Belararox in a sprint towards zinc-base metals at Belara

Belararox is targeting a resource estimate for its Belara zinc-base metals project by August. Pic: Thomas Barwick via Getty Images

Growing demand from renewable energy and battery markets for critical minerals has seen several new explorers list on the ASX this year, but this company has soared thanks to its advantages.

Belararox (ASX:BRX) listed on the ASX on 28 January 2022 with two fully-owned projects – Belara in New South Wales and Bullabulling in Western Australia – after raising $5.06m through an initial public offering priced at 20c each.

Shares in the company rose steadily to a high of $1.53 in late March before easing to the current price of about 42c… just over twice its list price.

The secret to its success boils down to two key factors; having quality projects run by a seasoned and well respected board and management team.

Speaking to Stockhead, Managing Director, Arvind Misra, said the company started from a very good base with both its projects, noting that the Belara base metals project already possessed an existing resource – albeit one based on the older JORC 2004 code.

Prior to relinquishing the project in 2020, previous owner Ironbark Zinc (ASX:IBG) had defined an Inferred Resource of 1Mt at 5% zinc, 0.4% copper, 1.5% lead, 0.3 grams per tonne (g/t) gold and 50g/t silver at a 4% zinc cutoff or 3.8Mt at 3.1% zinc, 0.4% copper, 1% lead, 0.2g/t gold and 34g/t silver at a 1% zinc cutoff.

‘It’s an older code, sir… but it checks out’

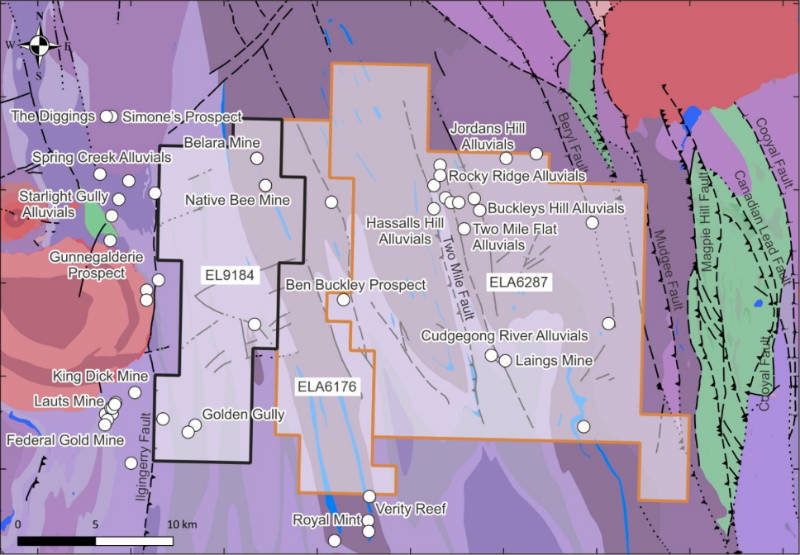

While this older code has been superseded by the JORC 2012 code, it still establishes the existence of mineralisation at the 643km2 project in Central NSW, which consists of one exploration licence and two licence applications.

Given that zinc prices of about US$3,660 per tonne are something like twice the price of between US$1,800/t and US$2,000/t when Ironbark did its modelling more than 10 years ago, Belararox is understandably keen to reframe this mineralisation in more modern terms.

Belara project basement geology. Pic: Supplied

Since listing, the company has completed gravity and induced polarisation (IP) surveying on the ground, drill diamond holes for metallurgical purposes and wrapped up prospectivity modelling.

Misra noted that the visuals from the diamond holes and the XRF scans it ran were “pretty consistent” with the previous old resource model.

Belararox is also progressing its Phase one resource drilling which has seen nine holes drilled to date with the company mobilising two rigs to accelerate the 5,600m program over the Belara and Native Bee prospects.

Both prospects are underground mines that were worked from 1875 to 1908.

“The intention is to complete the first 5,600m of drilling, the initial amount we said in our prospectus, and define a maiden resource by August,” Misra told Stockhead.

But the company is not stopping there with Misra noting that feeding all the available data into a self-learning algorithm used by the technical team had indicated that the known resource at Belara is just the tip of proverbial iceberg with 34 new targets identified in late May that extended the exploration area ten-fold.

“I’ll probably take one of the rigs, which is a combination rig capable of drilling both RC and diamond holes, and drill into the area to test how big it is,” he explains.

“Maybe initially for geology purposes because we need to drill holes to understand the rock and the geology. If I hit the (mineralised) area we expect, that will really be a bonus for us.”

