Battery metals: Jervois is going all in on cobalt with $61m marriage

Junior cobalt explorer Jervois Mining (ASX:JRV) has struck a “friendly” $C58m ($61m) all-scrip merger deal with Canada’s eCobalt Solutions.

Investors liked the news, pushing the share price up nearly 11 per cent to 25.5c on Tuesday morning.

The news comes a day after Jervois told investors it had sold the remainder of its gold royalties for $3.6m.

Now Jervois is setting itself up with a pipeline of projects in Australia, East Africa and the US.

The East African projects come from the previously announced merger with M2 Cobalt.

The rationale for the tie-up is that the bigger company will have a greater scale, liquidity and diversification with “re-rating potential”.

Jervois currently has a stake of 4.5 per cent in eCobalt, and shareholders that collectively own a further 11.4 per cent have indicated their intention to vote in favour of the merger.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

Under the deal, Jervois will issue 1.65 of its own shares for every eCobalt share held, which equates to an implied offer price of 36c Canadian cents.

The pair are bolstering their cash position prior to the merger, with eCobalt undertaking a C$2m placement to Dundee Resources.

All up the combined company, which will be dual listed on the ASX and Canada’s TSX Venture Exchange, will have a cash balance of $16.5m.

“Against the backdrop of challenging cobalt and battery raw material markets, this provides a strong platform to move forward all of New Jervois’s expanded portfolio of assets,” Jervois said in an ASX statement this morning.

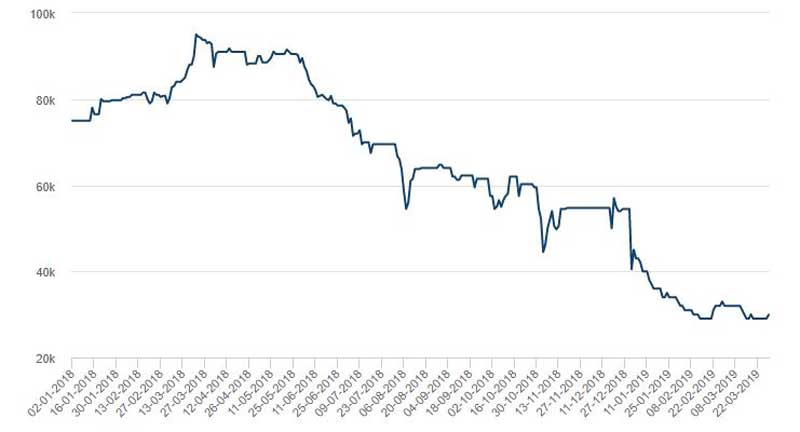

From about early last year the cobalt price has been on a downhill run.

It hit a record $US95,000 per tonne in March 2018 and since then has wiped off nearly 70 per cent to bottom at $US29,000 in February this year.

eCobalt’s flagship asset is the Idaho cobalt project, which Jervois says has the “highest combination of cobalt grade and scale in the US”.

The project hosts a resource of 45.7 million pounds at 0.59 per cent cobalt in the higher confidence measured and indicated categories.

Mineral resources are categorised in order of increasing geological confidence as inferred, indicated or measured.

Resources in the measured category can be converted to a reserve — which are resources known to be economically feasible for extraction.

Meanwhile, Jervois’ focus has been on its Nico Young cobalt and nickel project in New South Wales.

The project hosts an inferred resource of 167.8 million tonnes at 0.59 per cent nickel and 0.06 per cent cobalt.

Jervois close to finalising a pre-feasibility study and says the Nico Young project will be one of Australia’s largest cobalt-nickel operations.

Jervois CEO Bryce Crocker was unavailable for comment at the time of publication.

Following the merger, Mr Crocker will stay on as CEO and Peter Johnston will continue on in his role as chairman. Two eCobalt directors will also join the board of the expanded company.

In other battery metals news:

European Metals (ASX:EMH) has proven it can potentially produce over 25,000 tonnes each year of lithium hydroxide from its Cinovec project in the Czech Republic. Demand for lithium hydroxide over lithium carbonate from electric car makers is on the rise because it can produce cathode material more efficiently. The cathode is used to conduct electricity flows out of a battery or device.

Jindalee Resources (ASX:JRL) has been able to achieve high recoveries of up to 97 per cent lithium from its McDermitt project located on the Nevada-Oregon border in the US. The company is now undertaking further test work to optimise the metallurgical process.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.