Big Tech’s nuclear pivot: How Amazon, Google and Meta are powering the AI revolution

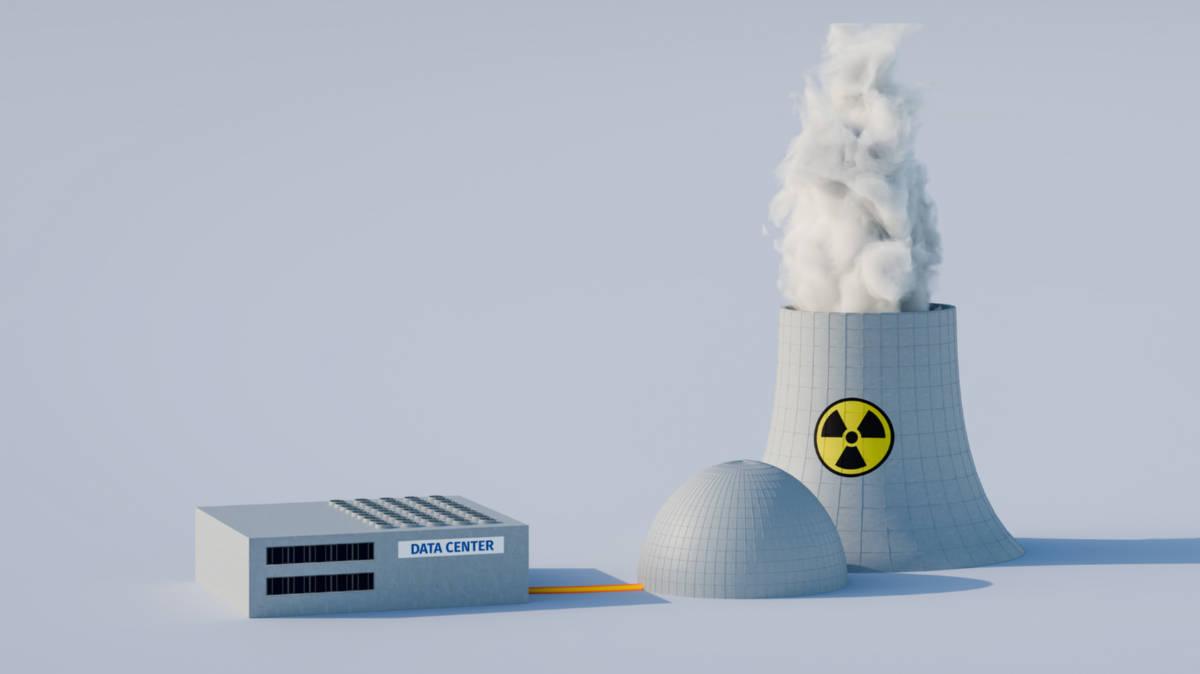

AI’s power crunch is pushing Big Tech toward the atom, with policymakers right behind them. Pic: Getty Images

- The AI boom is encouraging Big Tech to rethink its power sources

- Amazon, Google, Microsoft and Meta are betting big on nuclear, a move fuelled by government incentives

- And a growing view by industry players is that nuclear is no longer a choice, but a necessity

The world’s largest technology companies are shifting towards nuclear energy as greater adoption of artificial intelligence drives an explosion in power demand.

Amazon, Google and Meta have signed a pledge to support tripling nuclear power capacity by 2050, joining more than 20 governments and major financial institutions in backing the clean energy source.

The move marks a dramatic reversal for an industry that historically favoured renewables and signals hyper-scalers have concluded wind and solar alone cannot meet their energy requirements.

AI data centres are projected to drive a 160% increase in US power consumption by 2030, creating what industry insiders describe as a “reliability panic” across electricity grids.

Tech sector meets government policy

The tech sector’s nuclear commitments extend beyond symbolic pledges.

Microsoft has committed to restarting Three Mile Island’s Unit 1 reactor under a long-term power purchase agreement, while Meta issued a call in December last year for nuclear developers to submit proposals to help add up to 4 gigawatts of new nuclear capacity in the US.

