Backed by big battery companies, St George re-starts lithium exploration push at Mt Alexander

Initial exploration last year confirmed the project’s lithium prospectivity, intersecting up to 1.8% Li2O. Pic: via Getty Images.

- SGQ has restarted lithium exploration at its Mt Alexander project in Western Australia

- The project is down the road from Delta Lithium’s 14.6Mt Mt Ida project in an emerging lithium province

- The exploration push follows a $3m deal signed with leading battery producer ATL

- Initial exploration already flagged lithium potential, with the company now doubling down on promising targets

- Rock chip sampling and mapping is currently under way

St George Mining says lithium exploration is under way again at its flagship Mt Alexander project in WA, testing new lithium targets.

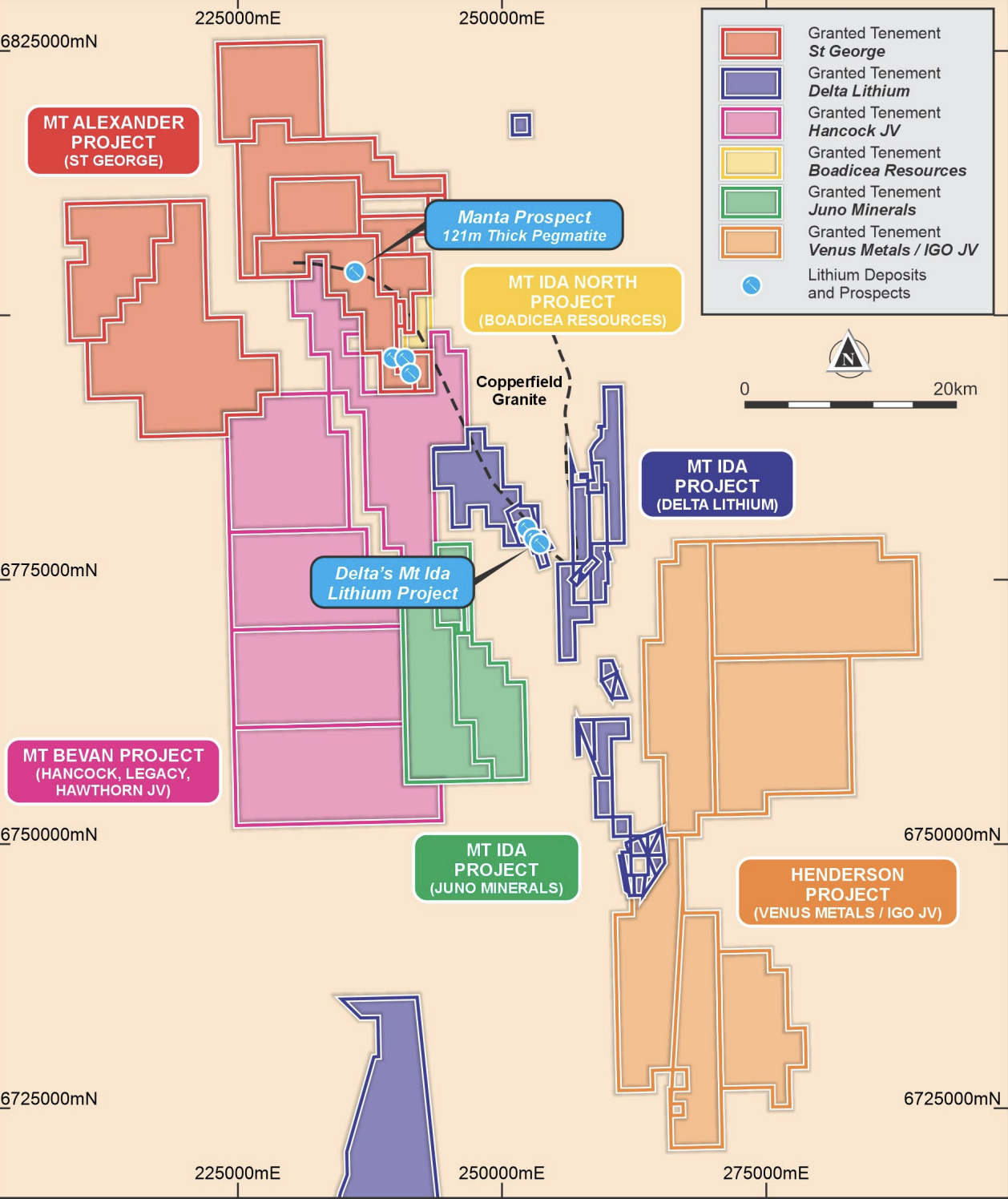

The company’s landholding has extensive exposure of the contact between the Mt Alexander greenstone sequence and the Copperfield Granite – part of a large, regional Lithium Caesium Tantalum (LCT) corridor that hosts the major lithium discovery by Delta Lithium (ASX:DLI) at its nearby Mt Ida project (14.6Mt at 1.2% Li2O).

St George’s renewed exploration push for lithium follows a $3m deal earlier this week with leading battery producer, the multinational ATL.

This region is a highly emerging province for lithium exploration, including a joint venture between Hancock Prospecting, Legacy Iron Ore (ASX:LCY) and Hawthorn Resources (ASX:HAW) at the Mt Bevan project, which abuts the Mt Alexander landholding.

Even Rio Tinto (ASX:RIO) has secured a significant tenement position in the region, while Liontown Resources’ (ASX:LTR) Kathleen Valley development north of Mt Alexander has been the subject of significant M&A action.

“Mt Alexander is located in a very favourable position within the Mt Ida Lithium province, which has fast emerged over the past 12 months as a lithium hot spot that has delivered material exploration success and attracted significant M&A activity,’ St George Mining (ASX:SGQ) executive chairman John Prineas said.

“We are excited to be ramping up exploration at Mt Alexander with the support of some of the most important global companies in lithium-ion batteries – ATL, Shanghai Jayson, Sunwoda Electronic and SVOLT – and look forward to reporting exploration results in the coming weeks.”

Doubling down on a potentially large lithium system

The company has already confirmed high-grade lithium at the project, with assays in late 2022 and early 2023 returning up to 1.8% Li2O.

Most encouraging was the very thick 121m fractionated zone of pegmatites intersected at the Manta prospect which SGQ says are the types of pegmatites required for a large mineral deposit and provide encouragement for greater potential across the large project tenure.

A key area of focus in the current field program is an 8km-long zone in the northern section of the LCT corridor within the Mt Alexander tenure – which includes the Manta prospect.

Results from the field work under way will be used to prioritise areas of interest for follow-up exploration including drilling.

“We are pleased that our field teams are back on the ground at Mt Alexander to follow-up multiple target areas for lithium mineralisation,” Prineas said.

“Significantly, many of these prospects have a similar geological context to the Mt Ida lithium deposit, which is about 15km south-east of Mt Alexander.

“Our initial exploration at Mt Alexander has confirmed the presence of high-grade lithium as well as very thick pegmatites – up to 121m thick.

“These results support the potential for a large lithium-bearing pegmatite mineral system.

“Our field work will provide further information on the zonation, thickness and distribution of pegmatites along the more than 16km stretch of the regional LCT corridor on our tenure.”

Rock chip sampling and mapping under way

Soil sampling, pegmatite field mapping and outcrop sampling is now under way focused on the 8km zone around the Manta prospect, and 4km zone of the Jailbreak prospect where the company intersected multiple lithium-bearing pegmatites with values up to 1.8% Li2O and rock-chip samples returning values up to 3.25% Li2O.

Results for laboratory assays of the first round of samples are expected in four weeks.

This article was developed in collaboration with St George Mining, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.