Back to the Future Part 3: These juniors are hunting gold and silver discoveries in historic mining regions

Historic mining regions like the Gascoyne, Forrestainia and Leonora are back on the radar for ASX explorers. Pic: Getty Images

- With gold prices soaring junior miners are reviving previously uneconomic or abandoned deposits

- Snapping up old mines with existing infrastructure makes for an accelerated route to production

- It’s not just goldies hunting around historic deposits

The old adage that the best place to find a new mine is near an old one continues to hold true more often than not, particularly in well-known precious metal hotspots.

Australia’s outback is littered with the remnants of once-thriving operations that fell victim to falling metal prices, technical challenges or simply running out of known ore.

But with Aussie gold prices pushing past the $5500 an ounce mark and exploration technology changing fast, a new breed of junior miners is breathing life into these previously uneconomic and dormant deposits.

Building a mine from scratch is expensive, time-consuming and fraught with regulatory hurdles.

However, by acquiring former producing assets complete with existing infrastructure, these ASX precious metals explorers are bypassing the lengthy development queue and setting themselves up for a fast-track route to production.

Take WA’s Gascoyne region for example. The area was dug up by old timers for more than a century, and plenty of what glittered turned out to be gold.

Notable mines included the Star of Mangaroon, which was found in 1956 and mined until 1983, producing 7464oz of gold at a whopping 34.8g/t gold.

Dreadnought Resources (ASX:DRE), now holds the Mangaroon project where RC drilling at the Star of Mangaroon prospect has hit results up to a whopping 20.5g/t gold.

The company is confident that there remain areas at the historical mine that are highly underexplored and could present a substantial opportunity to host more gold mineralisation.

And they’re not the only player on the hunt for precious metals in the region.

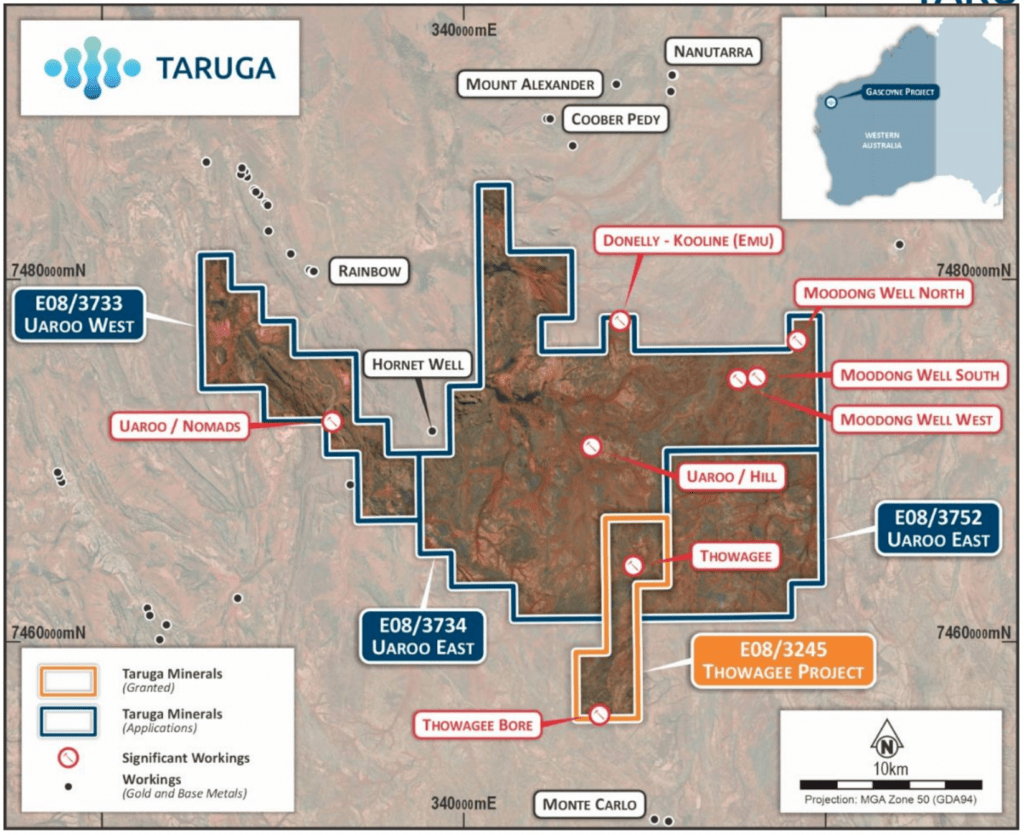

Just down the road, Taruga Minerals (ASX:TAR) has recently nabbed three contiguous permits (covering 416.5km2) which contain numerous high-grade historical workings for base and precious metals.

Taruga sees the Gascoyne as an underexplored province. To date the basin has been categorised as housing small deposits and nothing of Tier 1 size or scale, which begs the question – is that a function of geology or lack of exploration spend?

