Bastion seeks long-lost Chilean mineral elephants

Pic: Tyler Stableford / Stone via Getty Images

An interesting new Chile-focused gold and copper explorer will list on the ASX this week, with Bastion Minerals, scheduled to enter the market tomorrow.

Entering with a three-project playbook, Bastion’s (to be ASX:BMO) focus is on realising long-lost potential in the mining friendly jurisdiction of Chile.

Chile may not be home to elephants in the literal sense, but it has well and truly built a reputation as elephant country when it comes to mineralisation – some of the largest and most lucrative deposits in the world can and have been found in its fertile soils.

But not all have had their potential realised and it is this premise which has Bastion’s experienced management team excited.

The company’s project book features three projects with big potential, with one mined to shallow depths in eras past and then left waiting for an explorer to realise their forgotten value.

The projects span more than 146.41km2, and the details are as follows:

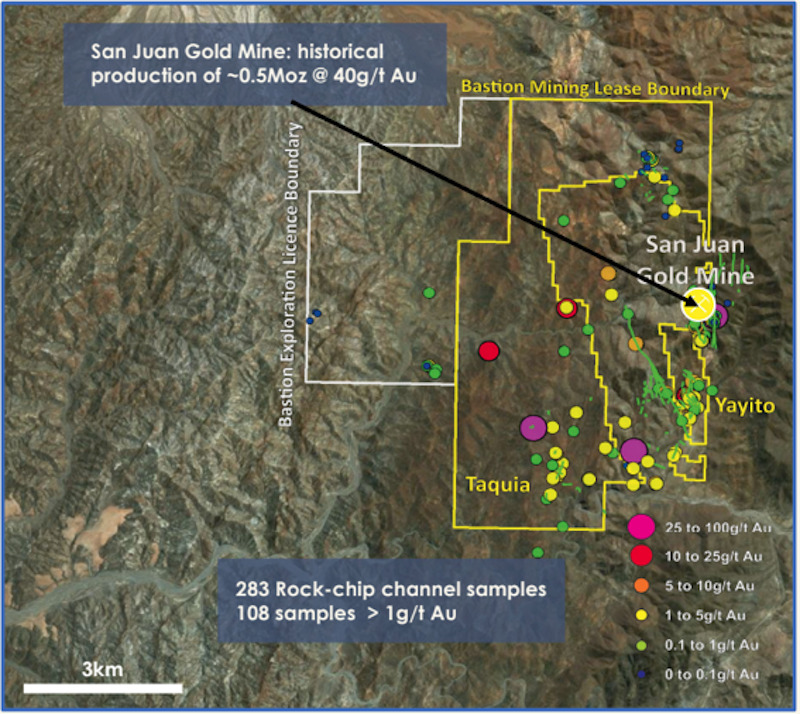

- The Capote gold project: Home of the historically significant San Juan gold mine, where 500,000 ounces of gold were produced at 40 grams per tonne through to 1954. Capote has been untouched for almost 70 years and never explored by modern means. Existing resources are open in all directions – a huge opportunity given the project’s history.

The Capote Project consists of 15 exploration licences, 21 exploitation licences and +44km2 of granted Mining Licences surrounding the historic San Juan Gold Mine in the Atacama Region, Chile. There is an extensive outcropping vein system and shallow historical workings at the project and the company is planning surface sampling, drilling and geophysics to define the system.

