Aussie copper looks more attractive as Chile mulls extra tax on the base metal

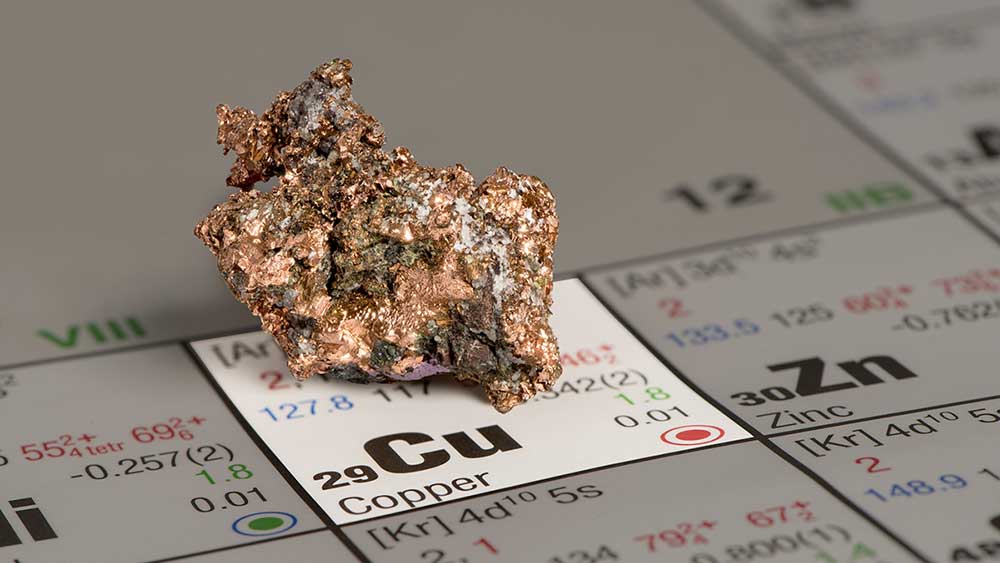

Pic: Getty

Special report: The outlook for copper is improving and Chile’s move to hike taxes for red metal miners will likely make Aussie copper look better.

Reuters reported recently that it had seen a draft of a proposal from Chile’s congress that suggested an extra 3 per cent tax be levied on copper miners producing more than 12,000 tonnes each year.

Chile is the world’s largest copper producer.

In 2010 the government hiked mining royalties from between 4 and 5 per cent to 4 per cent to 9 per cent of mining sales on a sliding scale, rising to 5 to 14 per cent starting in 2018, Reuters reported.

This is good news for copper players like Castillo Copper (ASX:CCZ) that have mines in Australia, which is already seen as a cost-competitive country.

Australia hosts a substantial portion of the world’s copper and was ranked second behind Chile in 2017, according to the United States Geological Survey.

Castillo is working to re-start production at its flagship Cangai copper mine in New South Wales.

The company recently made a new high-grade copper and silver discovery at the project.

Soil and rock chip sampling has uncovered a potential high-grade north-east trending mineralised extension, returning grades of as high as 23.9 per cent copper and 55.5 grams per tonne (g/t) silver.

Anything above 1.5 per cent copper and 50 g/t silver is considered high-grade.

Since mining operations ceased a century ago, limited exploration has taken place which Castillo says underscores the potential upside across the Cangai copper tenure.

Castillo is confident it will identify further mineralisation. The company is undertaking multiple surveys and continuing drilling.

The company is also advancing its plans to monetise the legacy stockpiles after metallurgical test-work confirmed copper concentrate recoveries of over 80 per cent and grades up to 22 per cent copper.

The project hosts five historic stock piles of high-grade ore located near the Cangai mine.

Castillo has received strong interest from customers interested in buying the discarded ore.

Copper price is heading up

While the copper price has slipped from a peak of $US3.30/lb ($4.56) in the opening six months of the year to $US2.72/lb, mining heavyweight BHP sees an 8.5 to 17 per cent upside in the copper price.

BHP believes current market fundamentals support a $US2.95/lb to $US3.18/lb trading range.

A return of copper to around the $US3/lb level would be welcomed by the juniors looking to get their copper projects into production to take advantage of the price-supportive supply deficit BHP and others see opening up in copper come the early 2020s.

This special report is brought to you by Castillo Copper.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice. If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.