Black Cat’s Paulsens Gold Operation is a real prize with study outlining rapid cashflow, low capex and future growth

Black Cat’s Paulsens Gold Operation looks to be a winner. Pic via Getty Images.

Black Cat has a clear path towards becoming a profitable, near-term gold producer if the economically attractive and low risk Restart Study for its Paulsens Gold Operation is anything to go by.

It is hard to argue after all with headline figures such as revenue of $355.9m and after tax operating cash flow of $81.2m from the recovery of 123,000oz of gold to deliver a very attractive internal rate of return (a measure of return on investment) of 75% using a $2,900/oz gold price.

This revenue and production will be delivered over an initial mine life of three years at an all-in sustaining cost of $1,892/oz – well within the lower half of Australian producers – and a low-risk, pre-production capital expenditure of just $34.3m that will be paid back in just 14 months.

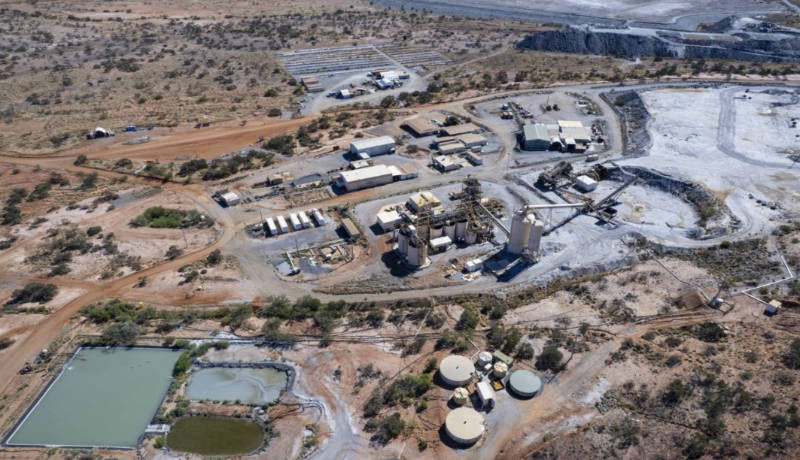

For Black Cat Syndicate (ASX:BC8), the numbers clearly highlight the dual benefits of having a head grade of 4.2 grams per tonne (g/t) gold – placing it squarely in the top 10 of Australian gold producers – and having critical infrastructure such as the well maintained 450,000tpa mill already available on site.

And should the company go through with the restart decision, it will be just six short months from starting refurbishment of the gold plant to first gold pour.

Mine life could also be extended through upgrading existing Inferred Resources, drilling known mineralisation outside the current Resource along with testing near-mine and regional exploration targets.

“The Paulsens Restart Study provides rapid cashflow, with low restart capital and a short ramp-up period to first gold poured. Pleasingly the attractive IRR of 75% and payback period of 14 months reflects current market conditions in WA, which have been fully factored into the Restart Study,” managing director Gareth Solly said.

“Paulsens has historically been operated with an average mine plan of 2.5 years, as such, the Restart Study, with mine life of approximately 3 years, forms an excellent base to start and then grow operations. Once restarted, Paulsens will have tremendous strategic value being the only gold processing facility within a 400km radius.

“Initial cashflow from Paulsens will be applied in the first instance to increasing life of mine through near mine extensions as well as the Apollo, Belvedere and Mt Clement deposits, before testing regional targets.

“Once we have achieved steady state operations and increased the Paulsens life of mine, we will turn our attention to building our other regionally strategic processing facilities, located in WA’s Tanami region at Coyote and east of Kalgoorlie at Kal East.”

Solly added that the project is fully permitted to commence development with all medium and large ticket items already quoted whilst contract negotiations with suppliers are well advanced.

“An experienced refurbishment crew is available to commence site works shortly after contract execution and we have a clear pathway to deliver first gold in 2024,” Solly noted.

“We are also well progressed for funding with Australian and US debt providers, with indicative term sheets already received.”

No surprise then that he expects a restart decision to be made imminently.

Ready for quick restart

The previously-producing Paulsens project has all the ingredients in place for a quick restart.

Production will be underpinned by the underground Ore Reserve of 87,000oz at 4.4g/t gold, which represents 64% of the production target and has been calculated at a lower $2,500/oz gold price to be capable of delivering a robust project on its own.

The remaining production will come from Measured Resources (4%) and lower confidence Inferred Resources (32%), with the total Paulsens underground resources coming up to 328,000oz at 9.9g/t gold.

Other ingredients include the well maintained processing facility, operating 128-person accommodation camp, workshops, office facilities, storage sheds, operational borefields and power station.

GR Engineering Services has already provided a detailed refurbishment plan for the plant, which has been reviewed by Professional Cost Consultants, which has advised on an appropriate contingency and will provide independent cost and progress supervision throughout the refurbishment.

Meanwhile, underground mining operations will be carried out in house under the management of the company’s Paulsens general manager Mark Davies – an experienced Western Australian, underground gold mine manager.

The initial target for mine production is 136,000oz at 4.2g/t gold over three years with average recovered gold ounces of about 42,000oz per annum from ore sourced predominantly from the Paulsens underground mine, which is fully dewatered, ventilated and accessible.

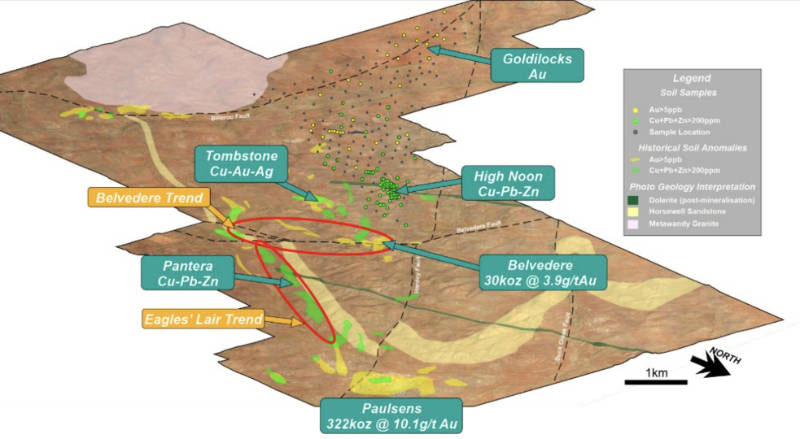

Additional feed will come from the nearby shallow Belvedere open pit, some 8,000oz from its current Resource of 30,000oz at 3.9g/t gold, during the third year of production.

We’ve only just begun

While the Restart Study presents an attractive route to kick off the restart of the Paulsens Gold Operations, Black Cat has already identified a multitude of ways with which to extend its mine life and production.

The low hanging fruit is to upgrade the Inferred Resource to increase mine life while ongoing underground drilling continues to extend high-grade gold mineralisation proximal to the existing and proposed development.

Highlighting just how much potential this offers, the company has added an average of 12,000oz of gold to the production target for each month since underground drilling began in November 2022.

Additionally, there are numerous advanced gold and base metal deposits in the region which have the potential to be expanded and developed in the future.

These include Belvedere, which will already contribute to the production target and presents as an opportunity to find “another Paulsens” with a ~2.5km long strike length, shallow open Resource and limited drilling to date.

Its economic potential below the water table will be included in future studies following further drilling.

Production could also be increased as the current plan leaves the processing plant with some 70,000t per annum, or about 15%, of spare capacity.

The company has already developed plans to increase mine development rates and gold recovery while growing mining inventory via ongoing drilling.

This article was developed in collaboration with Black Cat, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.