Amazon and Google announced investments last October to help launch small modular reactors, backing technology still under development that the industry hopes will reduce the costs and timelines that have plagued new reactor builds.

And Meta inked a 20-year agreement with US utility Constellation Energy in July to keep one of its nuclear plants running, a facility already powering about 800,000 homes, while lifting output by 30MW.

These moves are being turbocharged by government support, with the US this month revealing an $80bn partnership with Westinghouse Electric Company, co-owned by Canadian uranium giant Cameco (49%) and Brookfield Asset Management (51%), to deploy advanced nuclear reactor focusing on AP1000 technology.

The deal is expected to create more than 10,000 jobs and boost domestic manufacturing, with the US government set to provide financing, streamline approvals and secure an equity stake.

It’s one component of a substantially larger bilateral investment framework, coinciding with Japan’s announcement of a $550bn US-Japan Technology Prosperity Deal.

The deal with Japan marks the largest share allocated to nuclear energy, up to $100bn for Westinghouse AP1000 reactors, and another $100bn for GE Vernova/Hitachi BWRX-300 small modular reactors.

According to uranium industry executives watching the sector closely, this surge in demand has transformed nuclear from an optional energy source into an inevitable one.

American Uranium (ASX:AMU) boss Bruce Lane says the latest wave of deals signals a powerful upswing in long-term uranium buying.

The $550bn US-Japan framework alone could lift global needs by 10 to 20%, while stretching an already-looming 184Mlb supply gap over the next 10 years, he noted.

“These announcements could spur US mining investments, potentially easing constraints if restarts occur,” he said.

“It also reinforces bullish uranium prices (which currently sit around $79 to 83/lb) with analysts forecasting rises to $100/lb by 2026 due to AI-driven demand and new reactor builds.”

AI boom meets uranium bottleneck

The squeeze is hitting hardest in the US, where production has all but vanished while reactors still chew through 45 to 50Mlbs a year.

Much the same way LNG offtakers once underpinned new liquefaction projects, Lane said Big Tech’s long-term power purchase agreements are now providing the financial backbone for nuclear development, helping turn marginal projects into bankable ones.

“Nuclear is now inevitable for baseload reliability amid AI-driven demand surges, which elevates the premium on near-term ISR pounds, like our Wyoming resources, potentially increasing their value two to three times as utilities prioritise quick to market domestic supply by 2030,” he added.

“In Wyoming, the heart of US uranium production, we’re seeing hyperscalers’ commitments accelerate domestic fuel needs, steepening the demand curve for US-origin uranium starting now through 2030, as new SMRs and restarts ramp up.”

Lo Herma poised to play role in supply crunch

With American Uranium’s Lo Herma asset potentially capable of reaching production in the late 2020s, precisely when the crunch between AI-driven demand and limited domestic supply will be most acute, the ISR project sits in the sweet spot of the emerging supply crisis.

It is located just 16 kilometres from Cameco’s idled Smith Ranch-Highland facility in Wyoming’s Great Divide Basin, and is one of the largest and most advanced ISR operations in the US.

The project remains on care and maintenance but sits close enough to Lo Herma to offer strong synergies if Cameco restarts – something Lane considers highly likely.

He estimates a 70–80% likelihood of a restart within 12 to 24 months, as Cameco – which co-owns Westinghouse – benefits from vertical integration and uranium prices above $80/lb, well clear of the ISR breakeven range of $40–50/lb.

The timing of American Uranium’s two-phase drilling program to expand and update its current resource base (6.21Mt at 630ppm eU3O8, totalling 8.57Mlbs) couldn’t be better.

“We’re excited to be in a strong position to be able to complete this first phase of resource expansion drilling this quarter, with an interim mineral resource estimate update expected in early 2026,” Lane said.

“American Uranium is ideally positioned in Wyoming’s premier districts to capitalise on this shift, with our Lo Herma ISR project ready to contribute to US energy security.

“We’re excited to be part of nuclear’s comeback story.”

At Stockhead, we tell it like it is. While American Uranium is a Stockhead advertiser, it did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.