Black Canyon scoping study highlights strong returns for Pilbara manganese play

Black Canyon’s Balfour manganese field is looking the goods with the scoping study outlining impressive economics. Pic: Getty Images

- Black Canyon scoping study outlines attractive economics for the KR1 and KR2 manganese deposits

- Deposits expected to produce 12Mt of manganese to deliver pre-tax NPV of $340 and IRR of 70%

- Potential to grow mine life and produce higher grade concentrate

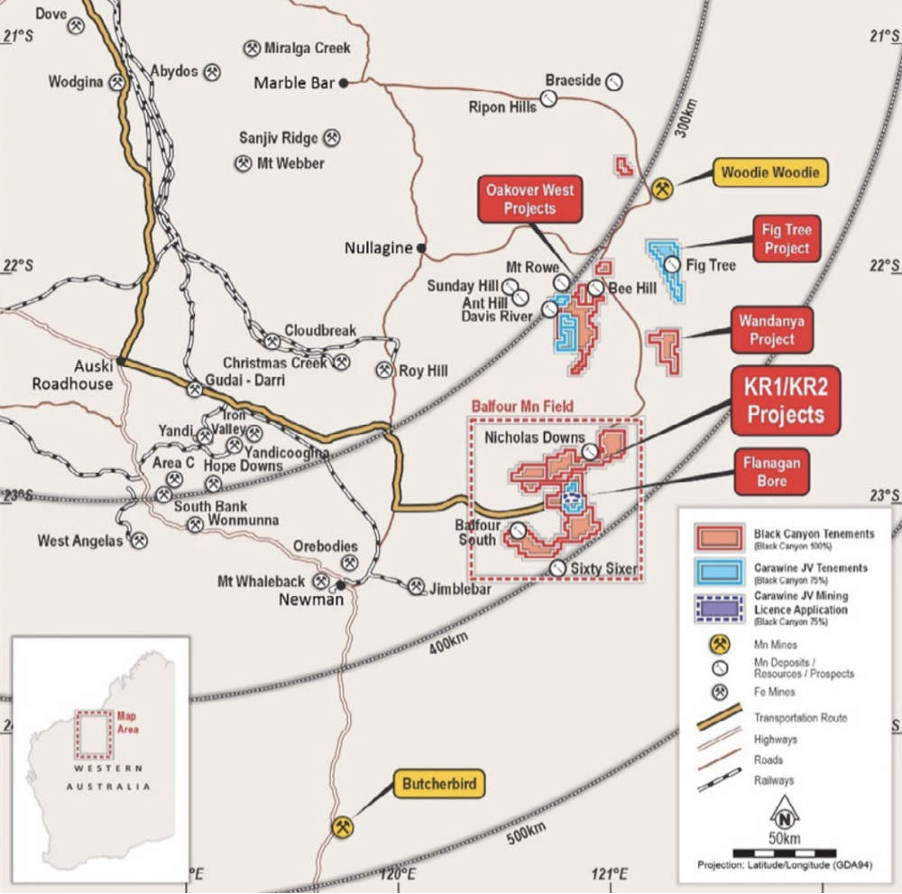

Special Report: Black Canyon’s Balfour manganese field in WA’s Pilbara region is taking shape as an economically attractive project with plenty of opportunities for growth.

In its scoping study, Black Canyon (ASX:BCA) envisioned the KR1 and KR2 resources within the Balfour Manganese Field as being able to deliver an average throughput of 3Mtpa to produce 12Mt of manganese over a 16 year mine life.

This will generate life of mine revenue of $2.78Bn and EBITDA of $654m with average annual operating cashflow of $46.1m.

Unsurprisingly, this will also deliver strong economics as underlined by estimated pre-tax net present value (NPV) and internal rate of return (IRR) of $340m and 70% respectively.

BCA estimated capex at a very palatable $84m – including $25m of indirect costs – with payback expected in less than two years.

The company expects the project to produce a 33% manganese concentrate that can be sold for US$4.60/dmtu with low all-in sustaining costs of US$3.38/dmtu thanks in part to the low strip ratio of just 0.56:1, which means less effort spent on mining waste material.

Most of the produced manganese concentrate will be used by smelters to produce non-substitutable alloys used in steel manufacturing.

A portion may also be used as feedstock for the downstream production of high purity manganese sulphate monohydrate (HPMSM), a critical precursor component of cathodes for batteries in electric vehicles.

Growth potential and upcoming plans

BCA notes that there is considerable opportunity to extend the mine life through expansion drilling, along with discovering substantial resources in the broader region.

It added that future studies will consider further project enhancements, including higher throughput, utilisation of low-cost surface miners in addition to conventional truck and shovel and a hybrid transport solution transitioning from contract to owner-based haulage.

There is also potential to integrate additional mineral resources managed by BCA targeting higher grade material with lower strip ratios within 20-30km of the planned processing plant.

Metallurgical studies and associated engineering design activities are planned, in preparation for detailed feasibility evaluation along with baseline studies to support permitting and environmental approval pathway.

“The scoping study has delivered substantially on the company’s expectations for the KR1 and KR2 deposits,” BCA managing director Brendan Cummins says.

“Efficient mining with a larger trucking fleet matched with increased processing throughput has demonstrated the development potential of the project.

“The positive findings suggest significant financial return over a 16-year period, with a pre-tax NPV of A$340 million and IRR of 70%, highlighting the robust economics of the project,” he says.

“The study also indicates competitive production costs and substantial manganese concentrate annual output.”

Shifting focus on feasibility studies

Cummins says BCA is not resource constrained with multiple deposits with low strip ratios and higher grades from surface, which provide potential upside.

“The use of low-risk conventional dense media separation as a primary separation technique will be further evaluated with the processing of life-of-mine composite metallurgical samples and several variability composites,” he says.

“Whilst we are satisfied that we can deliver a standard 30 to 33% Mn concentrate our next objective is to improve on the grade with ambitions to produce a higher-grade concentrate as part of our product suite.

“The company can now focus on more detailed feasibility studies and prepare for the necessary permitting and environmental approvals, confident in the long-term market prospects for manganese products.

“We will also pursue investigations into opportunities to advance an HPMSM project in Australia with key government initiatives continuing to support downstream processing of critical minerals.”

Big resource already defined

BCA’s scoping study is based on inferred and indicated resources of 103Mt grading 10.4% manganese at the KR1 and KR2 deposits, which are about 115km northeast of Newman.

This includes a higher-grade subset of inferred and indicated resources of 29Mt at 13.3% manganese.

However, the KR1 and KR2 resources makes up just a third of the 314Mt at 10.4% manganese that the company has discovered in its 2100km2 area since exploration commenced in December 2021.

Several of these resources remain open while the large-scale mineralised system presents multiple development options with an exploration target of between 160Mt and 215Mt grading 11-12% manganese outlined over the Pickering and Balfour East deposits.

This article was developed in collaboration with Black Canyon, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.