Barton reckons gold will be back in fashion with investors next year as it ramps up SA exploration

Since IPO the company has confirmed 3 new gold zones totalling ~2km of new gold mineralisation. Pic: RyanJLane (E+) via Getty Images.

Barton Gold is gearing up for an aggressive drilling program in 2022 at its South Australian projects, with MD and CEO Alex Scanlon confident the gold market will trend net positive next year as the market digests the reality of the past 24 months.

“Much the same as it did from late 2009 as the market digested the reality of the preceding 24 months from late 2007–2009,” he said.

“I see the gold market as fundamentally mispriced while investors remain distracted with inflated equity markets, fuelled by cheap debt and loose printing policies.

“On a long-term horizon both gold, and gold securities, are undervalued relative to the state of the money supply, and the fundamental value intrinsic to many gold equities.”

Scanlon said the gold market often lags its loudest indicators as institutional investors tend to respond to key catalysts slowly, “noting that it is hard to position large pools of capital into gold equities on an institutional scale, hence this takes time”.

“However, rising geopolitical instability, truly entrenched (and now grudgingly acknowledged) inflationary pressures, and a frothy and increasingly volatile equities market is adding to the macro setup for reallocation of investment to downside and/or risk protection,” he said.

Hit the ground running after June IPO

Barton Gold’s (ASX:BGD) $15m IPO in June meant it was fully capitalised to aggressively explore across two major systems identified in pre-IPO work.

Barton identified 25 shallow structural targets and a new shallow, high-grade open pit extension at Tarcoola Project which validated its pre-IPO theses and technical work.

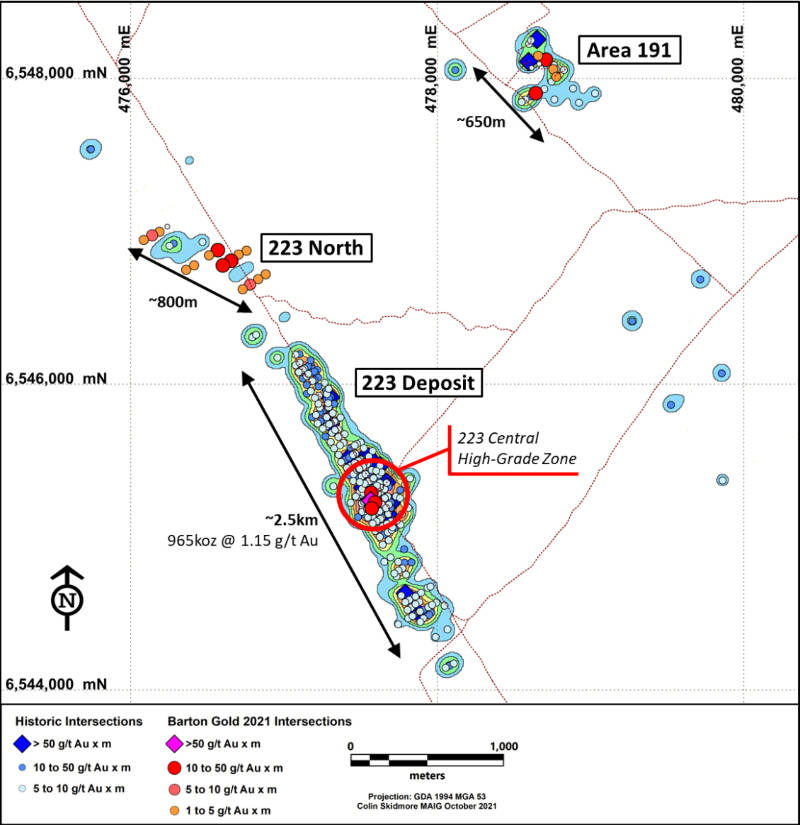

Plus, they discovered two new gold zones and higher-grade central zone at the Tunkillia Project, which improved the development characteristics of existing JORC Mineral Resource, and a proven pathway to large-scale Mineral Resource growth.

Scanlon said the completion of 10,300m drilling, 2.6sqkm ground penetrating radar and 80.5sqkm gravity surveys within around four months of listing demonstrates the company’s ability to execute programs quickly and efficiently despite COVID challenges.

Added to this, Barton has nabbed multiple South Australian Government grants totalling $380,000.

“This is indicative of significant Government support for our story and strategy, and has helped accelerate significant discovery outcomes,” Scanlon said.

20,000m of drilling planned in 2022

Scanlon said the company’s success this year has set it up for an “even bigger 2022 with over 20,000m drilling planned to continue our pace of discovery and set up for a meaningful MRE update(s) during 2022”.

“We are very well capitalised ($12.9m at 30 Sep 2021) with a proven track record of planning, execution and discovery,” he said.

“We do not need to return to market for additional capital and can continue aggressively building out mineralisation for another 18-24 months, targeting a multi-million-ounce resource base, starting from our current ~1.1Moz JORC 2012 MRE.”

Not to mention that compared to its peers, Scanlon reckons the company is valued very attractively, as the only explorer with existing 100% owned processing infrastructure.

This article was developed in collaboration with Barton Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.