BDO puts uranium, gold M&A on the watchlist as lithium continues to capture investors’ hearts

Pic: Getty

- Lithium explorers were able to raise mountains of cash despite sliding prices in the December quarter

- Uranium and gold are ripe for M&A with prices on a positive trend

- ASX explorers spent over $1b drilling in the December quarter

Figures tabled by accounting and financial services firm BDO show lithium investments remained strong even as prices nosedived in late 2023 with Australian explorers continuing to splash the cash.

But its global head of natural resources Sherif Andrawes says to keep a lookout for M&A in uranium and gold, two commodities which are catching the eye as prices run ahead of equity valuations.

“Uranium hasn’t been the most popular of commodities for a long time but now with pricing coming back we’ve seen transactions recently like 92 Energy (ASX:92E) just this week. They had their scheme approved with ATHA Energy in Canada,” he told Stockhead.

“We saw A-Cap and Lotus Resources (ASX:LOT) at the back end of last year. I think we might see more in the uranium space.

“That’s certainly going to be something that’s been neglected for a while and I’m surprised we haven’t seen more uranium M&A coming out.

“Gold is always there. The current gold price is spectacular, but particularly in the Australian dollar gold price. I think that might just generate a bit more M&A happening and we’re seeing things like Silver Lake (ASX:SLR) and Red 5 (ASX:RED) at the moment but I think we’ll see more coming up in the near future.”

Lithium prices may have crumbled by almost 90% in 2023, but investors were still backing lith stocks and explorers were still drilling their hard earned into the ground in the December quarter, data from BDO’s Quarterly Explorer Cash Update showed.

Explorers secured $2.68b in funds in the three months to December 31, up 32% on the September quarter, while $1.01b was spent on drilling with a 23% rise in companies spending between $100-300,000.

Up from $993m in the corresponding period in 2022, that’s among the highest quarterly splurges since 2013, with explorers still confident they can head back to investors for more drilling capital.

LithCos dominate 2023 fundraisings

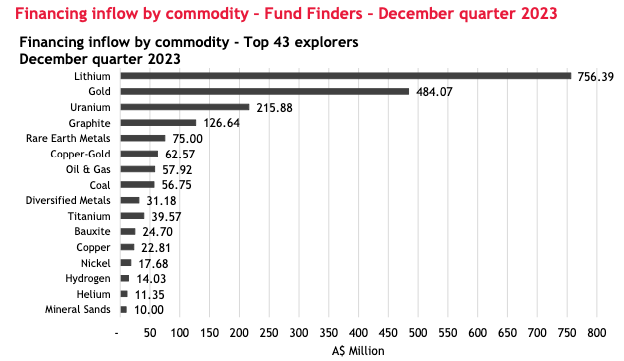

Even as prices began to slide, LithCos secured $756.39m from investors in the December quarter among the 43 companies which raised more than $10m, outstripping the next highest recipients the gold sector ($484.07m), uranium ($215.88m), graphite ($126.64m) and rare earths ($75m).

That was propelled by Liontown Resources (ASX:LTR) and its $389.94m equity raise after Albemarle’s $6.6b deal to acquire the Kathleen Valley lithium mine owner fell through.

A $300m raising from De Grey Mining (ASX:DEG) also added some gloss to the gold sector’s numbers as did big capital injections for Boss Energy (ASX:BOE) and Syrah (ASX:SYR) in uranium and graphite.

But those big equity raisings certainly showed investors had long term outlooks that battery metals demand will remain strong.

While we haven’t seen lower prices trigger a wave of lithium M&A after a rush last year when the industry was at its zenith, Andrawes said most big acquirers (think MinRes, Gina Rinerhart et al.) are taking a long term rather than cyclical approach to investing in the sector.

On a calendar year basis lithium explorers hoovered up $1.952b in fresh investment followed by gold ($1.786b), graphite ($494.8m), rare earths ($302.29m) and oil and gas ($272.48m).

The one battery metal that really dropped off investors’ radar, Andrawes said, was nickel, which went from one of the prized pigs of the mining game to a pariah within a year as oversupply of battery grade product from Indonesia halved prices.

“There’s a difference between each of the battery metals, it’s a very broad category and nickel was probably the worst of them all. It fell in our rankings of fund finders,” he noted.

“Early in the year it was quite high, but in this particular one, it falls down to the bottom end of it, so it’s probably the laggard in the whole scheme of things whereas lithium was quite different.

“I think there’s a distinction between what’s happening in the short term lithium market and what’s impacting producers compared to what the opportunities are for lithium in the longer term and I think explorers reflect the longer term rather than the short term.”

Will IPOs return?

Since returning to a decade high in 2021, resources IPOs have quickly slowed to a trickle, with Andrawes saying BDO’s pre-IPO assessments are largely coming from Canadian companies looking to chase the stronger mining dollar on the ASX.

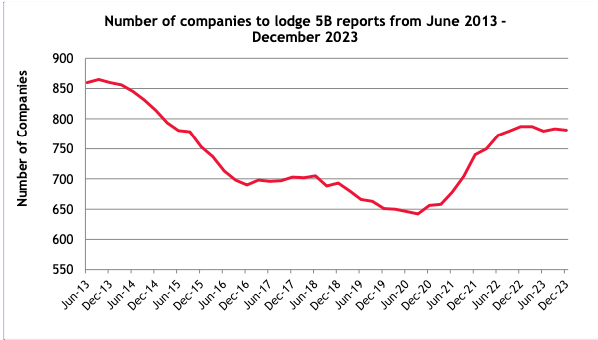

“The concern is that the IPOs are coming off. One of the measures I quite like which is most telling is the number of companies there are and there’s a graph we have that shows over the over last 11 years we’ve been doing it the numbers drop off a lot and then cycle back up again,” he said.

“That’s plateaued in the last year or so.

“I’d love to see that going back up again. It shows that we’re strong but not as strong as we’d like to be.”

There were just six exploration IPOs per quarter in 2023, down from 17 in 2022 and 26 in 2021. Four companies were delisted in the December quarter due to takeovers.

But cash balances remain healthy with few exiting due to company collapses, with 77% of companies reporting Appendix 5B statements holding $1m cash or more. That fell to around 45% during the downturn in 2015 and 2016.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.