Bargain Barrel: These junior explorers are looking to make waves in Australia

Catching the right wave Pic: Getty Images

Bargain Barrel has scoured the ASX for more little gems, and this week we are focusing on two junior explorers, the first of which has unearthed some interesting nickel results recently while the other is at an early stage of exploring its ground.

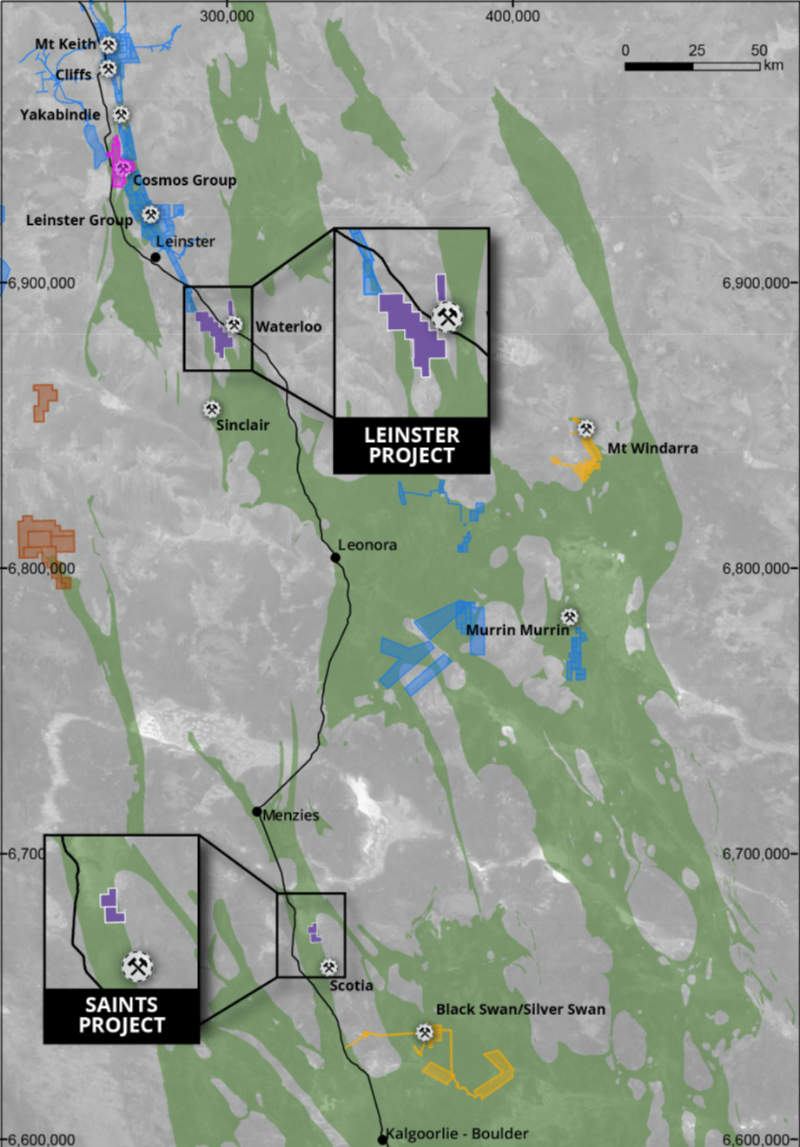

Auroch Minerals (ASX:AOU) has been busy with its Saints and Leinster nickel projects in Western Australia after acquiring them in August this year.

While the company has only just got the ball rolling, its belief in the nickel potential of the Saints project near Kalgoorlie has already been vindicated with the first hole returning a very high-grade nickel intersection of 1.77m at 6.72 per cent nickel, 0.27 per cent copper and 0.13 per cent cobalt from a depth of 227.31m that includes a 0.5m zone grading just under 10 per cent nickel.

Saints is just 65km northwest of Kalgoorlie and has a current resource of 1.05 million tonnes at 2 per cent nickel, 0.2 per cent copper and 0.06 per cent cobalt in three zones – St Andrews, St Patricks and the Western Contact.