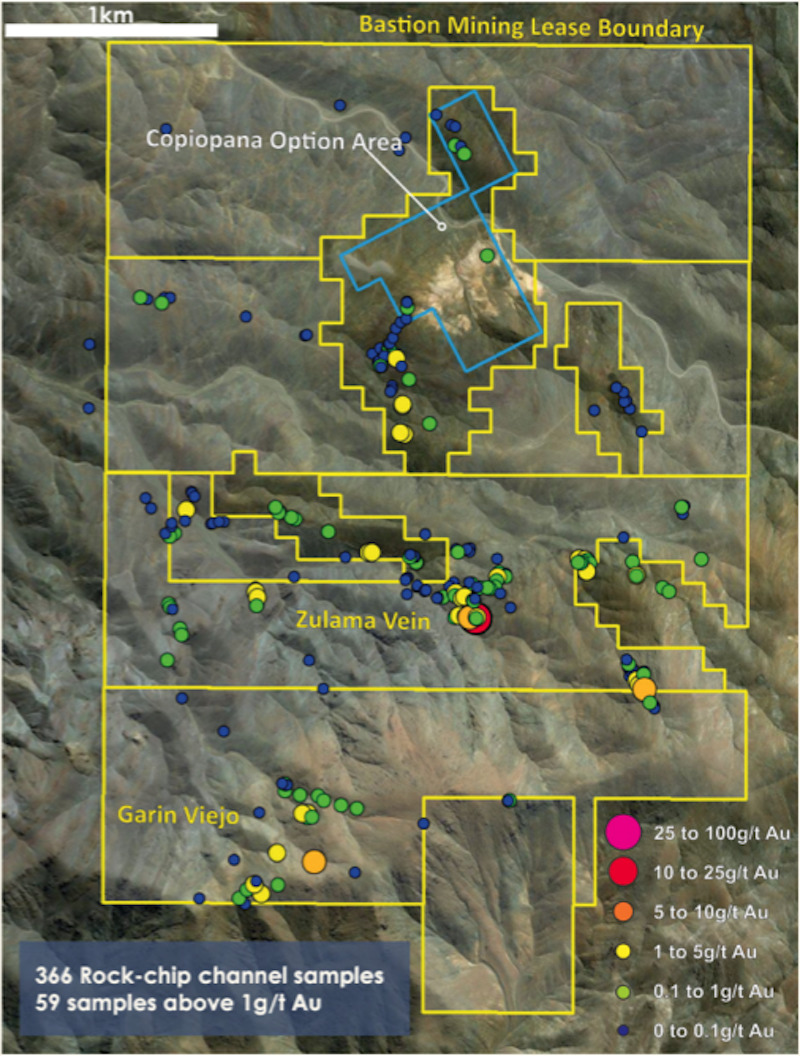

- The Garin gold project: Garin is a project with porphyry potential. Home to high-grade, low sulphidation epithermal gold-silver mineralisation, the area features a large alteration footprint which hosts an extensive silica cap. High grade gold rock chip assays have been taken from multiple trends, and veins are recognised over 2.5km of strike.

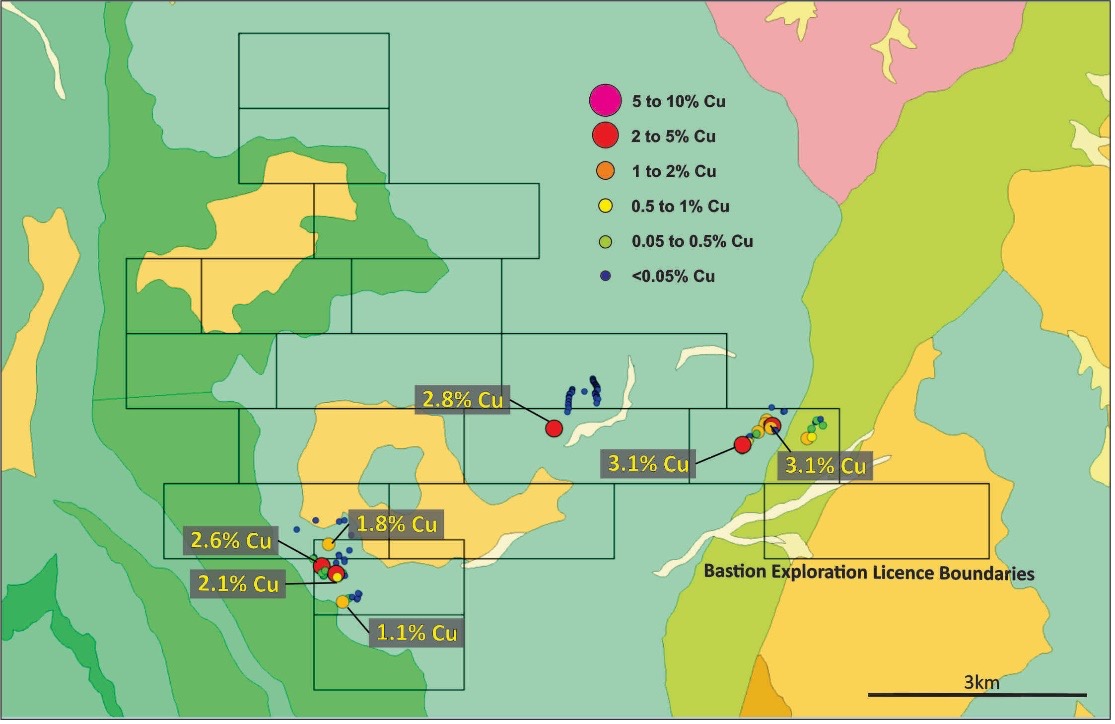

- Cometa copper district: Bastion’s third prong is an early-stage copper project where rock chip sampling has returned extremely high-grade copper percentages. Of 153 rock chip samples taken at Cometa, 30 came back with copper content above 0.5%, with readings as high as 5.5%. The project is a Chilean-style iron oxide copper-gold target.

Initial exploration spending is expected to focus on Capote and Garin, and Bastion’s IPO stated an intention to seek out further exploration and acquisition opportunities in Chile.

The IPO leaves the company valued at around $15 million, with nearly +$5 million in the bank to hit the ground running.

Bastion’s chairman is veteran geologist Ralph Stagg, with decades of experience under his belt, including as co-founder of Citadel Resource Group. Citadel Resources was taken over by Equinox Minerals for $1.25 billion in 2010 before Equinox themselves was bought by Barrick for $7.1 billion the very next year.

The name Bastion is in fact nod to Citadel with the term Bastion being known the last stronghold in a Citadel. It is no doubt that the Bastion team would love to replicate that success.

The company is led by financial services expert Ross Landles and corporate lawyer David Nolan, joining the board as executive directors, with Xanadu Mines CEO and geologist Andrew Stewart and Sam El-Rahim to serve in a non-executive capacity.

This article was developed in collaboration with Bastion Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.