Battery metals are now driving the small cap sector, says fund manager

Volkswagen produces 72 e-Golf electric cars a day at this factory in Dresden, Germany. Pic: Getty

Battery metals have been a key driver of returning investor interest in the previously struggling resources space, an analyst says.

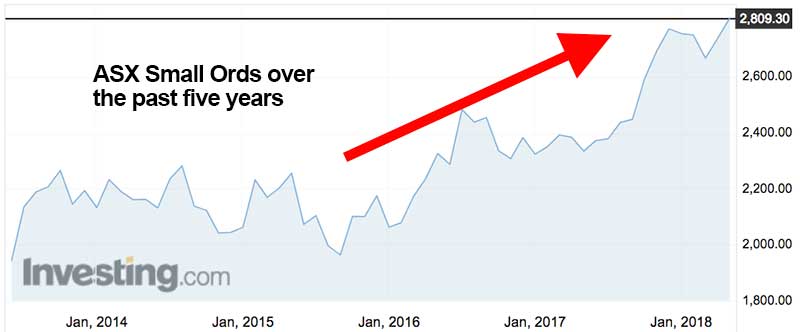

An index of ASX small caps tracked by Lion Selection Group investment manager Hedley Widdup is up 241 per cent since January 2016.

The ASX Small Ords index — which features a number of billion-dollar stocks — is up around 35 per cent over the same period.

“There’s two phases where the small caps have out-performed their larger peers within their respective indices,” Mr Widdup told investors at this week’s Resources Rising Stars conference in Queensland’s Gold Coast.

“And that corresponds with the best performance in the mining space — which leads me to think investors are looking to take on extra risk in order to get that extra growth.”

Gold was the initial driver of a small cap uptick in early 2016.

But commodities such as lithium and cobalt — dubbed “battery metals” because of their requirement in devices and electric cars — were responsible for another surge in investor interest late last year.

“Come the end of last year there had been the promotion and growth of quite a number of battery-focused stocks into the indices and that was driving performance, particularly in the small [caps] over the large,” Mr Widdup said.

Increasing interest in commodities like lithium, cobalt and graphite is due to a continuing ramp-up in production and sales of electric vehicles.

Some estimates put electric car sales as high as 100 million by 2025.

But New World Cobalt (ASX:NWC) boss Mike Haynes believes the number should be at least 30 million by 2030 — up from from 1.1 million cars last year.

New World Cobalt has four advanced cobalt projects in North America.

In the space of four months last year, New World Cobalt’s share price rocketed 640 per cent to a 52-week high of 18.5c in November.

Battery metals were certainly “no longer a flash in the pan”, Mr Haynes told the Gold Coast conference.

“Whatever you thought 12 or 18 or 24 months ago about commodities like lithium, cobalt, graphite, rare earths, this is pretty real in terms of the amount of money chasing it,” he said.

Battery-focused stocks now make up 4.2 per cent of the market capitalisation of all the mining stocks in the ASX300 index.

That is where iron ore stocks were in 2007.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Iron ore hit a peak price of around $US190 a tonne in 2011 on strong growth in China. Strong demand for energy storage is now driving the price of the battery metals up.

“Irrespective of what you think is going to happen with that space from now I can see it’s got a very promising future, particularly as the first few get into production and start meeting some of this demand,” Mr Widdup said.

“That has kickstarted the appetite for equities in the mining space and has brought a lot of investors back to the space and it has generated paper profits which can now be recycled into investments across the rest of the space.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.