At least 97.5 per cent of the resource is fresh primary sulphide mineralisation that stretches to a depth of 480m below the surface.

Leinster is about 40km southeast of the town of Leinster and 60km from Leonora.

While a resource was defined in 2008 to the older JORC 2004 standards for the Horn deposit at Leinster, no further material work has been undertaken since that time.

The project also includes the Valdez target that is along strike from Saracen Minerals’ (ASX:SAR) Waterloo nickel sulphide deposit.

Managing director Aidan Platel told Stockhead that the company’s immediate focus was on completing the current 3000m diamond drilling program at Saints.

“We have two to three holes left to finish in this program at Saints and we will have more results very soon from the down-hole electromagnetic (DHEM) surveys on the first seven holes and assays back for the first six holes,” he said.

“We will get those results out fairly soon and when the drill program finishes, we will have more results from the final holes and we will do DHEM on those holes and really work out some pretty solid drill targets.”

Platel also noted the company was drilling holes that infilled the historical holes that had been drilled by WMC at Saints.

“So we probably can bring some of that resource into the indicated category when we redo the resource with these new holes,” he said.

An “indicated” resource provides enough information on geology and grade continuity to support mine planning.

Platel added that given Saints’ proximity to Kalgoorlie and its location near existing processing plants, including Posidon Nickel’s (ASX:POS) Black Swan plant that is being re-started, the project would have low capital expenditure requirements if a development was warranted.

“There is an opportunity for toll treating and the ore starts within 40m of surface and it is 100 per cent fresh primary sulphides. The capex to decline down and start mining is very small upfront,” he said.

Additionally, while Auroch is processing the data and working up the new targets at Saints, it will move on to carry out reverse circulation drilling at the Leinster project.

“There is a JORC 2004 resource at the Horn prospect there so we have to carry out drilling to expand it a bit, bring it up to JORC 2012 and then we will reassess it to have a more extensive program,” Platel told Stockhead.

“The second tenement up there is Valdez, which is a 1200m electromagnetic plate. That’s an excellent target that has had some shallow drilling over the top of it with 0.5 per cent nickel and sulphides in ultramafic rock. We will drill up there.”

The company will then return to Saints for a more extensive exploration program.

“We like to be fairly aggressive. We have money, we put it into the ground. That’s certainly what we intend to do over the next six-12 months.

Platel also flagged that while exploring Saints and Leinster was Auroch’s primary focus, the company was still looking at acquiring more projects.

“There are a lot of unloved nickel projects that we can make use of.”

Watch: 90 Seconds With… Aidan Platel, Auroch Minerals

Next up is Golden State Mining (ASX:GSM), a greenfields, grassroots explorer that is methodically hunting for gold and base metals in the Pilbara, Murchison and Goldfields regions of Western Australia.

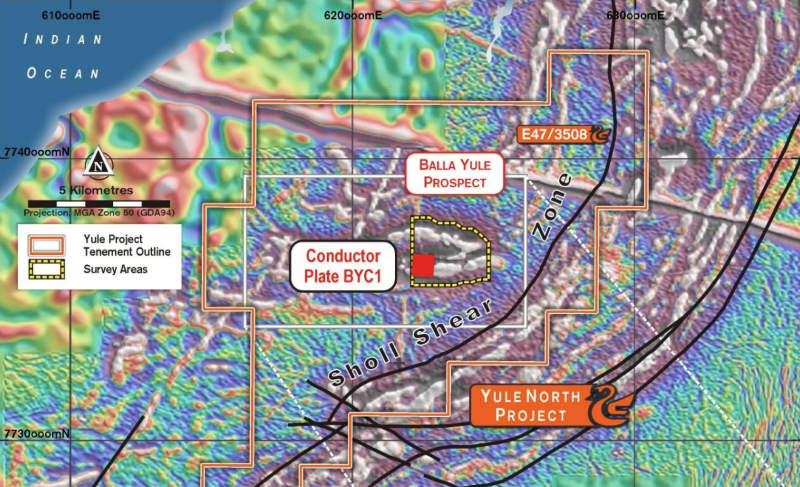

The company’s Yule project in the Pilbara contains some compelling gold, base metal and rare earth element target areas about 30km from Port Hedland.

