Base metals: Havilah reveals promising numbers for Kalkaroo copper project

As the copper market heads towards a supply shortage, Havilah Resources has delivered the numbers on its Kalkaroo project and the junior explorer reckons it could well have a profitable, large-scale open pit copper-gold mine on its hands.

The news edged shares up 3.6 per cent to 14.5c on Tuesday morning.

- Scroll down for more ASX base metals news >>>

The results of a pre-feasibility study indicates Kalkaroo will have an estimated pre-tax net present value (NPV) of $564m and an internal rate of return (IRR) of 26 per cent at a copper price of $US2.89 ($4.22) per pound of copper and US$1200 per ounce of gold.

NPV and IRR are metrics used to assess the profitability of a project. The higher the NPV and IRR, the more profitable a project will be.

Havilah says the Kalkaroo project will be highly sensitive to commodity prices with a 10 per cent increase resulting in a 48 per cent jump in the pre-tax NPV to $835m.

The mine is expected to produce an average of 30,000 tonnes of copper and 72,000 ounces of gold each year over an initial 13-year period.

Right now the copper price sits at around $US2.63 per pound and the PFS forecasts Kalkaroo will have C1 costs of $US1.67 per pound.

And although the copper price has weakened and demand is levelling off, all indicators are that demand is set to take off again in the next few years.

At the same time the world needs more big copper discoveries to help meet that rising demand – which is coming thanks to the electric vehicle revolution and the necessary infrastructure needed to support that.

Kalkaroo is expected to require a pre-production capital spend of $332m.

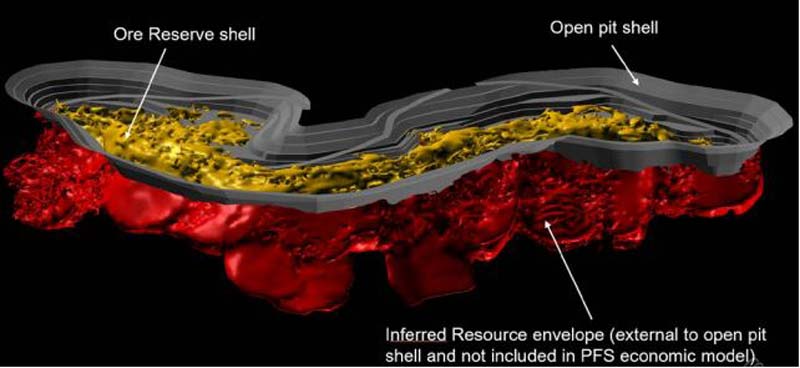

Technical director Dr Chris Giles told investors there was still plenty of upside potential to extend the mine life if Havilah could incorporate the substantial inferred resources into the mining plan.

He added there is also potential to add to the resource given that Kalkaroo remains open down-dip and along strike.

Check it out:

“We are continuing to work on these various upside opportunities with the assistance of RPM in order to determine what effect they could potentially have on the mining economics,” Giles said.

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

In other base metals news:

Chalice Gold Mines (ASX:CHN) has picked itself up a nickel sulphide project in Western Australia. The project is right next to Buxton Resources’ (ASX: BUX) Merlin project, where nickel sulphide mineralisation grading up to 8 per cent has been intersected. Buxton recently reeled in larger miner Independence Group (ASX:IGO) as a partner on its project. Shares advanced 4.4 per cent to 12c on the news.

Venturex Resources (ASX:VXR) has uncovered a thick intercept of high-grade copper mineralisation at its Sulphur Springs project. Recent drilling returned a hit of 31m at 3.24 per cent copper from 94m, including 11m at 4.15 per cent from 99m. The news sent shares up 11.8 per cent to 19c on Tuesday morning.

Stavely Minerals (ASX:SVY) also reported high-grade copper hits this morning at its Thursday’s Gossan project in western Victoria. Drilling delivered grades of up to 5.05 per cent copper and 6.06 grams per tonne gold. Shares climbed nearly 9 per cent to 24.5c today.

Cassini Resources (ASX:CZI) says drilling has returned multiple high-grade copper intersections that are the best results yet from its One Tree Hill prospect. Results include 6.2m at 3.61 per cent copper. The news edged shares up 4.2 per cent to 9.9c.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.