Auroch just ‘one hole away’ from a game-changing nickel discovery

Pic: Schroptschop / E+ via Getty Images

Special Report: Auroch Minerals (ASX:AOU) believes it is close to unearthing the high-grade motherlode in one of Australia’s most prolific nickel belts.

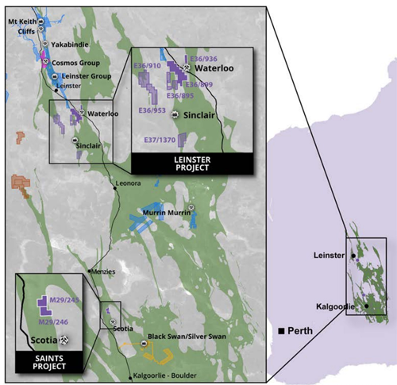

Auroch’s Saints and Leinster nickel projects are located in the Norseman-Wiluna Greenstone Belt, arguably the best address globally for nickel sulphide mineralisation.

Of the 50-odd known Kambalda-style nickel sulphide deposits around Norseman-Wiluna Greenstone Belt, 48 have a main ‘feeder’ channels to the deposit. Understanding Kambalda-style nickel sulphide deposits is key to successfully finding them.

The company is currently undertaking RC and aircore drilling across both projects with Managing Director Aidan Platel believing they are just “one hole away” from a rerating event.

Feeding the upside

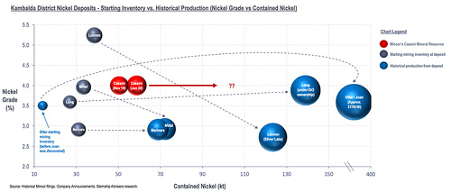

“The feeder channel is where you find the thickest, highest grades and could contain at least 30,000t of nickel at 3 to 5 per cent,” Platel says.

“All of these Kambalda style deposits basically have one of these things, with both Saints and Leinster extremely underdone from an exploration standpoint, there is a strong potential for both projects to have multiple feeder channels.

“These Kambalda resources all grow exponentially once you get onto the feeder, which often has a very small surface footprint but a big vertical extent. That’s why we are drilling and that’s what we are looking for.”

The following graph shows how Kambalda deposits have grown over time, from initial mining inventory to overall historical production:

Finding the feeder

At Saints, Auroch immediately jumped into a diamond drilling program once the acquisition was finalised last year to confirm the existing nickel resources.

“We did some infill drilling and some short step out drilling and got really high-grade massive sulphides up to 10 per cent nickel, which was very encouraging,” Platel says.

“But then we really just stepped back.

“We can step off and do those little incremental increases to the resource – and certainly we will do that as well – but the grand prize is to locate the feeder channel to the whole system.”

“Auroch redid all the geology from existing drilling, a lot of shallow aircore across the basal contact where the channel would be, and a lot of geochem.

“It was unsexy stuff to the market, but this good technical work has really set us up for success.”

Platel said “five to six” new channels were identified at Saints to the existing mineralisation.

“Now we are really just systematically working our way through those, drilling and testing for that feeder channel,” he said.

“We have another diamond program later this year. Very shortly we will be starting an RC program at T1 and T2 – two of the other channels we have defined throughout the year.”

With the 21,400t Auroch already has in resources at Saints, an initial 50,000t of contained nickel is considered “critical mass” for the company to press the button on a development story.

Once they press that button it’s relatively simple — Saints is located on two granted mining leases and has an existing offtake agreement with BHP.

And the current resource starts just 40m from surface.

“In that scenario we could start production fairly quickly,” Platel says.

‘One hole away’

Legend Mining (ASX:LEG) and Chalice Gold Mines (ASX:CHN) have shown everyone what one drill hole can do for an exploration company.

A big nickel find in the Fraser Range has pushed Legend’s share price up almost 350 per cent since late last year.

Chalice is now up ~1400 per cent since mid-March as its regionally defining Julimar discovery continues to grow.

“Really, that’s where we are at – one hole away,” Platel says.

“And as long as we have that rig turning on some solid tier 1 targets, we are giving ourselves every chance to get that re-rate.

“We raised some money in June, so we are pretty cashed up and in a good position to keep things ticking over.

“And always looking for new acquisitions as well. We are very much nickel sulphide focused – and there’s certainly some ground out there that is not receiving the attention it deserves at the moment.”

The right team

Platel joined Auroch about three years ago and, in August 2019, finalised a deal to buy two WA nickel assets in the Norseman-Wiluna Greenstone Belt from copper-gold focused Minotaur Exploration (ASX:MEP).

Platel knows what exploration success looks like. In 2004, the seasoned geologist put the discovery drill holes into Brazil’s Santa Rita, the largest nickel sulphide discovery in over a decade.

“I took that right through resource drill out, development, and into mining,” he told Stockhead.

“I’ve been lucky enough to make a discovery. There’s a lot of good geos out there that never achieve that.”

Santa Rita became one of the world’s largest open pit nickel sulphide mines, operated by Australia’s Mirabela Nickel which was recently acquired by Appian Capital and restarted in 2019 and upgraded its mine life to 34 years.

“These are two very solid projects with existing high-grade resources in one of Australia’s highest-producing nickel belts — and they are very underdone on the exploration side,” Platel says.

Existing high-grade resources at Saints and Leinster

There are two very important things that make core projects Saints and Leinster stand out from the pack.

Firstly, they come with existing high-grade nickel resources.

“At Saints, we already have 21,400 tonnes of contained nickel in JORC resources at 2 per cent — the highest grade on the ASX behind Mincor and the existing mid-tier producers,” Platel says.

At Leinster, the main larger tenement contains a resource called the ‘Horn’.

“It’s only JORC 2004 so we aren’t allowed to talk about it yet, but again its high-grade massive sulphides up to 15m thick. There’s good copper in there as well,” Platel says.

“Those resources de-risk our exploration in a sense, because we already have that nickel in our back pocket.”

But more importantly for Auroch and its shareholders, there is a ‘nickel motherlode’ at both projects which is yet to be found.

Leinster: ‘The Next Saints’

Like Saints, Leinster has an existing resource which Auroch is about to drill up to JORC 2012 standards.

That tenement is straight along trend from BHP and Western Area’s ground nearby.

“BHP’s tenure trends right into ours,” Platel says. “They are watching quite closely, as you can imagine.”

Then there’s the Valdez tenement off to the northeast, which is along strike and in the same rocks as Waterloo, Saracen’s nickel mine.

Valdez had basically never seen any drill holes, Platel says.

“We covered that with 4,500m of aircore, and got some pretty nice early hits which indicated the source is underlying nickel sulphides rather than any other lateritic enrichment,” he says.

“There’s a channel we have identified at Valdez which coincides with that higher-grade nickel.

“We just worked through a ~1500m RC drilling program, getting some really deep holes into that contact, which we will follow up once again with downhole EM to see if anything lights up.”

Valdez is the company’s ‘blue sky’ project – it could be anything.

“Being that close to Leinster is a real positive as well,” Platel says.

“I think that could change the whole scenario pretty quickly if we make a discovery there.”

Auroch has also just added four tenements to the Leinster project through an earn in agreement with Jindalee Resources (ASX:JRL).

One of the tenements there is contiguous with the Horn tenement and again, directly along strike from BHP to the north and Sinclair, Talisman’s old nickel mine, to the south.

“There are targets we need to follow up there,” Platel says.

“Once the drilling program finishes at Valdez we will head straight there and drill 1,000-1,500m on a few of these targets.”

This story was developed in collaboration with Auroch Minerals, a Stockhead advertiser at the time of publishing.

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.