Earlier this year, it identified 17 targets using historical geophysical data, the most prospective of which is the large 4.2km by 1.8km Balla Yule prospect.

Over in the Murchison, which is a proven gold region that is responsible for more than 7 million ounces of production over the past 126 years, the company is targeting large gold systems within a 425sqkm tenement package.

The company is targeting large gold systems such as the Cuddingwarra, Big Bell South and Cue projects.

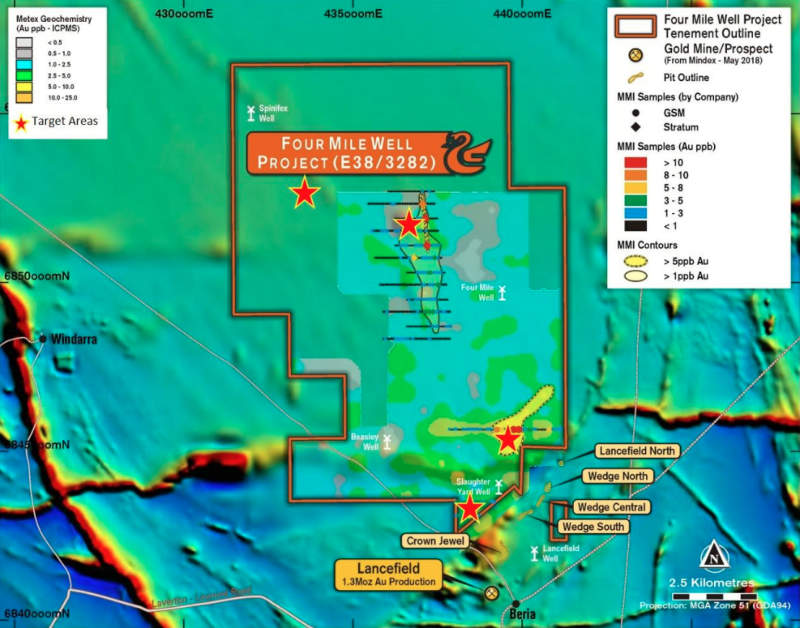

Golden State is also carrying out exploration at the Four Mile Well project, which is close to the town of Laverton in the eastern Goldfields.

Four Mile Well is close to some of the projects in the region such as the Windarra and Mt Windarra nickel deposits to the west, and the 1.3-million-ounce Lancefield gold deposit less than 1km to the south.

“We are what you will call a genuine greenfields grassroots explorer, we have ground in areas that is in some respects underexplored where other people have had significant success, be that in terms of exploration or operating mines very close by,” managing director Mike Moore told Stockhead.

“We have a low [enterprise value] but that provides significant leverage to any discoveries that we might make.”

The company has just completed a fixed loop electromagnetic survey at the Yule project to follow up on previous work that identified the large 750m by 900m bedrock conductor at Balla Yule.

“We are looking in this program to get better definition and hopefully that will enable us, if the results are positive, to design a reverse circulation drilling program to test it better,” Moore said.

A final report from this survey is expected within the next two weeks.

“Also, coming up in November, will be the commencement of an aircore drilling program at Four Mile Well, where we identified some reasonable gold geochemical anomalies and some interesting structural targets that were identified through geophysical methods,” he added.

“Hopefully, the drilling of that will start this month and with results available before Christmas.”

He added that in the new year, the company was hoping to get further work going at Yule once it received all relevant approvals.

“We have an aircore program planned for Yule South, where we have a number of targets that have been generated from geophysics,” he said.

“If we get some traction on one of those aircore targets, then the likelihood is we will follow up the aircore program with an RC program.

“We are also seeking approvals for an aircore program at Cuddingwarra up in the Murchison region, we will expect to undertake that work very early in new year, probably January or February.”

Watch: 90 Seconds With… Mike Moore, Golden State Mining

At Stockhead, we tell it like it is. While Golden State Mining is a Stockhead advertiser, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.