Musgrave faces take-over before gold project delivers

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Gold explorer Musgrave Minerals is nervously looking over its shoulder as it gets cracking on its 2018 exploration program at its Cue project in Western Australia’s Murchison region.

The program has the aim of increasing the company’s existing 440,000 oz resource base towards the 500,000 to 600,000 oz level required for Musgrave to have a standalone mine development on its hands.

There is no nervousness from Musgrave (ASX:MGV) that the target is out of reach.

What is making it nervous is the prospect of it becoming the subject of a low-ball takeover bid — before its standalone option goes live — from one of the many bigger operators in the region with hungry treatment plants to fill.

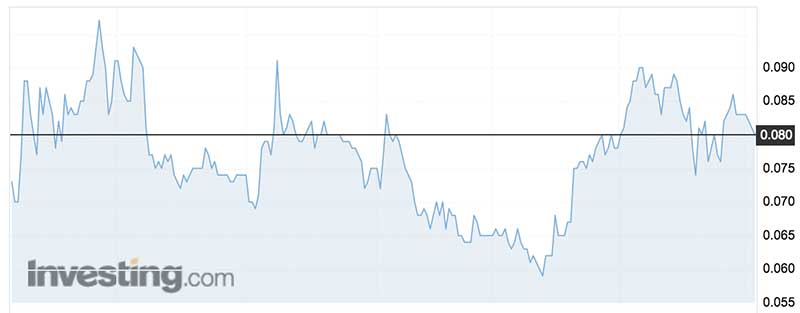

As things now stand, Musgrave’s 8c share price for an enterprise value of $19 million gives it one of the lowest enterprise value per resource oz multiples among its ASX-listed peers.

While that in itself makes Musgrave attractive as a takeover target, it also reflects expectations that ore from the Cue project will end up being toll-treated at a cost to project returns for the company as it lacks the scale for a standalone development.

But Musgrave is out to prove the doubters wrong, with current drilling activity likely to lead to a new resource upgrade in the second half of the year on the group’s journey to becoming a producer in its own right.

Somewhat ironically, success in the program would make Musgrave an even more attractive takeover target, particularly if a share price re-rating in response to progress in building the resource base is muted.

Musgrave’s status as a potential takeover stock is reflected in its strong research following for a company of its size.

Veritas Securities placed an 18c price target on the stock back on December 12 and Resource Capital Research went for 16c in a December 5 note.

Both targets were built on the expectation that Musgrave would increase its resource base over time, with the high-grade flagship deposit, Break of Day (200,000 oz at 7.2 grams of gold per tonne), seen to have particular appeal, both to Musgrave’s standalone ambitions, and to would-be takeover bidders.

(Anything over 5 g/t is generally considered high grade. High grades takes less effort to extract which reduces costs).

Musgrave now has a drilling rig whirring away at Break of Day for down dip extensions to the mineralisation.

Break of Day excited the market for a while late last year when drilling returned an 11m hit at 54g/tonne.

In about five weeks time the rig will move to drilling targets along a 12km section of prospective shear zone hidden beneath a salt lake.

The salt lake has never been tested previously despite the 100 year-plus mining history in the area.

- Bookmark this link for small cap breaking news

- Discuss small cap news in our Facebook group

- Follow us on Facebook or Twitter

- Subscribe to our daily newsletter

Success in either the Break of Day or salt lake programs could be a game-changer for Musgrave.

The exploration effort is bound to be closely watched by the two nearby mill owners considered most likely to make a move on Musgrave – Ramelius Resources (ASX:RMS) and Westgold Resources (ASX:WGX).

Both companies have been growing their interests in the region and as outlined by Resource Capital in its research note.

They could each do well from the $20 million to $40 million in annual cashflow that even a modest scale development at Break of Day could deliver.

Musgrave’s wide-open share register means there is no blocking stake to any takeover moves. Independence Group (ASX:IGO) is on the register with a 3 per cent stake, and Silver Lake Resources (ASX:SLR) has a 3.5 per cent stake.

Both of those would be considered likely sellers into an agreed takeover bid, should one arrive before Musgrave gets to do what it wants to do — become a producer in its own right in the Murchison.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.