Breaking the ice: EHR has plans to become ‘a midcap diamond producer’

Pic: John W Banagan / Stone via Getty Images

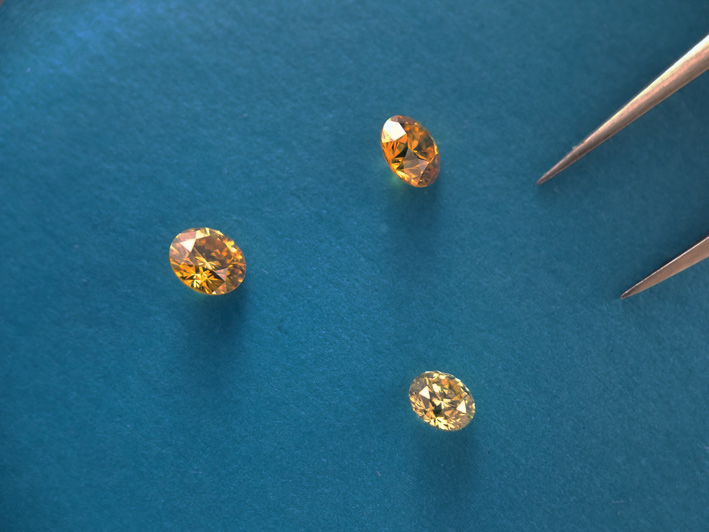

Diamond exploration and mining can be a tough gig, but very lucrative for those who get it right.

You only have to look at the waning diamond production in Western Australia’s Kimberley region or the difficulties faced by Lucapa (ASX:LOM) in Angola to see just how hard it can be.

There are just a handful of diamond players listed on the ASX. For a long time Rio Tinto (ASX:RIO) dominated Australian diamond production at the Argyle mine, one of the world’s largest suppliers of diamonds and the world’s largest supplier of natural coloured diamonds.

Rio’s Argyle and the now closed Ellendale, when it was operational, accounted for one third of global annual production.

Argyle has produced more than 825 million carats of rough diamonds since it began production in 1983, but only has sufficient reserves to economically mine through to the end of this year.

Meanwhile, Ellendale sent its former owner Kimberley Diamond Company into administration when the company was unable to renegotiate a good price for its diamonds with American luxury jewellery giant Tiffany & Co.

Lucapa’s case was more one of sovereign risk, with Angola’s previously restrictive legislation over diamond operations not allowing foreign investors to own a majority stake in projects and requiring all diamonds be sold through a central state-owned government agency.

However, in September 2018, the Angolan government relaxed its rules because it wanted to attract more foreign investment in its natural resources, including diamonds.

This meant Lucapa could sell its large premium-value diamonds on the international market, where they could fetch a higher price.

But these sovereign risk woes, among other issues, have taken their toll on the stock.

Despite Lucapa making millions from selling its high-quality diamonds, the investor interest just hasn’t been there, with its share price wallowing around 5.2c.

Mid-last year Warwick Grigor, executive chairman and managing director of Sydney-based private investment bank Far East Capital, told Stockhead the fundamentals looked “very attractive based on existing production, but the market is not switched on to diamonds as there have been too many failures and too many undelivered promises”.

A new generation of diamond miners

But just because investors haven’t shown much interest doesn’t mean it can’t be a big money maker for a company that has the right ingredients.

This industry interest has spurred a number of juniors to add diamond projects to their portfolios.

In 2018 there was a flurry of activity in WA’s diamond-rich Kimberley. Companies like DevEx Resources (ASX:DEV) and Gibb River Diamonds (ASX:GIB) ventured into the area.

Gibb River picked up the old Ellendale mining leases after winning a bid for them from the WA government.

Canada is also witnessing the entry of new diamond hunters into the region.

According to the Canadian government, the country was the world’s third largest producer of diamonds by value (14.4 per cent) and the third largest producer by volume (15.7 per cent) in 2018.

That year Canada’s total primary exports of diamonds were valued at $2.9bn.

EHR Resources (ASX:EHX) has been on a buying spree recently, picking up two Canadian diamond projects in the past few months.

The company this week announced it had entered an option agreement with TSXV-listed North Arrow Minerals to earn an initial 40 per cent interest in the Naujaat diamond project in Canada.

This followed the completion of the acquisition of Nanuk Diamonds, which owns 625 mineral claims located east of the Ungava Bay in Northern Quebec.

EHR says the “world-class” Naujaat project represents the largest undeveloped diamond property in Canada that is not under the control of a major mining company.

It was first discovered by BHP in the early 2000s, but was divested as part of BHP’s corporate refocus on its iron ore, coal and petroleum operations later that decade.

EHR diversified into diamonds because it only had one project, the La Victoria gold-silver project in northern Peru, and that has somewhat stalled because of permitting delays that have been ongoing for 18 months.

The company has a slightly different strategy to most, and it starts with being backed by one of Australia’s best corporate deal makers — Michael O’Keeffe.

O’Keeffe, EHR’s biggest shareholder and a non-executive director, built up coal miner Riversdale Mining from a market cap of $7m before selling it to Rio Tinto for $3.9bn in 2011.

He has also been the CEO of ASX-listed Canadian explorer Champion Iron (ASX:CIA) since 2014 and during the time he’s been at the helm, the company’s share price has risen from 25c to $2.83 on the back of several shrewd acquisitions.

Investors appear to be interested in EHR’s pivot into diamonds with its share price running from 3c in December to a high of 14c in January.

Not making the same mistakes

EHR Resources has a global mindset and is on the hunt for more good diamond projects across Australia, Botswana and Canada.

Managing director Peter Ravenscroft told Stockhead EHR doesn’t want to make the same mistake other junior diamond explorers had made and was looking to build out a “balanced portfolio”.

“We’re looking at a more global kind of scale and there are a number of junior diamond companies listed in Canada and in London,” he explained.

“I guess the thesis behind which we’re working is that most of those companies, junior companies in particular, are focused on single projects, or maybe two projects, and the amount of capital they require to bring those projects to an advanced state is way beyond the funding that is available to a junior company.”

Ravenscroft says the most expensive stage for a diamond miner is the process of finding out just how much their diamonds are worth in terms of quality and price.

“Typically, you need to be spending $10-$20m to find that out,” he said. “And a lot of the companies we’re talking to are at that stage, they have very promising projects, but they need to spend that much money and their market cap is $3-$5m, so really impossible for them to raise that kind of money on their own.

“We don’t want to be another one of them and just face exactly the same challenge. What we’re doing is building a portfolio of a number of these different projects and then being able to build scale through that process and raise the appropriate capital.

“At the moment we’re a very small company, but that’s not our intention. We see ourselves growing into a mid-cap diamond producer at the end of this.”

Steady as she goes

But EHR isn’t rushing the process. It has shortlisted five to 10 diamond projects that it likes in Canada, Botswana and Australia.

EHR’s plan is to build up a pipeline of advanced and early stage projects.

“It’s a question now given our current size and scale and the requirement to manage our capital as best we can, we’re taking it as steadily as we can, but the opportunities are there and we know what we want to do,” Ravenscroft said.

Ravenscroft says EHR is working to a “countercyclical strategy”.

“Our major shareholder Michael O’Keefe has a reputation for being contrarian and doing things at the right time in the cycle,” he noted.

“He had been looking around the resources industry, looking for commodities that were in a position where there were opportunities at the bottom of the cycle, and diamonds was probably the leading one of those.

“At the same time, I had been generating this strategy on my own, ended up talking to Michael and we saw a really good fit. And EHR was a vehicle which we thought was the ideal one in which to put the strategy.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.