The ASX stocks in battery metal deals with Japan and South Korea

Japanese and Korean conglomerates have not been shy in partnering with Aussie critical minerals companies. Pic: Getty Images

- Japan and Korea are increasingly taking stakes in ASX companies tied to the energy transition

- Canada is also presenting a similar investment opportunity

- Here are a few of the more recent major deals

South Korea and Japan have been supporters of Australian and Canadian exports since the late 1880s, with deep rooted ties to ‘The West’ established through the trade of coal, wool and green tea.

But as time goes on and the energy transition starts to take a new form, so too do these investment relationships, with mineral fuels and oils, as well as critical minerals like copper, nickel, lithium, graphite and rare earths becoming a staple to support the growing manufacture of electric vehicles and high technology devices.

A serious lack of resources in both countries, along with their ageing and shrinking populations, make ‘The West’ attractive destinations for resources and investment.

Over the past decade, at least half of the world’s incremental lithium production has been attributed to Australia, while Canada ranks among the top five global producers of indium, niobium, PGE metals, titanium concentrate, and uranium.

Japan and Korea are increasingly taking stakes and making early-stage investments in Australian mining companies and their projects, especially those tied to the energy transition, and that’s not just anecdotal.

The East Asian nations rank as Australia’s second and third largest export markets for resources and energy respectively.

Exports to South Korea including iron ore, LNG and coal totalled $47.5 billion in 2022, while ROK (Republic of Korea) investment in Australia was worth $28.1bn.

A report by law firm Herbert Smith Freehills and The Australian National University noted a record 53 merger and acquisition (M&A) transactions took place in Australia in 2023 by Japanese companies, who increasingly view Oz as a politically stable ‘growth market’.

Total Japanese foreign direct investment in Australia hit record levels of $133.8b as energy and supply chain security issues came to the fore.

The Pilbara of the north

Canada is presenting a similar investment opportunity for Japanese and Korean car and battery manufacturers.

A case in point came from Green Technology Metals (ASX:GT1), which announced an $8 million investment from Korea’s EcoPro Innovation in August, which is also planning to become a strategic partner in a lithium conversion facility in Ontario near the sites of its proposed Seymour and Root hard rock lithium mines.

GT1 will be delivering a joint PFS leveraging EcoPro’s in-house research and development capabilities and lithium-processing knowhow.

MD Cameron Henry said the addition of a major Korean company to the project would significantly enhance its capabilities to deliver an integrated mine to the chemical business.

“A key factor in our ability to attract this kind of partner is the strategic location of our projects,” he said.

“The Ontario region is second to none for a complete battery ecosystem and has seen significant investment, including over $44 billion in recent years.

“Producing spodumene concentrate and shipping it out of Ontario won’t be viable in the long term, so the strong government support and influx of battery manufacturers present a unique opportunity to establish an integrated lithium business and we are excited to successfully build this in Ontario with our new strategic partner.”

Henry said the company’s strategy has always been to establish an integrated lithium business in Ontario including two processing hubs and a lithium conversion facility. While there is tremendous opportunity in Canada, it is not something Green Technology Metals can do alone.

“We specialise in developing lithium mines but building and operating a lithium conversion facility presents additional complexities,” he said.

“Even the best in the industry have faced challenges, which is why we are committed to partnering to de-risk the project.

“Our new strategic partnership with EcoPro Innovation, a major Korean company and global leader in battery materials development, enhances our capabilities significantly.”

Record investments in ASX mining space

Australian minerals and energy were among the range of investments by Japanese companies last year, with many ASX mining juniors seeking funding to carry out exploration and move their projects further along the development pathway.

