Big investors think gold is heading higher again in 2025

Investors continue to tip higher gold prices after 41 record closes in 2024. Pic: Getty Images

- State Street Global Advisors are bullish on gold, tipping prices could rise as high as US$3100/oz

- The outcome is highly dependent on how Donald Trump’s policies influence rate decisions by the US Fed

- VanEck analysts are betting gold miners will make up more ground to the underlying commodity

The world’s fourth biggest asset manager and one of the top investors in Australian gold equities have laid down optimistic outlooks for the bullion market in 2025, betting that both the metal and stocks will run higher this year.

State Street Global Advisors, among the top institutional backers of Australian listed miners, said gold could run as high as US$3100/oz in 2025 after setting 41 new closing highs through a watershed 2024.

“Although gold’s momentum stalled in November as Donald Trump’s win at the polls drove a surge in risk assets and the US dollar, we think its price still has room to run in 2025,” State Street’s gold strategists, led by George Milling-Stanley, said.

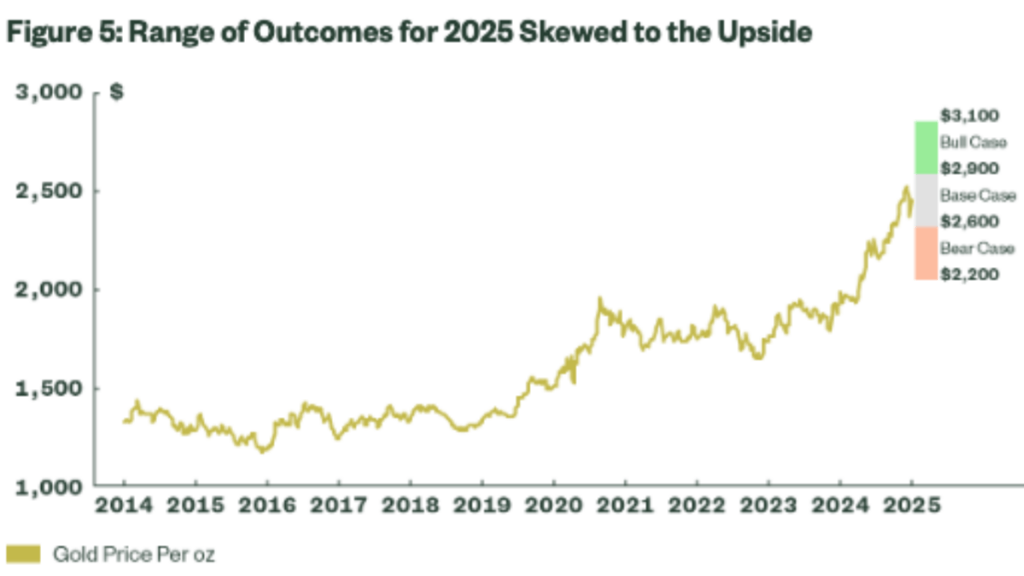

“Our base case is for gold to range between US$2,600 and US$2,900 in 2025, with the potential to rise to US$3,100 under certain economic scenarios.”

Gold is currently trading at US$2650/oz, or $4250/oz in Aussie dollar terms.

By contrast, average all in sustaining costs across the Australian-based miners are running at $2150/oz.

Reasons to be bullish

There are a number of factors backing State Street’s bullish outlook, with Milling-Stanley and Co. pointing to three “good reasons”:

- Central bank purchasing is expected to continue, countering a strong US dollar

- Consumer demand in China and India is rising

- Monetary easing (interest rate cuts) and the potential inflationary nature of Trump’s tariff-led economic policies.

While the risk on tone that sent equity markets to new highs in 2024 will remain ahead of “business-friendly” Trump’s return to the White House, State Street says there’s no shortage of anxiety about inflation, government debt and geopolitical tensions.

“We don’t see this changing and expect the secular demand trends underpinning gold’s price and its status as a safe haven to continue enhancing gold’s appeal as a core portfolio asset, even if capital markets strike a risk-on tone in 2025,” the analysts say.

They’ve drawn similarities between the policies of Trump and those of George W. Bush. The latter’s presidency coincided with gold’s largest rally under any US president since the abolition of the Gold Standard in the 1970s, with bullion running 220% higher during his two terms in office.

“In that period the Fed applied an accommodative monetary policy at a time when government spending sent gross federal debt as a percentage of gross GDP surging 50.44%. Gold’s rally at that time was also fueled by economic and foreign policies weakening the US dollar and exacerbating geopolitical tensions,” Milling-Stanley et al said.

“Many of Trump’s fiscal plans are similar to President Bush’s policies. Trump wants to extend the Tax Cuts and Jobs Act’s sizeable tax breaks, increase defense spending, curb immigration, and introduce higher tariffs.

“Combined with anticipated rate cuts by the Fed, Trump’s policies could recreate the dual tailwind of a growing fiscal deficit and accommodative monetary policy which catalysed gold’s bull market during Bush’s presidency.”

State Street places a 50% probability on a base case where gold swings between US$2600-2900/oz under a scenario where US growth surprises to the upside, keeping the US Fed fund rate above the 3.25-3.5% projected by market watchers in September last year.

If US growth slows and interest rates are cut more aggressively, prompting gold ETF inflows to stay positive most of the year, a bull case with a 30% probability would see gold trading from US$2900-3100/oz.

A bear case, with a 20% probability according to State Street, of US$2200-26000/oz would see US growth accelerating way more than expected on a strong US manufacturing run, keeping rates paused.

Disconnect

It’s not only the metal itself catching the interest of institutional investors, with major ETF provider and equity investor VanEck placing its focus on gold stocks.

A move in the gold price generally corresponds to a more meaningful lift in cash margins generated by gold producers, VanEck analysts wrote in its January VanEck Viewpoints update.

But the market hasn’t necessarily been treating it that way.

Using the NYSE Arca Gold Miners index as a guide, gold stocks fell 15.3% in the first two months of 2024 against a price slide of just 0.9%, a 17x multiple.

But as gold lifted 34.5% from that point to October 22 , 67.7% lift in gold stock prices only doubled the metal’s gains.

As gold fell post the election of Trump in November, miners dropped 14.8%, 3.8x the slide in bullion.

“Since 2020, positive quarterly moves in the gold price translated to outperformance by the gold equities by an average 1.94x multiple,” VanEck said.

“We excluded the first and last quarter of 2020 from this calculation. In those two quarters, gold was up while the stocks traded down. Meanwhile, negative quarterly moves in the gold price led to underperformance of the gold equities by a factor of 8.72, on average.”

There’s now a disconnect between bullion and equities which VanEck says “won’t last forever”.

“The significant gap between gold and gold equities had been narrowing over the last year, but the post-election weakness in the gold sector has widened it once again,” they said.

“With gold producers enjoying record margins, leading to record free cash flow generation, we expect this disconnect won’t last forever.

“Investors looking to hedge broader market risk through gold exposure, we think should also consider an allocation to the gold mining sector. They may be among the few equities not priced to perfection.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.