Barry FitzGerald: Lithium play Ardiden leaps on a golden opportunity in Canada

Pic: Tyler Stableford / Stone via Getty Images

Exploring in and around historic Australian gold fields has been a winning formula for ASX-listed juniors of late.

But given competition for prospective ground has become more intense than ever in a $A2170oz gold price environment, the hunt is being expanded to other parts of the world, preferably in matching Tier 1 jurisdictions.

That’s why Canada and Alaska increasingly feature in ASX announcements.

The big end of town has been taking advantage of the cannabis-induced slumber of the North American mining markets, with Newcrest and St Barbara moving in to Canada, and Northern Star heading north to Alaska.

ASX juniors are also getting in on the action, with today’s interest in a little thing called Ardiden (ASX:ADV) which is trading at all of 0.3c for a market cap of $5m and an enterprise value of $2m after counting its cash.

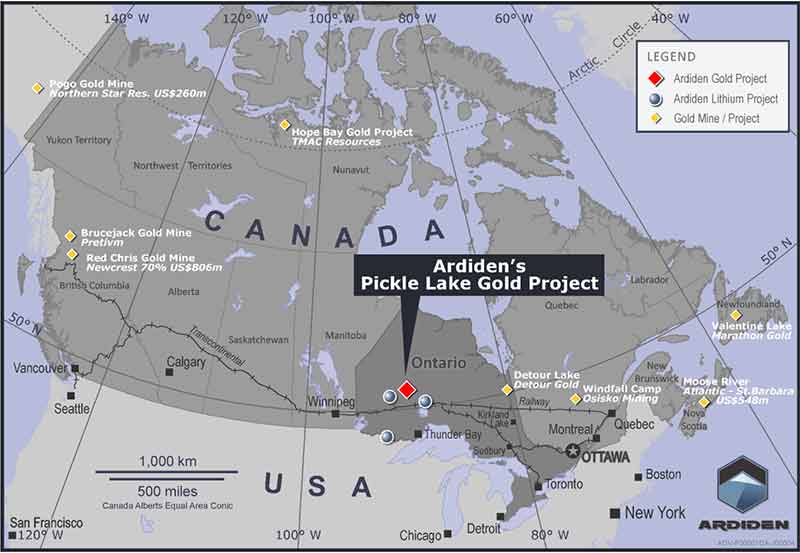

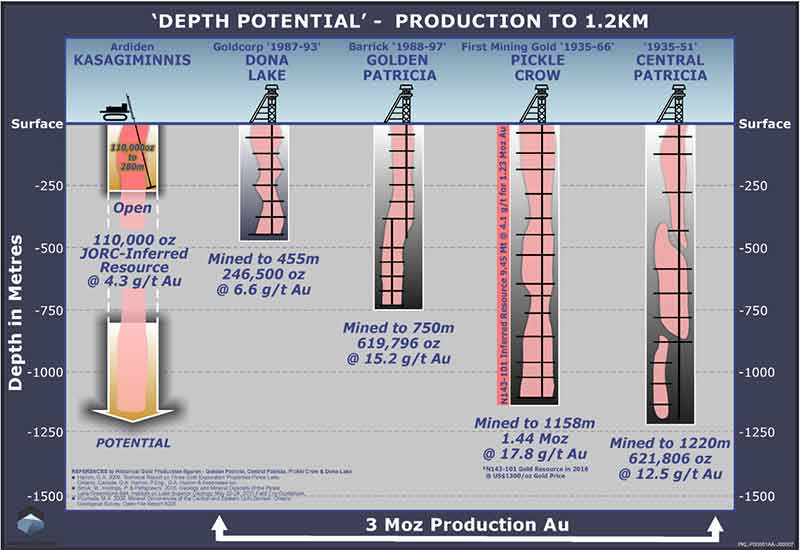

Ardiden has recently snuggled up close to some historic high-grade gold mines in the Pickle Lake gold mining camp in Ontario in Canada where some 3 million ounces of gold have been produced over time from now-closed mines.

Followers of the stock will know immediately that the Ontario gold focus is a change of direction by the company which was previously focused on lithium, also in Ontario.

The lithium has not gone away. “We’ve still got the lithium but it’s parked up,’’ Ardiden’s CEO since May, Rob Longley, told Garimpeiro.

“It’s not costing anything and it might come back but meanwhile we are just looking at gold at Pickle Lake, north-west Ontario,’’ Longley said.

Ardiden moved to 100 per cent ownership of what was previously a joint venture at Pickle Lake in July and has wasted no time in coming up with a maiden and ASX-compliant resource estimate at one of the four projects areas it has in the mining camp.

Now, it has to be said that Ardiden could have bandied about a big historical resource estimate across the project. But to his credit, the seasoned geologist that Longley is, prefers to stick to the here and now and only report estimates that comply with current reporting requirements.

It was on that basis that Ardiden recently reported a maiden underground resource of 110,000oz grading 4.3 grams of gold a tonne for the Kasagiminnis prospect to a depth of 250m.

“We have got a clear two-year plan to get in there and build the resource base up from 110,000 oz to bigger numbers and to see what we can aggregate from deals and acquisitions in the area,’’ Longley said.

The potential to bulk up Ardiden’s presence in Pickle Lake beyond the drill bit by cutting some deals/acquisitions is a function of the malaise in the Canadian junior exploration market.

Not only are they struggling to raise funds to advance their projects in the face of competition for the speculative dollar from cannabis stocks, they have also left a lot of prospective ground go, leaving it open to pegging by others.

“So we don’t just have to drill to achieve momentum and to get the critical mass we want,’’ Longley said.

Ardiden nevertheless will be drilling in the opening months of next year, taking advantage of the winter chill to get out on to the iced up shallow lakes in the region to follow up extensions of known gold mineralised trends.

The same prospective geology that exists at the 27m oz Red Lake gold mining camp extends east to the Pickle Lake camp, which despite its 3m oz from now dormant high-grade underground mines, remains largely under explored.

Ardiden’s South Limb project is likely to be to be the first of the prospects to be drilled.

South Limb is close to the old Dona Lake mine (250,000oz between 1987-1993 at 6.6g/t gold) and there are some very good looking geophysics and intersections coming in to Ardiden’s ground.

Drilling is also planned to extend Kasagiminnis to the east. Because it is more remote, drilling is likely in late January, early February.

MORE From Barry FitzGerald:

These two explorers aim to restore the high-grade Menzies goldfield to its former glory

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.