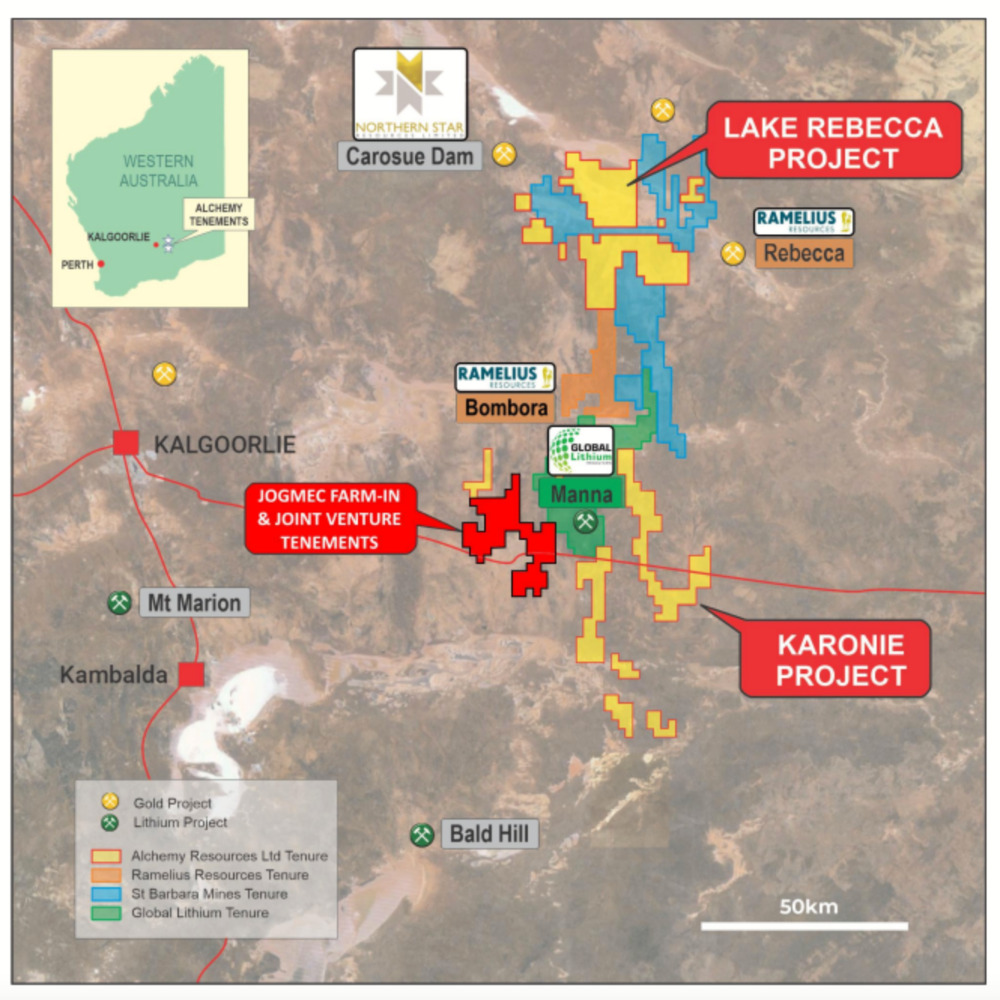

That trend has continued this year with one of the latest deals being the farm-in and joint venture agreement between Alchemy Resources (ASX:ALY) and JOGMEC (Japan Organization for Metals and Energy Security), a Japanese government agency which seeks to secure stable resource supplies for Japan.

JOGMEC is notable for its steadfast support of Lynas (ASX:LYC), propping up what is now the world’s major ex-China rare earths producer during a period of bargain barrel rare earths prices with a series of debt repayment holidays to ensure diverse supply of magnet metals.

The Alchemy agreement will see JOGMEC earn up to 51% of the 248km2 Roe Hills target areas within Alchemy’s Karonie project in WA’s Eastern Goldfields by spending $6m by March 31, 2029, and a minimum expenditure commitment of $600,000 by March 31, 2025.

What sets Oz apart from the rest of the world

Speaking with Stockhead ALY CEO James Wilson said Australia stands apart from the rest for NOT being a big ‘technology maker’, plus we have resources in abundance.

“There’s a sort of meeting in the middle there with Japan who are a technology provider and need our resources,” he said.

“We’re probably one of the biggest lithium destinations in the world for new projects and new discoveries, [and] our government is also friendly with the Japanese government because they are our trade partners.

“It’s easier for these sorts of deals to take place in Australia than in the US due to energy security – it’s very difficult for a foreign government to try and gain access to their national resources,” he said.

While ALY’s Karonie project has a long way to go from a development perspective, Wilson said there were multiple reasons why JOGMEC were attracted to the asset.

