AW1 scores $18.8m royalty funding deal for Storm copper project

Funds under the royalty package will be accessed this week. Pic: Getty Images

- AW1 scores $18.1m royalty funding deal for Storm copper project in Canada

- Project hosts resource estimate of 17.5Mt at 1.2% copper and 3.4% silver

- AW1 seeking to eliminate need for traditional flotation plant in pursuit of carbon reducing footprint

- Company is currently undertaking scoping study on copper production process

Special Report: American West Metals has signed an agreement with TMRF Canada, a subsidiary of Taurus Mining Royalty Fund, for up to US$12.5 million (A$18.8 million) under a royalty package for its Storm copper project in Canada.

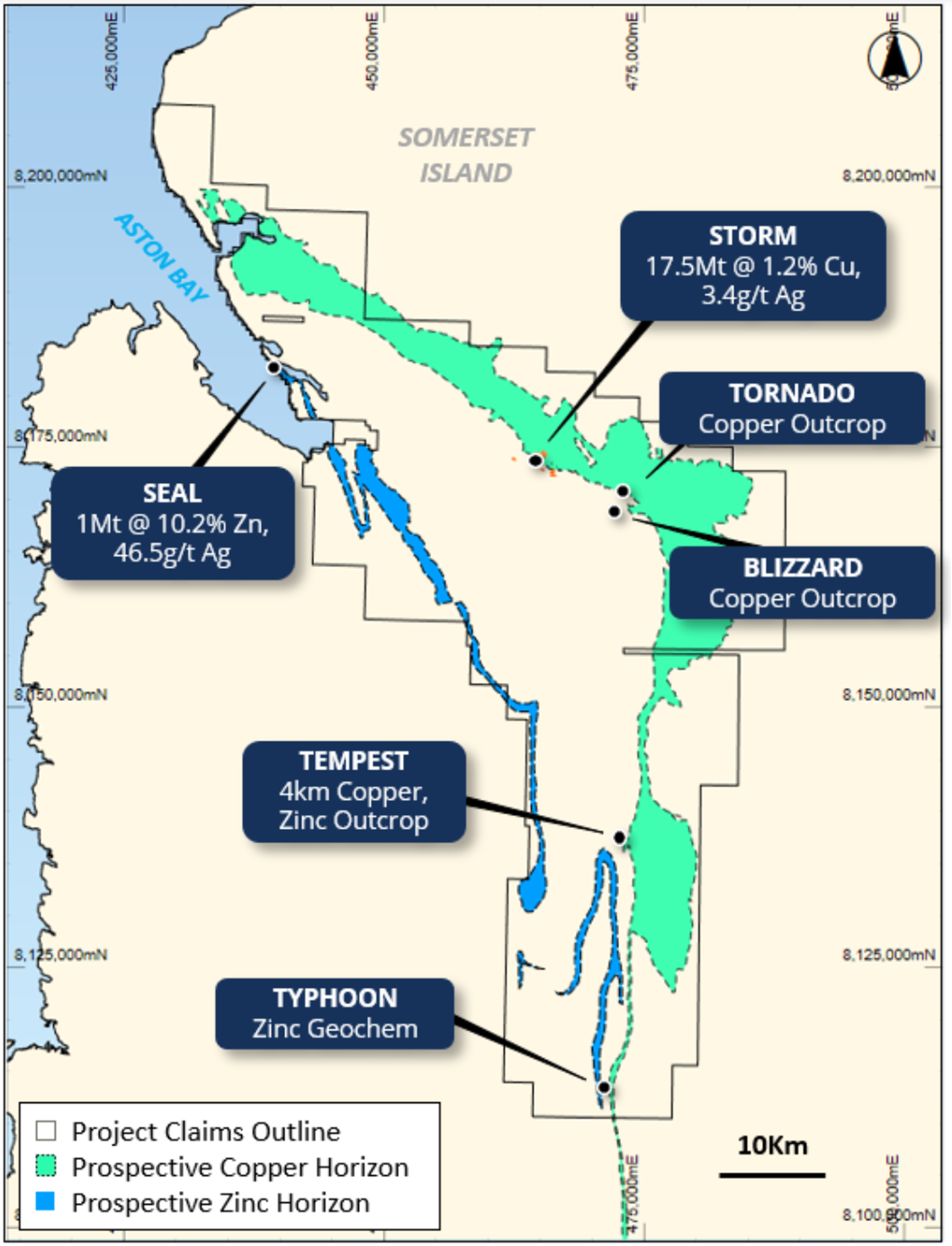

The project hosts a resource estimate of 17.5Mt at 1.2% copper and 3.4g/t silver (0.35% copper cut-off), which includes 205,000t of copper and 1.9Moz of silver.

The first payment under the royalty package is US$5m (approximately A$7.5m), US$1m (approximately A$1.5m) of which will be advanced to American West Metals (ASX:AW1) this week with the balance to be provided upon completion of registration of the royalty at the Nunavut Mining Recorder’s Office, expected within 2-3 weeks.

Further payments under the royalty package are:

- US$3.5m (~A$5.25m) upon delivery of a Prefeasibility Study (PFS) for Storm and submission of permitting documents for a development at Storm; and

- US$4m (~A$6m) upon announcement of an increase in the resource for Storm to at least 400,000t of contained copper at a resource grade of at least 1.00% copper

Endorsement of project’s production potential

American West Metals and Aston Bay Holdings will share funds under the royalty package in accordance with their respective interests under the unincorporated joint venture for Storm, being 80% for American West Metals and 20% for Aston Bay Holdings.

“We are very pleased to have finalised formal documentation of the royalty funding which allows us to commence accessing substantial non-dilutive funding for the Storm copper project,” AW1 managing director Dave O’Neill said.

“The royalty funds have allowed us to expand activities at Storm this year, resulting in considerable advancement of the project which is rapidly taking shape as a potentially globally significant copper mining operation.

“The investment from Taurus recognises the strong foundations for growth established by American West to date and is an endorsement of both the American West team and the production potential at Storm.”

Taurus chief investment officer Michael Davies said they continue to be impressed with achievements at the Storm copper project and “its potential to be a significant mining operation.”

“We are delighted to be supporting the team at American West Metals as they continue to grow Storm’s copper resources and progress development plans for the project,” he said.

The royalty arrangements with Taurus do not impose any royalty on American West’s West Desert and Copper Warrior projects in Utah, USA.

PFS due early 2025

The company is confident of the project’s immediate upside potential, with shallow copper mineralisation open in all directions.

That includes high grade copper discoveries at Thunder (48.6m at 3% copper), Lightning Ridge (15.2m at 2.3% copper and 15.2m at 2.1% copper), Cyclone North (27.4m at 1.1% copper) and Cyclone Southwest (15.4m at 1.4% copper), none of which are included in the current resource estimate.

The funding will enable an expansion of exploration and development activities at Storm including an expansion of the 2024 drill program with more than 22,000m of drilling completed to date with the aim of delivering a resource upgrade.

The funding is also an investment in the 2025 field activities with bulk supplies being delivered to site this week by ship charter – saving around $4m on the potential logistics costs for the 2025 program.

It will also support the completion of environmental, mining and development studies, including detailed test work that supports the potential for a direct shipping ore operation, which will support delivery of a PFS in early 2025.

The near-surface, high-grade mineralisation at Storm means the ore is suitable for simple beneficiation techniques. After using full scale ore sorters and inline pressure jigs in successful tests, AW1 management are confident to bypass the need for a traditional flotation plant to reduce operating footprint and capital.

A scoping study is currently taking place to optimise and refine this potential process.

This article was developed in collaboration with American West Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.