Barry FitzGerald: Red Metal way ahead of BHP in the Nullarbor

Pic: Bloomberg Creative / Bloomberg Creative Photos via Getty Images

Exciting times in the months ahead for Red Metal (ASX:RDM).

It’s got the jump on BHP (ASX:BHP) no less in determining whether Australia’s next big metals province lies beneath the Western Australian portion of the limestone capped Nullarbor Plain.

Trading at 10c for a market value of $21m, Red Metal is planning to drill “proof of concept’’ holes starting in late October to test the best of the geophysical targets identified at its Nullarbor project.

OZ Minerals (ASX:OZL) has an option to earn 51 per cent in the joint venture, with the drilling program an important test of the mineral potential of what ranks as one of the last big exploration frontiers in Australia.

Red Metal’s early move in to the Nullarbor’s Madura province – sandwiched between the Eyre Highway in the south and the Trans Australian Railway to the north – means it was able to pick and choose its tenements.

The gold and lithium focused WA exploration industry looked the other way in 2015/2016 when new geophysical and basement rock data was released by the Geological Survey of Western Australia and Geoscience Australia outlined what could be an exciting new metals province under the Nullarbor.

But Red Metal got very interested, in keeping with its reputation for taking on base metals and copper-gold prospects with big-time potential rather than the small time stuff which limits the ambition of most ASX juniors.

Red Metal’s early move in the Madura province was endorsed by its tenements there being included in the company’s “Greenfields Discovery Alliance” struck in January with the $3 billion OZ.

The alliance gives OZ a two-year option to fund a series of mutually agreed, proof-of-concept work programs on Red Metal’s Nullarbor project and five other projects in Queensland and WA.

A further endorsement came earlier this year when Stockhead’s Reuben Adams exclusively revealed that BHP had taken up a massive ground position in the province.

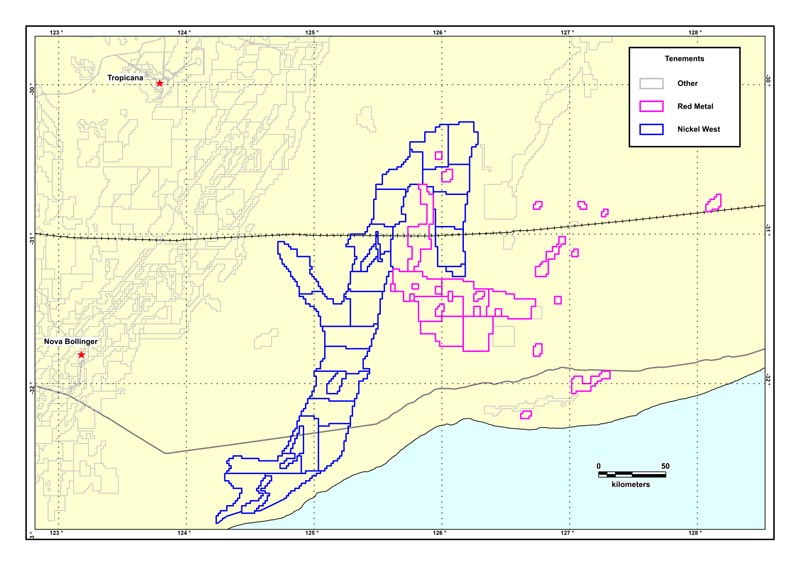

BHP’s 26 tenements cover a strike length of 350km over an area of about 13,000sqkm. It has called the project area Seahorse because the shape of the tenements resembles the upright posture of the most PC of fish (male seahorses carry babies in their brood pouch).

The bulk of Red Metal’s tenements sit under the neck and head of BHP’s Seahorse ground, with others surrounded by Seahorse, or sitting off to the east.

Following Adams’ early revelations about BHP’s Seahorse push, BHP’s nickel boss Eddie Haegel opened up about the project at the Diggers & Dealers conference in Kalgoorlie earlier this month.

“This geological setting is similar we think, to world class nickel mining camps such as Voisey’s Bay in Canada (nickel/copper/cobalt) and was possibly the last large-scale belt of rocks available in WA that is prospective for sulphide deposits’’ Haegel said.

“We have started carrying out integrated field exploration tests at Seahorse and we are working with various research organisations on this.

“As always with greenfield exploration it could yield very little but, having secured a province-scale region, we are hopeful for positive results.”

So too is Red Metal. It followed up the government survey work by going in and pegging all of the top ranked anomalies it could afford at the time.

OZ liked it and has since completed gravity survey work that infilled the earlier government work. It’s that work that saw orebody-sized anomalies start to jump out.

While BHP has given its Seahorse project a nickel flavour, Red Metal has gone for a copper-gold and copper-nickel flavour.

This is due mainly to visible copper specks being encountered in random holes drilled in the government program to understand the stratigraphy rather than specific anomalies.

The reality is that the rocks under 250-450m of thick limestone and sedimentary cover are prospective for all types of sulphide mineralisation models.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.