Brightstar begins Second Fortune processing as it chases Laverton gold cash flow

Mining

Mining

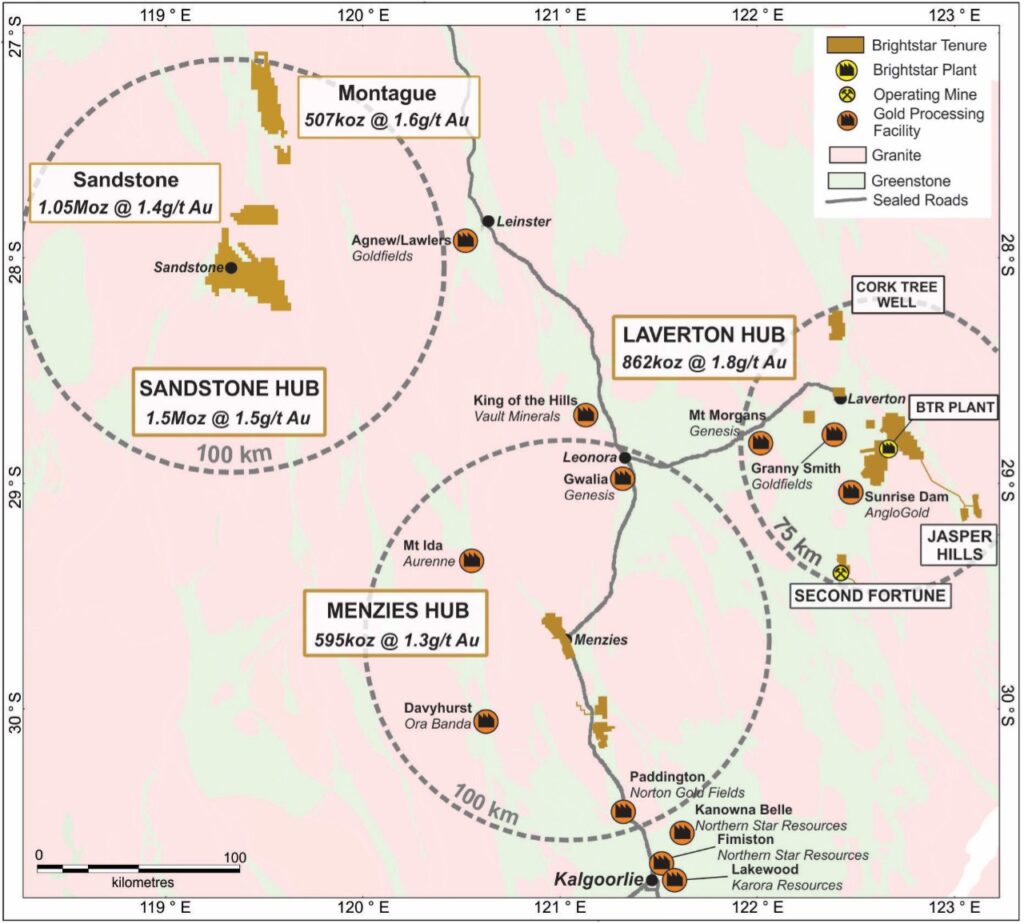

Special Report: Brightstar Resources has begun processing ore from its Second Fortune and Lord Byron operations ahead of a maiden pour in the WA Goldfields.

A first 60,000t parcel at 2g/t gold from Brightstar Resources’ (ASX:BTR) Second Fortune Mine and existing stockpiles from the Lord Byron open pit is now being worked on at the Laverton Mill for a pour later this week.

Haulage continues to the Genesis Minerals (ASX:GMD) site under an ore purchase agreement, allowing Brightstar to sell up to 500,000t through 2025 and into the first quarter of next year.

Brightstar managing director Alex Rovira said the beginning of production and cash flow was a major milestone as the emerging ASX gold miner continues to ramp up operations.

“Second Fortune production will soon be complemented by Brightstar’s second underground mine, Fish, once in production from April 2025,” Rovira said.

“The Fish development, which is currently on schedule and budget, represents Brightstar emerging as a multi-mine producer at a time of record AUD gold prices.”

Rovira said, along with production and development activities at those two mines, Brightstar has continued to advance a definitive feasibility study due in the June quarter for a restart at both its Menzies and Laverton assets.

“In parallel, our geology team is focused on multi rig extensional and infill drilling programs at the Sandstone Gold Project and Cork Tree Well (Laverton Hub), striving to rapidly grow and improve the existing mineral resources and advance the portfolio through the development pathway towards production opportunities,” he said.

Brightstar expects ore to be delivered and cash to come back consistently through the ore agreement, supporting aggressive exploration and development plans on its campaign to become a 100,000ozpa producer.

Stockhead contributor Kristie Batten sees shades of gold titan Northern Star in the way Brightstar built up its assets and management under new leadership.

The company holds the largest resource not under a mid-tier producer in the Eastern Goldfields and has quite the leg up on other junior goldies looking to capitalise on record market prices.

But while gold is ascendant and margins reported by producers have been expanding even faster, there is growing sentiment that the broader market is yet to catch on and miners still present huge value in the bullion boom.

Brightstar has made it known that it’s not land-banking projects and has a team of developers and miners who want to dig, but hasn’t ruled out that it could become a target for a larger peer as an M&A avalanche starts rumbling over the WA gold space.

This article was developed in collaboration with Brightstar Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.