“The best place to find a mine is next to an existing one,” he said.

“They liked Karonie for its jurisdiction and where we sit in relation to Global Lithium’s Manna deposit, only 5km to the east, we share a common boundary with them as well.”

Long-term supporters of Australia and Canada

Situated in the same region as ALY is Maximus Resources (ASX:MXR) and its Lefroy asset, which received Foreign Investment Review Board (FIRB) approval by the Australian government earlier this year with the Korea Mine Rehabilitation and Mineral Resources Corporation (KOMIR).

KOMIR will fund US$3m (A$4.5m) of lithium exploration to earn a 30% interest in Lefroy where multiple high-grade spodumene-bearing pegmatites, up to 6m at 1.11% Li2O, were intersected during the FIRB review process.

During the lithium peak, MXR managing director Tim Wither said Maximus received a significant amount of inbound interest from lithium market participants.

“KOMIR was introduced to us through LG Energy Solution – the second-largest battery manufacturer in the world – [with] which we have a non-binding MOU executed and gives them the option to acquire KOMIR JV interest,” he said.

“Our dealings with them have been fantastic, the lithium market is still in its infancy stage but the long-term outlook is robust with global battery manufacturers busily securing raw product supply for many decades ahead.”

There’s no doubt these deals represent the long-term view both Korean and Japanese governments have on the lithium and EV narrative.

Dermot Woods, a portfolio manager for Perth-based Precision Funds Management, says Korean and Japanese companies back resources in places like Australia and Canada rather than Chinese-backed jurisdictions like Zimbabwe because of their focus on the quality of resources.

While Japanese and Korean companies haven’t always been known to do well out of their equity investments, they have demonstrated themselves to be patient, long-term supporters of projects, having played a key role in the development of Australia’s iron ore and coking coal mines.

“I think they were pretty bad at it in terms of the equity stakes they took in things, I thought a lot of that was faddish to be honest and quite ill-disciplined,” Woods told Stockhead.

“But those two countries are famed for being longer-term thinkers than the average equity market participant who has a timeframe of between one day and two months I reckon on average.

“They see it as real. They don’t go around throwing money at commodities that often.

“What they’ve typically done in Australia in the past, is going to buy a chunk of a project and aligned long-term offtake with it.”

Nickel hopeful Ardea Resources (ASX:ARL) pulled in Mitsubishi and Sumitomo to spend $98.5m on a definitive feasibility study at the Kalgoorlie Nickel Project despite the parlous state of the nickel market outside Indonesia, which, backed by Chinese investors, now controls more than half of the world’s supply.

“I think both Japan and Korea have a very good and strengthening relationship with Australia, particularly in the critical minerals sector,” Ardea boss Andrew Penkethman said.

“Contributing factors include Australia’s well understood and respected operating standards that meet the high ESG standards expected by both nations, Australia is also considered a stable jurisdiction providing supply chain diversity and security.

“I think our timing to be completing the Kalgoorlie Nickel Project – Goongarrie Hub Definitive Feasibility Study is perfect, along with our timing to production when the nickel market is expected to be back in deficit and the nickel price is rising in response.”

‘Inelastic’ demand for raw materials

Located on the cusp of a state forest some 70km north of Perth is Chalice Mining’s (ASX:CHN) Gonneville PGE-nickel-copper-cobalt deposit, where a pre-feasibility study is in the works once metallurgical testing has been assessed by the Tim Goyder and Gina Rinehart backed developer.

The company entered into a non-binding MoU with Japan’s Mitsubishi in July to collaborate on the PFS with the intention of forming a strategic partnership to develop Gonneville. Along with its iconic car brand, Mitsubishi is a major platinum group metals trader.

CHN is planning to complete the PFS by mid CY25, which will assess several development cases seeking the best to progress to a feasibility study.

In an interview with Stockhead, CHN managing director and CEO Alex Dorsch said whilst markets are oversupplied short term, critical minerals demand is forecast to grow exponentially to pursue decarbonisation and electrification goals.

“That is the key discussion currently setting the pace,” he said.

“Previous estimates were too aggressive and previous policies were too inflationary.

