ASX resources companies ramp up exploration spending to highest for eight years

Mining

Mining

ASX and Australian resources companies cranked up their spending on exploration activities to an eight-year high of $718.4m in the December 2020 quarter as COVID-related travel restrictions encouraged firms to develop more home-grown projects.

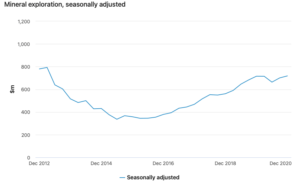

Total spending on exploration activities in the December quarter is at its highest level since March 2013 at $793m, and was up 2.5 per cent on $700.6m in the September quarter, said the Australian Bureau of Statistics in a report this week.

“In the past year, a number of Australian resources companies have moved back to Australia because of travel restrictions due to COVID-19, and many are seeing this as an opportunity to develop projects here,” said Rob Murdoch, principal consultant at Austex Resource Opportunities.

Murdoch’s firm tracks exploration spending by ASX listed resource companies detailed in their Appendix 5B reports which they are obliged to file at quarterly intervals throughout their financial year.

The Appendix 5B report summarises the amount of expenditure each ASX resources company has incurred on exploration, development and mining activities in a quarter period.

Murdoch stressed that the ABS data included spending on exploration activities by ASX listed and non-listed companies that includes privately-owned resource companies.

Experts put forward other reasons for the steep rise in exploration spending which had languished at below $400m per quarter between March 2015 and March 2017.

They included high commodity prices, recent large resource discoveries, large amounts of investor cash that has flowed to explorers and boom time market conditions.

MineLife founding director and senior resource analyst, Gavin Wendt, said the rise in exploration spending by ASX resource companies was in train before COVID-19 hit.

“The past 18 months to two years has seen boom conditions and investor interest in the small end of the resources market. A lot of money has flowed into the sector recently,” he said.

“Companies’ coffers are bulging with cash they have raised and it is their duty to shareholders to spend that money,” said Wendt.

Resource companies in the exploration phase are highly geared to the prices of commodities which for some like copper, nickel and tin are going through a bullish cycle.

A great deal of exploration spending has been driven also by cashed-up entities seeking to replicate the success of ASX companies that have made big finds.

“There has been a lot of interest in the exploration space driven by fantastic discoveries such as Chalice Mining’s Julimar discovery and De Grey’s Hemi discovery, both in WA,” Wendt said.

Julimar was discovered by Chalice Mining (ASX:CHN) in March 2020, and is a high-grade platinum group element-nickel-cobalt-copper-gold project located 70km northeast of Perth in WA.

De Grey’s (ASX:DEG) Hemi gold find is located in WA’s Mallina province near Port Hedland.

The trend for ASX exploration companies to look for new discoveries in Australia is the reverse of market conditions a decade ago when some ASX companies went overseas for projects.

“Ten years ago there was a stampede of companies looking offshore for projects in regions such as Asia and Africa, as there was a feeling that a lot of the low hanging fruit in Australia had been picked,” said Wendt.

Increased red tape for mining projects was another driver for this overseas exploration trend.

This soon petered out as the “harsh realities” of doing business in overseas jurisdictions hit home to companies.

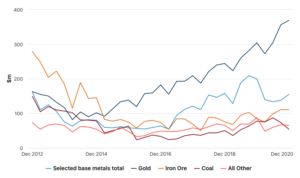

Gold was top of the list for exploration spending by ASX resource companies at $369m in the December 2020-ended quarter, accounting for about half of the total exploration spend.

This is more than four times its low point of $81.7m in March 2014 and indicates that the trend for increased exploration on gold projects has been going for several years.

WA continued to dominate spending on exploration in the resources sector, accounting for nearly two-thirds of the total spending in the December-ended quarter.

Base metals exploration spending in the December quarter was $155m, and peaked at $208m in the September 2019 quarter.

Iron ore exploration spending in the December ended quarter was a steady $110m, but is down from $278m in the December 2012 quarter, according to ABS data.

Exploration on iron ore projects amounted to 15 per cent of the December quarter’s total spending. For coal, just $54m was spent on exploration in the December quarter.

Data for exploration spending on another fossil fuel, petroleum fell to $228.8m in the December quarter, down from a peak of $1.5bn in the June 2014 quarter.