Bellevue Gold charts path to 250,000ozpa in bid to scale up namesake gold mine

Bellevue believes its investment and debt restructuring will pay off in spades. Source: Stockhead.

- Bellevue Gold CEO Darren Stralow has explained the thinking behind a surprise $175m capital raising at the newly minted gold miner

- The decision to pay off debt early will enable mining rates to increase and underground exploration to ramp up in tandem

- BGL planning to produce 165,000-180,000oz in FY 25 but ramp up to 250,000ozpa from 2029

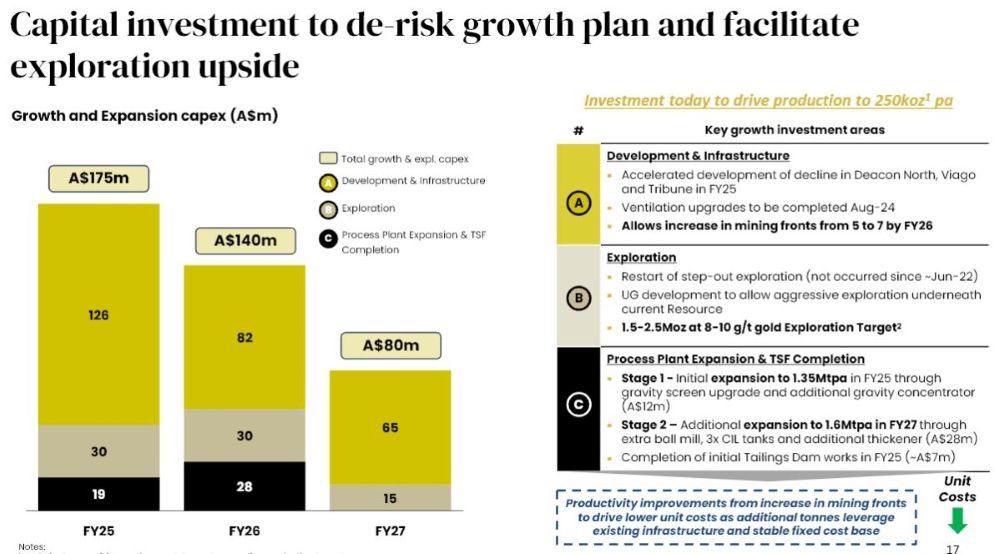

A capital raising last week to inject $175 million of fresh capital into newly minted gold producer Bellevue Gold (ASX:BGL) took the market by surprise, but its management is confident its five year, $395 million plan to grow production by aroudn 40% to 250,000ozpa is the right one.

The cash call came just two weeks after Bellevue hit an all time high of $2.03, a reward to shareholders who had stayed the course since the recapitalised shell of a spent coal explorer Draig Resources was Frankensteined with the Bellevue asset at 3c a piece in 2017.

Coming not long after BGL declared commercial production, hit its first half-year guidance by producing 80,043oz in the June half and delivered $41 million in free cash flow through the June quarter, the move clearly blindsided many investors.

The $1.8bn capped ASX 200 goldie saw its shares close as low as $1.33 on Tuesday, with the mine’s delivery having previously looked impeccably timed, coinciding with record gold prices in excess of US$2400/oz.

But CEO Darren Stralow says the decision to deleverage Bellevue and pay down a Macquarie Bank facility through the placement will remove a handbrake to growth. There may have been short term pain, but the aim is longer term gain.

“We’re actually going through an investment phase in growth, and the thing about that is the earlier you start spending towards that growth, the earlier you see the rewards,” Stralow said on a site visit ahead of next week’s Diggers and Dealers Mining Forum.

“When you look at the competition for capital at Bellevue, you weigh it up – do you spend money on growth, do you spend money on the operation, or do you pay the debt down. We couldn’t do all of those things at once without adding risk to the operation.”

Stralow also notes the company didn’t want to be caught out if the gold price changed.

“By reducing our debt from $220m down to $120m, it brings us down to a very manageable level from an operational point of view,” he said.

They’re being pushed out to FY27, as the heavier front-loaded capex in the early years. “It wasn’t just about optimising the size of the debt, but the payment schedule too,” Stralow said.

Investing in organic growth

The current production target for FY25 is 165-180,000oz at an AISC of $1750-$1850/oz, however the miner sees an opportunity to grow into one of WA’s top performers by running development and exploration spending in tandem.

$175m will be used in this financial year alone, with $126m of the kitty spent on development and infrastructure, $30m across exploration and $12m on an initial Stage 1 upgrade of the Bellevue processing facility from an initial nameplate of 1Mtpa to 1.35Mtpa. A Stage 2 upgrade ($28m) will see it process ore at a run rate of 1.6Mtpa from FY26.

$60m worth of exploration is going ahead to upgrade the current 3.2Moz resource. Decline development over the first two years of the plan will enable access to areas where Bellevue has outlined a 1.5-2.5Moz at 8-10g/t gold exploration target to the southern extent of the ore system.

Notably most of the high grade resource presented before the construction of the mine was drilled from surface. Drilling from underground can outline and infill resources more densely and cost effectively when looking for deep, narrow vein discoveries.

Two lots of $30m will be spent across FY25 and FY26.

Infrastructure for the long term

The decline development at Deacon North and Tribune to increase the current five mining areas to seven by FY26 will be taking priority, with the aim to decrease costs and ramp up mining volumes.

Those upgrades will “de-risk targeted ramp-ups across the next five years on our pathway to our five-year, 250,000ozpa target,” Stralow says.

“Implementing that infrastructure will be the real thing that unlocks productivity.”

Bellevue is also looking to increase underground access, upgrade ventilation and other key infrastructure as an enabler to grow the current resource and step up exploration activity while expanding mining rates.

The reporter travelled as a guest of Bellevue Gold.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.