Auroch makes stunning entrance into emerging US lithium market with Nevada project purchase

Pic: John W Banagan / Stone via Getty Images

Auroch Minerals has made a barnstorming entry into the booming lithium market, announcing a strategic acquisition of a new project within 340km of Tesla’s Reno Gigafactory.

Nickel explorer Auroch (ASX:AOU) has inked a deal to acquire an 80% interest in the Nevada Lithium project near the historic silver mining town of Tonopah.

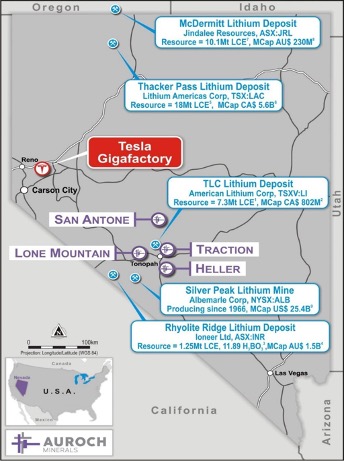

It includes 65km2 of ground across the Traction, San Antone, Heller and Lone Mountain prospect areas, which are considered highly prospective for large sedimentary-hosted lithium deposits.

Located in the mining friendly counties of Nye and Esmeralda in Nevada, Auroch will be exploring for the battery metal in a domain renowned for hosting some of the world’s largest deposits of sedimentary lithium.

These include Ioneer’s (ASX:INR) Rhyolite Ridge, American Lithium’s TLC project and global lithium giant Albemarle’s Silver Peak mine 45km to the west, the only producing lithium operation in North America.

Auroch says the project has seen shockingly brief lithium exploration despite covering the same lacustrine sedimentary formation that hosts other large lithium deposits in the region like TLC.

“We are very excited by the potential of the NLP to host significant lithium mineralisation in a stable pro-mining jurisdiction in Nevada, USA,” Auroch managing director Aidan Platel said.

“The project areas cover the same geological formations that host very large lithium deposits in the region, including the TLC Lithium Project nearby.

“The acquisition adds to and supplements the company’s increasing focus on battery metals and represents a tremendous opportunity to enhance value for Auroch shareholders.

“We look forward to completing the acquisition and initiating exploration as soon as possible!”

Battery metals in Auroch’s crosshairs

The acquisition sharpens Auroch’s focus on battery metals, complementing its nickel projects across WA as it looks to capitalise on the rise in electric vehicle and battery demand.

Lithium carbonate prices have soared due to undersupply in the global market, rising to more than US$70,000/t on the Asian spot market in recent weeks.

The NLP’s location close to the Tesla Gigafactory is a key advantage, with the US Government aiming to increase its support of local critical minerals projects to stimulate a local supply chain for the Chinese dominated market.

“The NLP is located close to the Tesla Gigafactory and has access to major US ports on the West Coast, providing a clear down-stream processing path for any significant lithium mineralisation we potentially discover,” Auroch chairman Mike Edwards said.

“Furthermore, the proposed acquisition of the NLP coincides with the recent Presidential Determination by the Biden Administration to ensure a robust, resilient, sustainable, and environmentally responsible domestic industrial base to meet the requirements of the clean energy economy.

“The timing and location couldn’t be better!”

Fellow sedimentary lithium developers have received favour from ASX investors in recent times as well.

$230 million capped Jindalee Resources (ASX:JRL) owns the 10.1Mt lithium carbonate equivalent McDermitt project to the north, while Ioneer’s 1.25Mt LCE Rhyolite Ridge mine has powered it to a $1.5b market cap and led to a $490 million investment from one of the world’s largest mining companies Sibanye-Stillwater.

Terms of the deal

Auroch has entered into a share sale agreement with the shareholders of Nevada Australia to acquire an 80% interest in the project, Nedeel LLC, Krakouer Capital and Cratonix.

Consideration will include the issue of 7.2 million shares valued at around $1 million, along with the issue of 7.2m performance rights that will convert to shares on Auroch announcing a new drill intersection of 25m at 1000ppm lithium starting within 100m of the surface of the NLP area.

Auroch will sole-fund exploration at the NLP until a decision to mine.

Auroch will also reimburse the vendors for expenditure incurred for an amount up to US$220,000, and issue a US$230,000 loan to support Nevada Australia through the acquisition process.

Under review

Along with the deal Auroch has also announced plans to sharpen its focus on lithium and nickel by initiating a review of its non-nickel assets in South Australia.

These include three early stage exploration projects focused on critical minerals including zinc, copper, lithium and rare earths.

They include the sedex style Arden zinc-copper project where diamond drilling at the Ragless Range target has intersected 12.8m at 5% zinc from 53m, including 3.65m at 15.5% Zn from 62.15m and more recently has shown potential for skarn-related lithium and rare earths mineralisation.

Also part of the review are the Bonaventura zinc-copper project and the Torrens East copper project, a greenfields project targeting iron oxide copper-gold mineralisatoon on the Sturt Shelf, the host of BHP’s massive Olympic Dam nine and OZ Minerals’ Carrapateena copper-gold mine.

Auroch says that could include a potential demerger and separate ASX listing.

“In parallel with the NLP acquisition, and as part of the Auroch’s ongoing commitment to maximise shareholder value, the Companyis undertaking an internal review of these non-nickel assets which will also include the NLP, subject to completion of the Proposed Acquisition,” Auroch said.

“Various opportunities to unlock value are being considered for these assets which may be realised through a range of transaction structures, including a potential demerger and separate ASX listing.”

This article was developed in collaboration with Auroch Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.