takeover offer and intend to vote all their shares in its favour in the absence of a superior proposal and subject to the independent expert concluding that it is in the best interests of shareholders.

Lending further weight to the offer is Windsong Valley – the largest shareholder in AME with ~15% of its issued shares – confirming that it will also vote in favour of the scheme with the same conditions.

A condition for BTR to raise $24m through a two-tranche placement of shares priced at 1.5c each has already been met.

AME’s Sandstone project covers ~900km2, which represents the vast majority of the historical Archaean Sandstone Goldfield ~600km north of Perth.

The second part of AME’s move to sew up the Sandstone district is to acquire 100% of the gold rights of the Montague East gold project, which already has a resource of 526,000oz of gold, for $14m from Gateway Mining (ASX:GML).

BTR will pay GML $5m in cash, $7m in shares and another $2m worth of shares to be paid out upon the start of commercial mining operations in relation to the gold rights or the delineation of JORC resources in excess of 1Moz.

New sheriff in Sandstone

Should BTR complete both acquisitions, it will pretty much rule the Sandstone region with a ~1100km2 landholding that provides new district scale growth platform to complement its existing production, development and exploration asset portfolio.

The addition of Sandstone and Montague East, which collectively have JORC resources of ~1.5Moz at an average grade of 1.5g/t gold, not only provides the foundation for a third production hub, they will also about double its inventory to ~3Moz sitting near its own and third-party milling infrastructure.

That the company is also a hop and a skip away from defining maiden ore reserves at its Menzies and Laverton projects will also provide certainty that still eludes many ASX gold players.

All this gives BTR a significant growth pipeline with its existing and near-term production from Laverton and Menzies hubs supporting the expedited exploration and development of the Sandstone Hub, which in turn backs its goal of becoming a significant gold producer within the next four to five years.

Existing scoping studies for its Laverton and Menzies hubs already outline production of 450,000oz per annum of gold over eight years with low capex requirements.

The combined entity will also have $31m in cash and a potential $36m finance facility from AustKor to fund the refurbishment and expansion of its existing processing infrastructure south of Laverton.

Becoming a mid-tier gold producer

“This is a compelling transaction for all stakeholders, as the sensible consolidation of the Sandstone and Montague East Gold Projects delivers an asset base with the critical mass to be advanced towards meaningful production,” BTR managing director Alex Rovira said.

“The Sandstone Hub has the mineral endowment and exploration upside to be a significant development opportunity in Western Australia in the coming years and presents as an asset with potential to support Brightstar’s aggressive growth ambitions to become a multi-asset, mid-tier WA gold producer.

“Brightstar has the team and experience to fast-track the exploration and development of the Sandstone assets in parallel with the development of the Menzies and Laverton Gold Projects, to underpin Brightstar’s ambitions of becoming a multi-asset producer in WA.

“With the DFS for the Menzies and Laverton Gold Projects due in 1H 2025, Brightstar remains well placed to make FID on the restart of several mining opportunities within our current portfolio which, when in production, we expect will assist to organically fund further investment in the Sandstone and Montague East Gold Projects in the near future.”

AME managing director Matthew Bowles said that should the scheme go forward, AME shareholders will not only benefit from a significant premium for their shares, they will also retain ongoing exposure to the development of the Sandstone gold project as part of a larger resources group holding multiple projects.

“We believe this transaction is a great outcome for Alto shareholders and stakeholders, who will benefit from the development of the Sandstone Gold Project as part of an enlarged gold company with an exciting future.”

Placement and funding

Investors are clearly in favour of the deal with BTR receiving firm commitments for the issue of ~1.6 billion new shares priced at 1.5c each, or a 5.7% discount to the 10-day VWAP, in two tranches to raise $24m.

This received very strong support from a range of new and existing institutional investors including a number of specialist gold and natural resources funds.

The first tranche will raise about $17m and was conducted within the company’s s available placement capacity pursuant to ASX Listing Rules 7.1 and 7.1A.

Shareholder approval will then be sought at an extraordinary general meeting to be held in mid-September for the second tranche to raise the remaining $7m.

“The strong support in the capital raising from well credentialled, dedicated long-only gold and natural resources-focused institutional investors is a testament to the quality of the package of assets and development plan at Brightstar, against the backdrop of a rising AUD gold price environment,” Rovira said.

Proceeds from the placement will be used to fund exploration and development across the company’s portfolio and will include a fast-tracked drill-out of the Sandstone project.

It has also executed a non-binding initial offer from AustKor Mineral – a South Korean strategic investor with strong connections to precious metals refining and gold distribution market in South Korea – for a multi-tranche investment of $40m.

This includes a $4m equity investment in the placement and a $36m offtake facility.

Other players to receive shares include drilling contractor Topdrill, which has agreed to take $1m in Brightstar scrip by converting drill costs to equity. Additionally, Raleigh Finlayson’s Genesis Minerals (ASX: GMD) has agreed to take BTR paper for $2.7m in processing costs – bringing one of the biggest ASX gold producers onto the register.

Subject to binding documentation, the completion of the company’s consolidated DFS and a final investment decision, the offtake funds will be used to refurbish its existing processing plant in Laverton.

The offtake facility has an interest rate of 12.5% and is underpinned by the delivery of physical gold doré metal by Brightstar to AustKor and affiliated precious metals refinery in South Korea.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.