“Japanese and Korean players are very aware of commodity cycles; they understand commodity price cycles and are very savvy mining investors.

“Their demand for raw materials is inelastic and doesn’t depend on price, also their advanced manufacturing economies need energy and metals to function.

“They have a very long term +25-year focus, unlike equity markets which think in quarter by quarter only and are very short term.”

High fence

The South Korean government played a crucial role obtaining concessions for battery makers, securing a window of grace on US IRA rules that enabled them to supply US carmakers with batteries where up to 95% of their graphite, among other commodities, was sourced from China.

Investments in western battery and EV metals producers are increasingly geared to solving this problem and capitalising on the unique opportunity it presents for Korean companies.

“It needs to start focusing on how it’s going to be US IRA compliant, how it’s going to comply with the Critical Raw Materials Act of EU,” former Australian ambassador to Korea James Choi said at a conference hosted by Benchmark Mineral Intelligence in Perth last month.

“It has no choice but to diversify away from the Chinese supply chain, but cooperate with China where it can. But ironically, Korea also has the most benefit if this high fence in the EU and US markets hobbles China’s access to those markets.”

Speaking with Stockhead, Arafura Rare Earths’ (ASX:ARU) managing director and CEO Darryl Cuzzubbo said there are many benefits as to why Korea and Japan want to help establish a battery metals supply chain here in Australia, but the obvious one is a reduced reliance on China.

“Given the economic and national security risks, being dependent on any one country as a source of critical minerals is far from ideal,” he said.

“China has an oversized influence on the rare earths sector in particular, speaking for approximately 70% of production and 90% of processing.

“The country has also shown a tendency to change rules around the export of critical minerals on a whim, as we have seen with antimony recently and germanium and gallium last year,” Cuzzubbo said.

“In contrast, Australian mining projects have demonstrated themselves to be a reliable supply often with growth potential.”

ARU signed a binding supply deal with South Korea’s Hyundai Motor Co and its unit Kia Corp in 2022 for the supply of up to 1,500t of Neodymium-Praseodymium (NdPr) oxide per year over a seven-year term from the Nolan project in the NT.

NdPr oxide, used in the production of NdFEB magnets found in EVs and wind turbines, is prized by automobile companies for its high magnetic strength relative to their size and weight, making them ideal for products that require a high energy-to-weight ratio.

Today, nearly 90% of NdPr supply is from China, with most of the 10% of ex-China supply locked up with Japan through Lynas.

Cuzzubbo said Japan enjoys this benefit today because it acted over a decade ago to support Lynas’ Mt Weld project.

“We have a similar situation emerging with Korea,” he said.

“We want to be to Korea what Lynas is to Japan and that is an environmentally responsible, reliable and scalable source of NdPr underpinning their rapidly growing EV sector.”

Deals with South Korea’s Posco

Graphite miner Syrah Resources (ASX:SYR) executed a long-term off-take agreement with POSCO Future M, the most significant anode producer outside of China, for natural graphite from its Balama operation in Mozambique.

SYR managing director and CEO Shaun Verner said POSCO’s sourcing of graphite from Mozambique and other ex-China mines provides a reliant, long-term feedstock for its South Korean anode facilities.

“It also aligns with policy requirements in the USA with the Inflation Reduction Act and Europe with the Critical Raw Materials Act in relation to critical mineral sourcing for the benefit of POSCO’s downstream customers in these regions,” he said.

“Development in the mining industry is capital intensive, and has long lead times, so the sooner customers and governments provide clearer incentive for ex-China suppliers to invest the better.”

Other ASX companies in major deals with POSCO include Pilbara Minerals (ASX:PLS), which finalised a joint venture agreement with the chemical and materials giant in October 2021 to develop a lithium hydroxide conversion facility in South Korea.

The chemical facility is owned and operated by the POSCO Pilbara Lithium Solution Co joint venture with POSCO Holdings owning 82% and PLS owning the remaining 18%.

In April this year the JV delivered its first lithium hydroxide order to a cathode-producing customer, a key raw material for high-nickel cathodes and a core component of a rechargeable battery.

At Stockhead we tell it like it is. While Green Technology Metals is a Stockhead advertisers, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.