Next stop: Bullabulling

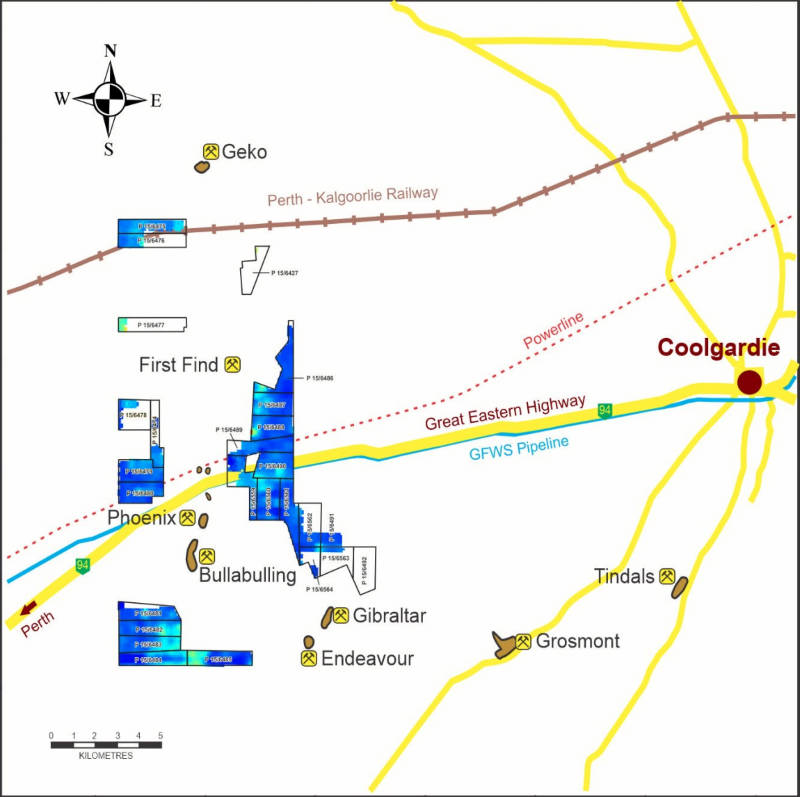

Bullabulling project gold soil samples. Pic: via Getty Images

While the company’s focus is currently on Belara – and rightly so given its historical resource and potential for quick growth, it certainly hasn’t forgotten the Bullabulling gold and nickel project near Coolgardie.

Bullabulling is an early stage exploration project consisting of 26 granted prospecting licences surrounding the 3 million ounce Bullabulling Gold Mine owned by Norton Gold Fields.

It sits on the same anticline as the third-party project and the company believes that it hosts similar mineralisation.

It also covers ultramafic lithologies that host the Nepean nickel mine about 30 kilometres along strike to the southeast.

“Some old soil sampling and shallow air drilling confirms there are gold occurrences,” Misra added.

“At the moment we are doing desktop work and drill targeting. Our intention is to drill some holes in the second half of the year and see if the theory is correct and if we do find a contact.”

Experience counts

All this potentially is ably guided by the company’s board and management, which counts highly experienced mining executive Neil Warburton as its non-executive chairman and Michelle Stokes – who has 40 years of experience and is co-owner of geoservices company Kenex – as a non-executive director.

“It is her and her husband Dr Greg Partington, who is also our chief technical consultant, who use their self learning algorithms and technologies to do the prospectivity modelling and targeting for us,” Misra notes.

“Kenex has been responsible for many successful field exploration programs that were taken all the way to IPO listings.”

“The 3Moz Bullabulling Gold project was actually upgraded by the Kenex team. They not only understand the technical side but also the corporate side.”

Belarox also recently appointed Simon Robertson and John Traicos as non-executive directors.

Robertson has over 15 years’ experience providing compliance, corporate governance, capital raising, strategic direction and planning and risk management advice while Traicos – who will also serve as the company secretary – is a lawyer with more than 30 years’ experience in commercial and corporate affairs in Australia and Southern Africa.

Both new directors have very good knowledge in compliances, legal and company secretarial and corporate governance knowledge and were also brought in as independent directors unlike Warburton, Stokes and Misra, who have substantial interests exceeding 5%.

Misra himself is an experienced mining engineer with more than 30 years’ of industry experience ranging from working in underground coal mines for Rio Tinto at Wollongong, NSW, to Anglo American’s copper mines in Zambia.

He also carried out consulting work and was the managing director for India Resources, which set up and ran a copper mine in India, contributing $200m in revenue to India’s government.

He subsequently joined with Warburton, Stokes and Partington to list Belararox on the ASX, largely on the prospectivity of Belara.

Further activity

Besides the plans for further drilling at Belara and the initial work on Bullabulling, the company also plans to fly a combined heliborne IP and gravity survey over the southern part of Belara, where the mineralised trend continues for about 20km.

It then plans to carry out work on the eastern side where the company has its two licence applications.

“These are very prospective for orogenic-style gold because there have been some old gold mines on the eastern side but no one knows where the source is,” Misra noted.

“So once we have flown the survey, which will also be over these ELA’s, which cover 643km2, gather the data, then start long-term planning, the 20km extension for VMS and then for orogenic gold on the eastern start.”

“At the same time we test for depth at Belara, current drilling is only to 350m, we don’t know how far below it can go. There is plenty of possibility and plenty of work to be done.”

This article was developed in collaboration with Belararox Limited, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.