Bastion Minerals on track to become the Bellevue of Chile?

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Bastion could be on track towards becoming a significant gold producer after securing an option for the acquisition of a previously producing high-grade gold project in Chile’s Atacama region.

The agreement has all the hallmarks of a 2017 Bellevue (then Draig Resources) that identified the exploration potential of the previously producing high-grade Bellevue Gold Mine which at the time was a forgotten treasure.

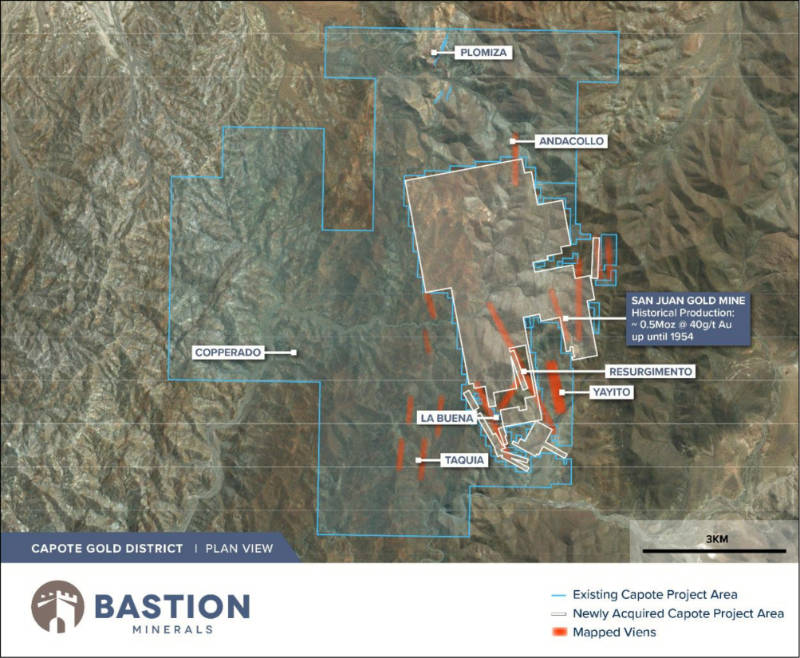

Under the agreement with Sociedad Minera del Norte, the company now has the option to acquire 100% of the high-grade San Juan gold project and surrounding licences within the Capote Mining District where mining has occurred over 300 years before ending in 1954.

No modern exploration has been carried out despite a total of 1.7 million ounces of gold at an average grade of 52 grams per tonne (g/t) from the San Juan Vein and surrounding high-grade gold veins being processed through the Capote mining operations.

Whilst it is still early days for Bastion the potential of this high-grade historically producing gold mine is reminiscent of Bellevue circa 2017 (then Draig Resources). The Bellevue Gold Mine at the time was a forgotten treasure – historically produced 800koz @ 15g/t, but the Bellevue team successfully identify the exploration potential and in late November of 2017 intercepted 5m @ 37.5g/t gold. The results sent the Company on its way to continued growth over the next 4.5years.

Bellevue’s Global Mineral Resource now stands at 3Moz @ 9.9g/t gold. Stage 1 feasibility is now complete and Bellevue is now building towards a stage 2 feasibility with attractive debt financing proposals received.

Bastion Minerals (ASX:BMO) executive director Ross Landles said the acquisition represented a rare opportunity to consolidate and control a historically significant high-grade gold system covering about 30sqkm.

“The potential of this new tenement package cannot be understated and represents execution of Bastion’s corporate strategy to identify, acquire and explore high-grade gold districts that have been locked-up for several decades and missed any modern exploration methods,” he added.

“This is very exciting and pivotal period for Bastion as we fast-track drilling at Capote, our in-country exploration team is on the ground at Capote finalising drill targets with drilling scheduled to commence in September.”

Sand Juan gold project

San Juan consists of 18 mining licences covering 11.5sqkm within the company’s Capote mining district.

It includes the high-grade San Juan, Resurgemento and La Buena gold vein systems of which San Juan is the largest with a strike of over 1.5km and historically mining to a depth of 300m.

San Juan Vein produced about 500,000oz of gold at 40g/t and remains open at depth and along strike.

The Resurgemento Vein, which extends for over 3km and was mined in places to a depth of up to 150m, also remains open at depth and along strike.

Acquisition terms

Under the agreement, Bastion is required to pay US$175,000 (less US$25,000 that was previously paid for exclusivity) on execution of the option agreement.

Another US$300,000 is payable within 12 months of the option date while the final US$1m is payable within 24 months.

SMDN will also receive a 2% net smelter royalty.

This article was developed in collaboration with Bastion Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.