Bougainville locals give thumbs up to RTG project; shares soar 83pc

Bougainville locals like this northern monkey-tailed skink give thumbs up to RTG. Pic: Getty

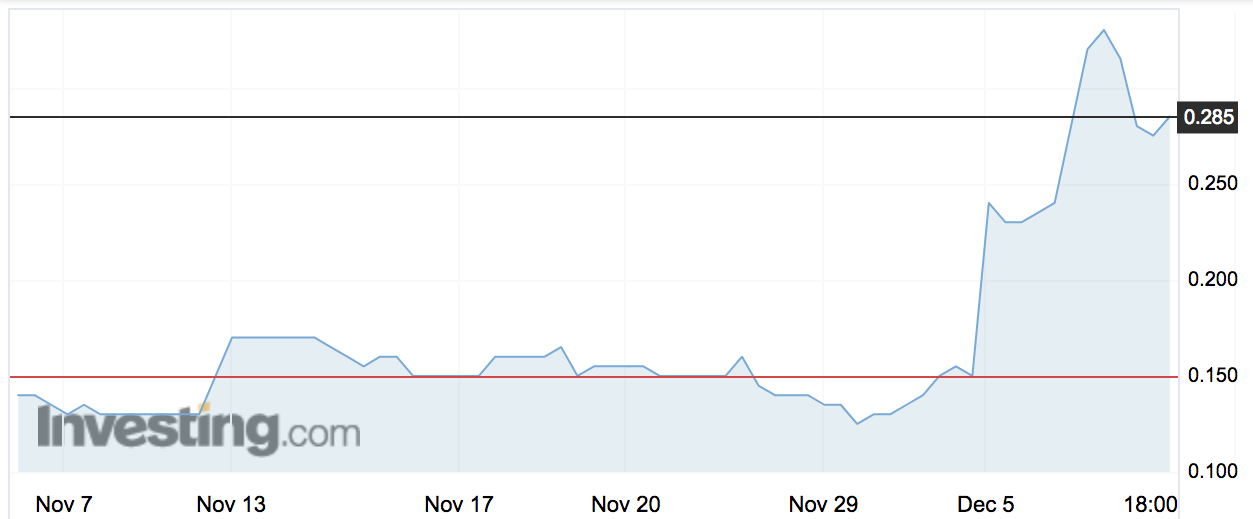

RTG Mining hit 52-week highs on Tuesday after the junior explorer got the green light from Bougainville locals to start work on its copper and gold mine.

The historic partnership, the first of its kind in 30 years, pushed RTG (ASX:RTG) shares as high as 34.5c before they cooled to 28c — a gain of 83 per cent for the day.

Consent from the traditional land owners is required for the issue of any exploration licence on their customary land at the Panguna 1.5 billion tonne copper and gold project on the central island of Bougainville, a process which has historically escalated to wide-scale political unrest on the island.

The region has long been known for its copper and gold prospects, but disputes between regional residents and explorers such as Rio Tinto subsidiary Bougainville Copper Limited (BCL) have marred production since the early 1970s.

Conflict between the Bougainville Revolutionary Army and Papua New Guinea Defence force escalated to a civil war in 1988 and took almost ten years to cease.

Now, the Autonomous Regional of Bougainville is seeking independence for its population of 250,000, with a target date of June15, 2019 set for a referendum on the topic.

They will be the ones to decide the fate of RTG’s application, now led by the traditional landowners, the Special Mining Lease Osikaiyang Landowners Association (SMLOLA) and chairman Philip Miriori.

“We believe the proposal presented by the SMLOLA consortium represents a unique and once in a generational opportunity to responsibly re-open the Panguna Mine for the benefit of all Bougainvilleans,” the company told the market.

“RTG has always suggested that this is best achieved by discussion and negotiation with all relevant parties, including the ABG.”

In 2016, Rio’s subsidiary BCL was forced to abandon the mine in the face of attacks by rebels, transferring its take to the provincial and national governments at no cost.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.