Billionaire investor Eric Sprott headlines $14m raise for Rapid Critical Metals

Silver investors are rushing into RCM as the metal hits a 14-year high. Pic: Getty Images

- Rapid Critical Metals has raised $14m in a placement, led by investments from Eric Sprott, Jupiter Asset Management and Tribeca Investment Partners

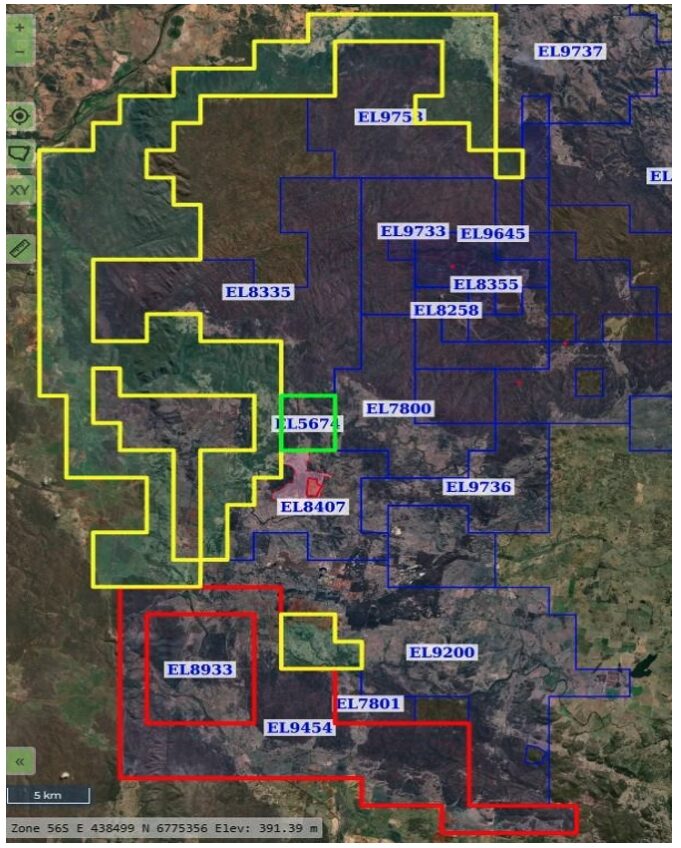

- Will help RCM close deal to acquire super high-grade Webbs Consol project in NSW

- Silver hits 14 year-high as demand for precious metal soars

Special Report: In a sign of confidence in Rapid Critical Metals and its emerging silver strategy, some of the world’s top resources investors have piled into a $14 million placement – including investment tycoon Eric Sprott.

The Canadian billionaire, famous for tipping the rise of precious metals to new highs during the Global Financial Crisis, is one of three titanic institutional shareholders to jump on board alongside Jupiter Asset Management and Tribeca Investment Partners.

These cornerstone investors contributed a combined $10.5 million for the raising.

The raising, which will see Rapid Critical Metals (ASX:RCM) draw $14m via the issue of 400m new fully paid ordinary shares at 3.5c a pop, has reinforced the large-scale potential of its Webbs Consol project in New South Wales.

Picked up from fellow silver darling Lode Resources (ASX:LDR), the placement funds will help RCM complete the acquisition, settle US$379,500 of facility notes to 1000433639 Ontario Inc., fund exploration at the NSW silver projects and Canadian germanium-gallium projects, and for general working capital.

Up 62% in morning trade, the big name backing and promise of Webbs Consol has driven RCM to two year highs at 5.6c, up more than 400% in the past year.

“The Board is extremely pleased with the strong level of interest in this placement. We are pleased to welcome the likes of Eric Sprott, Jupiter Asset Management and Tribeca Investment Partners as shareholders in the Company and see this as an endorsement of the Company’s NSW silver exploration strategy,” RCM managing director Byron Miles said.

“The company is now well capitalised and the board will diligently use these funds to not only complete the acquisition of the Webbs Consol but also to continue to develop and implement a thorough and well planned exploration program on our NSW and Canadian projects.”

Tranche 1 will see $5.6 million raised via 159.7 million new shares, while Tranche 2 will raise $8.4 million through the issue of 240.3 million new shares. Tranche 2 will be subject to shareholder approval at an extraordinary general meeting to be held early November this year.

Watch: Byron Miles joins Stockhead TV

Silver surge

Webbs Consol is the highest grade silver project in Australia, with a resource running at 1.6Mt at 636g/t silver equivalent for 32Moz AgEq.

That’s on top of RCM’s 100%-owned Webbs and Conrad deposits, which already host 35Moz.

The deal will include the exchange of $3.75m in cash, $3m of which is due on completion, and 115m RCM shares, along with a 2% NSR royalty.

Results from drilling completed under Lode ownership include hits of 17.3m at 1734g/t AgEq from 281m, 149.2m at 455g/t AgEq from 98m and 24.5m at 1450g/t AgEq from 144m.

Those grades are exceptional by Australian standards.

It comes as silver prices soar, following the precious metal’s cousin gold to hit a 14-year high of US$42.69/oz, closing in on the all-time high of US$49.45/oz set during the Hunt Brothers silver squeeze in 1980.

Concerns about the state of the global economy and hopes of interest rate cuts have sent the metal 41% higher over the past year, with silver a cheaper alternative to gold as a store of wealth for investors.

But unlike gold, it is also sitting in a deep deficit thanks to rising industrial demand, related to its growing use in solar PV.

According to Sprott Asset Management, 2025 will be the seventh consecutive year of deficits, with mined supply crumbling by 7% since 2016.

Since 2021, close to 800Moz of silver has been required beyond primary mined supply, setting the stage for a price run to support new operations like Webbs Consol.

This article was developed in collaboration with Rapid Critical Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.