Base Metals: Galena keeps getting higher lead and silver grades in WA

Pic: Tyler Stableford / Stone via Getty Images

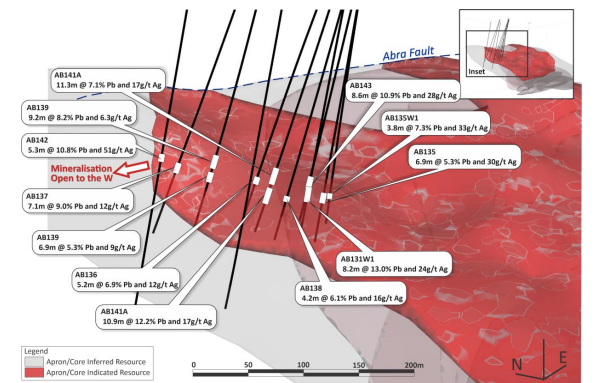

Galena Mining’s (ASX:G1A) latest results from drilling at its Abra base metals project in Western Australia have come back at grades higher than the current resource.

The last 11 drill holes returned hits including 8.2m at 13 per cent lead and 24 grams per tonne (g/t) silver and 5.3m at 10.8 per cent lead and 51g/t silver. Sixty seven per cent of holes from the program were above the current resource grade.

Over 10 per cent lead is generally considered high-grade, while above 50g/t silver is considered high-grade. The current resource stands at 37.4 million tonnes at 7.5 per cent lead and 18g/t silver.

“We have a mix of infill and step-out holes and overall its impressive to note that such a high proportion of holes have returned significant intersections higher than the most recently modelled resource grade,” managing director Alex Molyneux said.

He said the program, “successfully enhances Abra’s status as a high-grade tier one Australian base metals deposit.”

Galena has also previously defined a probable reserve of 10.3 million tonnes at 8.8 per cent lead and 24g/t silver.

The resource is due to be updated in the final quarter of this year.

At full production, the Abra project is expected to produce 95,000 tonnes of lead and 805,000 ounces of silver each year for an initial 16 year mine life. This would give it a net present value (NPV) of $553m and an internal rate of return (IRR) of 39 per cent.

NPV and IRR are metrics used to assess the profitability of a project. The higher the NPV and IRR, the more profitable a project will be.

While shares were unchanged this morning, Galena has more than doubled since Christmas last year.

Base metals: Galena uncovers more high-grade lead, highest silver hit yet in WA

Barry Fitzgerald: Looking for lead in the wrong places? Pacifico pops up

In other ASX base metals news:

Scorpion Minerals (ASX:SCN) has been granted an exploration licence at its Mt Mulchany copper-zinc project. Measured, indicated and inferred resources total 647,000 tonnes at 2.4 per cent copper and 1.8 per cent zinc. Intercepts have included 6.8m at 3.7 per cent zinc and 4.9 per cent copper, and 11.3m at 4.9 per cent copper and 4.2 per cent zinc. Twenty untested targets have been identified with VTEM surveying and soil geochemistry.

Myanmar Metals (ASX:MYL) has extended the strike length of the Yegon Lode discovery following strong results from two recently drilled holes. One intersected 33m at 4.4 per cent lead and 103g/t of silver as well as 6m at 4.6 per cent lead and 103g/t of silver. CEO John Lamb said, “what we are seeing with these drilling results are wide mineralised intervals at good grades within the planned pit shell. This is clearly positive for our starter pit, which already boasts compelling PFS level project economics.”

Sunstone Metals (ASX:STM) has raised $4.6m to accelerate drilling at its Bramaderos gold-copper project in Ecuador. The money came from underwriting and exercise of options.

White Rock Minerals (ASX:WRM) has provided an update on its Alaskan zinc project. As the climate cools, it is defining targets to follow-up next summer. Three have been identified so far and are believed to be proximal to horizons prospective for base metal rich sulphides. There are already two high-grade deposits at the Red Mountain project that host an inferred resource of 9.1 million tonnes at 12.9 per cent zinc equivalent.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.