Bardoc Gold’s WA project is cleared for take-off with DFS completion

Bardoc Gold’s new gold mine near Kalgoorlie will generate $740m of pre-tax cashflow according to its DFS. Image: Getty

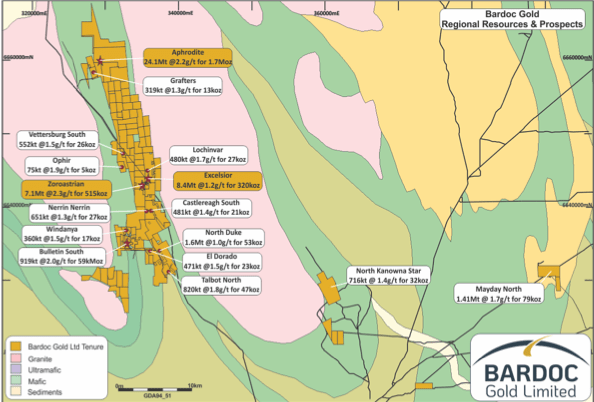

Bardoc Gold’s eponymous gold project north of Kalgoorlie is cleared for take-off with the finalisation of a definitive feasibility study (DFS) laying out its attractive economics.

Forecast production for Bardoc Gold’s (ASX:BDC) project is 136,000 ounces of gold at an all-in sustaining cost of $1,188 per ounce, setting up the company as a mid-tier gold producer.

“The strong DFS outcomes show that the Bardoc Gold project is without question one of the best underdeveloped gold projects in Australia, with the potential to deliver strong production and cashflows and compelling financial returns over a long period of time from a brand new fully-integrated mining and processing operation located right on the doorstep of Kalgoorlie,” chief executive, Robert Ryan, said.

The Bardoc Gold project has a capital cost of $177m and is underpinned by an ore reserve of 1 million ounces that would generate a pre-tax cashflow of $740m over its lifetime.

“At the heart of the DFS is a 28 per cent increase in ore reserves to over 1 million ounces – a fantastic result which reflects the highly effective drilling programs conducted over the past 12 months and the excellent technical work completed on our mining and processing schedules to optimise the project to a very high level,” said Ryan.

The project is one of a few Australian gold projects to come online in the next two years.

Study showcases project’s resources, low-cost production

The DFS has also produced an increase in the project’s measured and indicated gold resource of 2.06 million ounces, representing 67 per cent of its global ounces.

The Bardoc gold project’s production would surge to 140,000 ounces per year of gold for a sustained six-year period, and its annual gold sales would average 135,760 ounces over 8.2 years of mill production.

“The mill will be fed by a blend of open pit and underground ore feed to produce an average of 136,000 ounces per year at an impressively low all-in sustaining cost of $1,188 per ounce over an initial eight-year production period, based on the updated 1 million-ounce probable ore reserve published today,” said Ryan.

First gold production at the Bardoc Gold project is due to start in late 2022, allowing the company to transition to a mid-tier gold producer and become a significant new player in the gold industry in the North Kalgoorlie region.

As a stand-alone mining and processing operation with a nominal throughput of 2.1 million tonnes of ore per year, the project is scheduled to deliver 1.1 million ounces of gold.

“The construction of a state-of-the-art on-site 2.1 million tonne per year CIL plant and floatation circuit located near the site of our Zoroastrian and Excelsior deposits just 40km north of Kalgoorlie will form the backbone of the Bardoc gold project,” said Ryan.

Off-take deal in place for project

A binding off-take agreement is in place for the sale of gold concentrate from the project.

“Importantly, the binding off-take agreement that we secured with leading global minerals trader MRI Trading AG in December ensures we have a dedicated market for the gold concentrate produced, significantly de-risking the project,” Ryan said.

On a discounted cash-flow basis, the project has a pre-tax net present value of $479m.

“At an assumed base case gold price of $2,250 per ounce, the project will generate an average $113 million in free cashflow per year post construction, with forecast life-of-mine free cashflow of $740 million, a pre-tax NPV of $479 million and internal rate of return of 41 per cent,” said Ryan.

Talks with lenders are progressing to tie-up funding for the project and an investment decision is lined-up for the September-ended quarter.

“With the impressive financials shown in the DFS, the board has resolved to progress the project to financing,” said Ryan.

Bardoc Gold will continue to optimise and de-risk all aspects of its gold project over the coming months to incorporate promising forthcoming exploration results.

Tenders have now been issued for the construction of a processing plant at the project.

The company is in the process of recruiting key managers for the project’s construction and mining phases to ensure these meet targeted timescales.

“The completion and delivery of this comprehensive and high-quality DFS is a fantastic achievement by our team, and marks a really important milestone for our shareholders, investors, supporters and other key stakeholders,” Ryan added.

This article was developed in collaboration with Bardoc Gold, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.