Blackstone confirms Ban Chang’s bulk tonnage opportunity with broadest high-grade hit yet

Blackstone is showing some serious muscle at its nickel project in Vietnam. Pic: Getty Images

Special Report: Blackstone has hit its broadest, high-grade nickel intercept so far at the bigger-than-expected Ban Chang deposit in Vietnam.

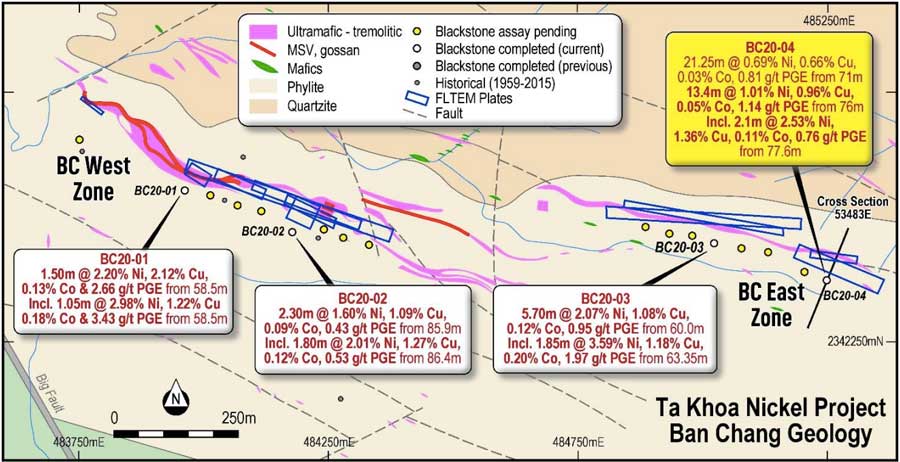

Blackstone Minerals (ASX:BSX) has now confirmed Ban Chang’s potential to be a bulk tonnage deposit with all four maiden holes drilled hitting high-grade massive sulphide nickel over a 1.2km strike.

The fourth hole returned the broadest intersection yet of 21.5m at 0.69 per cent nickel, 0.66 per cent copper, 0.03 per cent cobalt and 0.81 grams per tonne (g/t) platinum, palladium and gold from 71m.

The latest results included a higher grade 13.4m at 1.01 per cent nickel, 0.96 per cent copper, 0.05 per cent cobalt and 1.14g/t platinum, palladium and gold from 76m.

This intercept included an even higher grade 2.1m at 2.53 per cent nickel, 1.36 per cent copper, 0.11 per cent cobalt and 0.76g/t platinum, palladium and gold from 77.6m.

“Hole four has delivered our broadest Ban Chang intersection to date and confirms we have a bulk tonnage opportunity that has potential to deliver significant high-grade nickel to our future mine plan,” managing director Scott Williamson told investors.

The mine plan will be underpinned by a base load feed coming from Blackstone’s flagship Ban Phuc orebody, which includes the King Cobra Zone (KCZ).

Recent drilling at KCZ extended the zone at depth, and it remains ‘open’ down dip and along strike. Blackstone hit thick, significant grade mineralisation down to depths of nearly 250m and mineralisation now extends over 200m of strike at King Cobra.

Open just means the company hasn’t found the edges of this potentially massive system just yet.

“Ban Chang is the first of our 25 MSV (massive sulphide vein) targets to be tested throughout the Ta Khoa nickel-copper-PGE district, leaving plenty of upside for adding high-grade feed to what looks like a bulk open pit mining scenario at Ban Phuc and KCZ,” Williamson said.

Previous owners of the Ta Khoa operation successfully mined 975,000 tonnes of high-grade ore at average grades of 2.4 per cent nickel and 1 per cent copper from an average vein width of 1.3m for 3.5 years.

Blackstone has accelerated its drilling blitz by adding a third rig to test high priority targets including King Snake, Ban Khoa, Ban Chang and Ta Cuong. The biggest of the three rigs is attacking the initial King Cobra discovery zone.

Closing in on maiden resource

Blackstone’s goal is to deliver a maiden resource in the current third quarter that will initially focus on the disseminated sulphides (DSS) at the Ban Phuc prospect.

The company is investigating the potential to restart the 450,000-tonne-per-annum concentrator at Ban Phuc.

Blackstone has also started a scoping study on a downstream processing facility at Ta Khoa.

This scoping study will provide crucial details for joint venture partners to formalise the next stage of investment.

Additionally, Blackstone has kicked off all-important metallurgical testing on the Ban Phuc DSS deposit to develop a processing ‘flow sheet’ for a product suitable for the lithium-ion battery industry.

The company will investigate the potential to develop downstream processing infrastructure in Vietnam to produce a downstream nickel and cobalt product for Asia’s growing lithium-ion battery industry.

Investors sitting up and taking notice

Blackstone shares have rocketed over 380 per cent since mid-March, now trading at almost 40c.

Blackstone Minerals (ASX:BSX) share price chart:

Former geologist and experienced stockbroker Guy Le Page told Stockhead earlier in August the results coming out of the Ta Khoa operation were “probably the better nickel results coming out from any junior explorer in the nickel space at the moment”.

“It looks like it’s thickening with depth,” he said. “So we could be dealing with a very large nickel sulphide system here.”

This article was developed in collaboration with Blackstone Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.