Birimian signs a deal with Mali women for access to lithium riches

Half of Mali's miners are women. Pic Getty

West African gold and lithium miner Birimian has signed a deal with a women’s mining cooperative in Timbuktu for access to lithium riches.

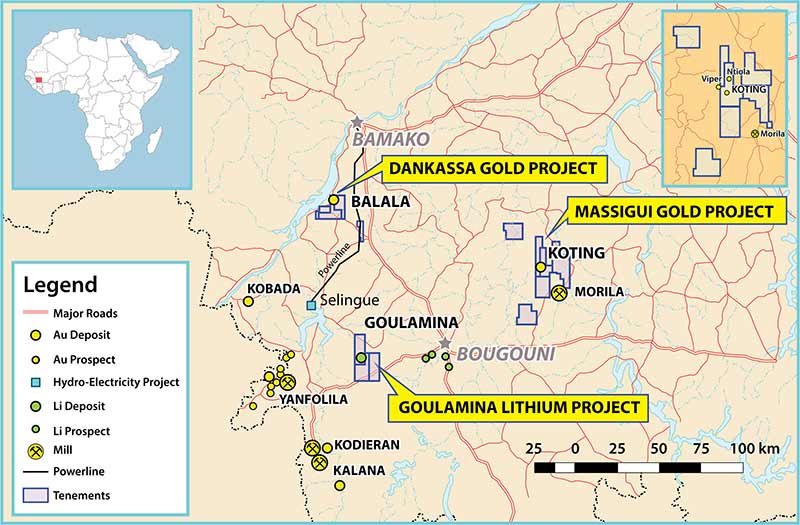

Cooperative Society Femima, a women’s mining cooperative in Mali, had a temporary exploration permit over the Goulamina Lithium Project in south-western Mali.

They agreed to surrender it in early 2016 to Birimian’s (ASX:BGS) local subsidiary.

Birimian will pay Femima $US20,000 ($26,000), bringing the total amount paid so far to $US40,000.

It’ll pay another $US220,000 when a mining permit is granted and commercial production at Goulamina starts.

Rights for Mali women miners

In Mali women have always been involved in the mining industry, making up about half of all miners according to the International Institute for Environment and Development.

“On some sites at Kéniéba or Kangaba for example, women constitute 90 per cent of workers involved drawing and washing of auriferous [gold-bearing] minerals,” the organisation said in a report.

“Women often drain excavations daily, using makeshift tools such as buckets, basins and calabashes.

“Processing methods are always crude, elaborated with makeshift means… When it is unmechanised, processing remains traditionally the domain of women.”

Local women’s associations have now formed to advocate for women miners’ rights.

Corporate review uncovered ‘a range of issues’

Birimian has had a tumultuous 2017.

Earlier this year a corporate review uncovered “a range of issues” after the company tried to sell the Goulamina project to a Chinese company, chief executive Greg Walker told Stockhead.

Goulamina was considered Birimian’s crown jewel, so there was a “degree of discontent in the way the company was being run”, he said.

Mr Walker joined in May, just after the company’s shares were suspended. The corporate review began in April.

“It started as standard due diligence,” he said.

“It wasn’t as though we came in with any suspicions. One thing led to another and it quickly became apparent that there were a number of issues.

“Hopefully we have unearthed all matters, but it remains to be seen.”

The results of the corporate review — outlined in an ASX statement released on August 16 — included a range of serious corporate governance related issues, improper payments, $1.8 million in unpaid taxes in Australia and Mali, and disclosure problems.

A new auditor found a payment to a company controlled by former managing director Kevin Joyce.

Mr Walker says the bonus of $182,000 was made to MQB Ventures, a company they’d used in the past for office and admin services, which was sent to Mr Joyce’s company Wavecape Holdings.

The company said in an “additional disclosure” — sent to the ASX on September 29 — that it “may have been calculated” to be an equity element of his contract.

“Details of the employment contract and its terms, including potential issues of equity, were never disclosed to ASX and, in any event, there was no enforceable agreement between Birimian and Joyce for equity remuneration’,” the ASX disclosure said.

“It would appear from information contained within the emails that have recently come to light that the cash payment was calculated on the basis of 607,000 shares at a deemed issue price of 30c each converted to the cash equivalent.

Birimian has asked for the money to be paid back.

Reinstatement leads to re-rating

Birimian shares dropped 36 per cent in one day in October when the company came out of a four-month suspension and the Goulamina pre-feasibility study was released.

Mr Walker said the study had been commissioned by the previous board and was premature.

“There was a level of disappointment with the lack of a specific recommendation going forward. The study discussed a range of options [and there was a] lack of clarity around a way forward,” he said.

The study did, however, identify new anomalies at Goulamina.

Birimian has since started a drilling program to define what they have in the ground. A definitive feasibility study is expected in early 2018.

Birimian owns the Massigui and Dankassa gold projects in Mali and the Goulamina lithium project, which has an estimated resource of 32.9 million tonnes at 1.37 per cent lithium oxide.

Birimian shares were up slightly at 35.5c in Wednesday trade, giving it a market value of $68 million.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.