Battery Metals: Liontown plans extra drilling to find the edges of the hefty (and growing) Kathleen Valley deposit

Pic: Schroptschop / E+ via Getty Images

It’s been a crazy run for advanced hard rock explorer Liontown Resources (ASX:LTR), a stock which has consistently flipped the bird at weak lithium market sentiment to be up 400 per cent over the past 12 months.

Liontown’s flagship Kathleen Valley project in WA boasts a current resource estimate of 74.9 million tonnes, which already makes it the 5th biggest deposit in Australia.

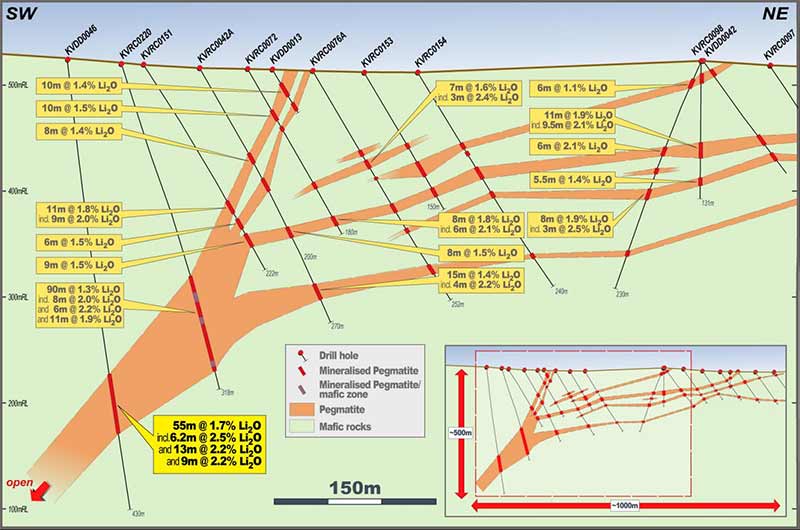

A current 15,000m drilling program is aiming to build on this by testing an additional exploration target of 25-50 million tonnes at 1.2-1.5 per cent lithium. “Exceptional” new drilling results suggest that Kathleen Valley is about to get a whole lot bigger.

This drilling has now defined a high-grade mineralised system over a minimum strike length of 1.4km and to depth of 400m below surface, the company says.

But the deposit also remains open (which means they haven’t found the edges yet) and so more drilling – on top of the originally planned 15,000m program – is needed “to delineate its extents” prior to preparing an updated resource estimate, the company says.

A pre-feasibility study (PFS), based on the current resource estimate of 74.9 million tonnes, is scheduled for completion this quarter.

Miners usually undertake three different types of studies to see whether or not a resource can be mined economically. These are, in order of importance, scoping, preliminary feasibility (PFS), definitive feasibility (DFS)/bankable feasibility (BFS).

Results from current drilling will underpin a major resource upgrade next year that will, in turn, form the basis of a 2020 DFS, Liontown managing director David Richards says.

“We now know that additional drilling will be required over and above the current 15,000m drilling program to fully delineate the potential of this high-quality lithium-tantalum resource,” he says.

“In the meantime, shareholders can look forward to the results of a PFS, including a maiden ore reserve, later this quarter.”

READ MORE about Liontown:

Playing a supporting role, Liontown’s Buldania emerges as a quality lithium project in its own right

Cashed-up Liontown reveals aggressive Kathleen Valley development schedule

In other battery metals news today:

Kibaran Resources (ASX:KNL) wants to build a $US22.8m ($33.1m) graphite processing plant in Kwinana, WA, for global lithium-ion battery customers.

It says that crucial test work confirms the effectiveness of its proprietary ‘EcoGraf’ purification process. Kibaran — which is changing its name to EcoGraf — now has enough info to finalise the all-important process flow sheet design. It was enough to send the stock up about 20 per cent in morning trade.

The company says it remains on schedule to make a final investment decision in the first half of 2020.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.