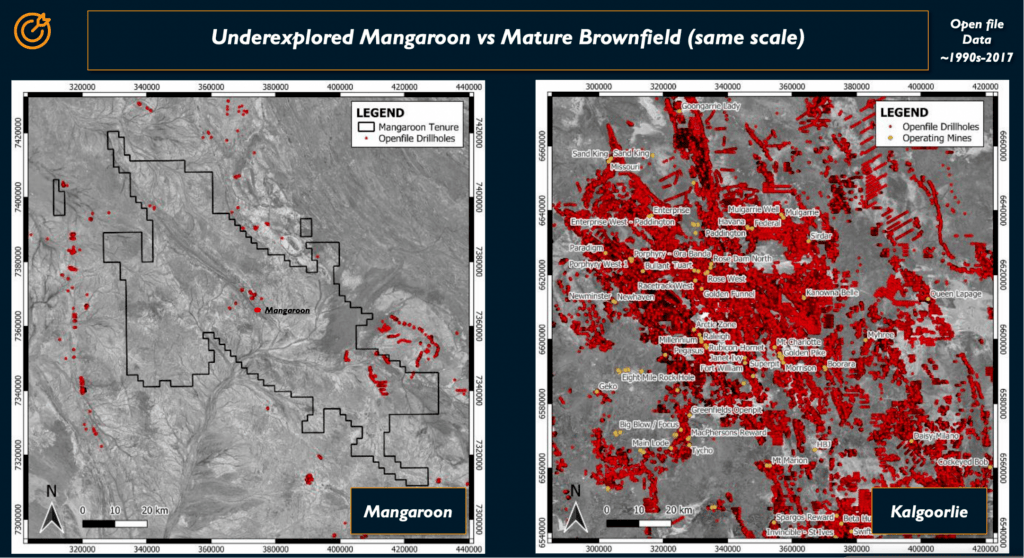

This map from DRE gives a bit of a clue – take a look at the holes drilled in the company’s Gascoyne tenure versus those drilled around Kalgoorlie.

DRE puts the difference down minimal historic and modern exploration due to fractured, small-scale ownership.

This presents an opportunity for juniors like DRE and TAR to ramp up the hunt for more mineralisation in brownfields assets.

Ramping up modern exploration

This is particularly prevalent at Taruga’s new tenements where there’s been a lack of exploration since the 1980s. What did occur was focused on base and precious metals, iron ore and uranium but no drilling whatsoever.

The company’s Thowagee tenement is especially interesting, as it features two historic polymetallic mining operations, with the Thowagee mine producing 15.2 tonnes of lead and 5878 grams of silver.

Gold, copper and zinc are also present in the mineral system. Notable historic rock chip results include up to 286g/t silver, 0.9g/t gold, 59.3% lead and 4.35% copper.

The new tenements also look full of potential, with Uaroo West featuring historic copper mining with 2.95 tonnes at average grade of 26% Cu reportedly mined in 1964.

Uaroo East hosts two historic mining sites (Uaroo-Hill and Donelly-Kooline (Emu) which have outcropping high-grade lead and silver mineralisation, with copper and gold also reported to be present.

Then there’s Uaroo-Hill where 19.59 tonnes of lead concentrate were reportedly mined in 1956 at a grade of 77.7% Pb and 301 g/t Ag, with gold and copper reported to also be present in ore.

And don’t forget Donelly Kooline (Emu) which produced 4.52 tonnes of lead in 1952 at an average grade of 55.8% Pb and 129 g/t Au, with gold and copper also be present in ore.

The company says no drilling for base or precious metals appears to have been completed within the permits despite the numerous high-grade workings and presence of favourable geology, structures and geophysics.

That’s about to change with Taruga now doubling down on potential drill targets for future programs.

Who else is hunting for brownfields discoveries?

TG Metals (ASX:TG6) is another example of a junior looking for more mineralisation around a historic asset, with its Van Uden gold project in WA’s Forrestania region.

Obscured for years by its battery metals operations, ground that has been locked up by other commodities is now being looked at for its rich gold potential as bullion prices hit record highs.

The closure of IGO’s (ASX:IGO) nickel mining operations has led to a transformation of the district, with Medallion Metals (ASX:MM8) acquiring Forrestania’s Cosmic Boy mill, which it plans to convert from a nickel to gold processing plant for its Ravensthorpe gold project.

That also leaves the processing path wide open for TG Metals, which has 227,000oz of inferred and indicated resources at Van Uden, including 60,232t of historical stockpiles at 0.84g/t Au, and 12,496t at 2.55g/t Au in surface laterite mineralisation.

This material is free digging, with waste material already stripped away also at the base of the Tasman pit.

Tasman was one of two historic mines operated at the project, 80% of which was held by a subsidiary of WA business conglomerate and lithium miner Wesfarmers (ASX:WES) until it was traded to TG earlier this year. Tasman and the Diemens pit historically produced 136,023 tonnes at 2.54g/t for 11,142oz gold according to the WAMEX open file.

Plus, just this week the company announced new assays from historical soil sampling have extended the gold strike to 6.5km – up from 2.5km which the current resource is based on.

That leaves a whole lotta strike length left to explore in the hopes of materially increasing the project’s resources.

Mt Malcolm Mines (ASX:M2M)

Mt Malcolm is another example of a company taking advantage of historic infrastructure in a historic mining centre on the hunt for new discoveries, with the Malcolm project covering +230km2 of ground just 12km from the town of Leonora and Genesis Minerals’ (ASX:GMD) historic Gwalia gold mine.

This region is well known for its high-grade orogenic gold systems and well-established infrastructure with Gwalia being one of a number of processing facilities nearby.

The Malcolm district produced approximately 47,200 ounces of gold from 62,485 tonnes of ore at an average grade of 23.5g/t Au around the turn of the last century.

This production came from numerous small-scale workings including Golden Crown, Dumbarton and Sunday, many of which targeted high-grade quartz veining systems, often yielding close to one ounce per tonne.

Last week, the company reported encouraging gold intercepts from inaugural RC drilling at the Sunday Underground prospect of 1m at 4.05g/t Au – confirming the presence of shallow gold mineralisation beneath historic workings.

Infill drilling at Dumbarton also returned 2m at 3.03 g/t Au, demonstrating the continuity of mineralisation and potential for further high-grade extensions.

At Stockhead, we tell it like it is. While Taruga Minerals, TG Metals and Mt Malcolm Mines are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.