ASX Pot Stocks: BOD Australia jumps 12% on record $7.52 million revenue for FY21

Pic: Ivan-balvan (iStock / Getty Images Plus) via Getty Images.

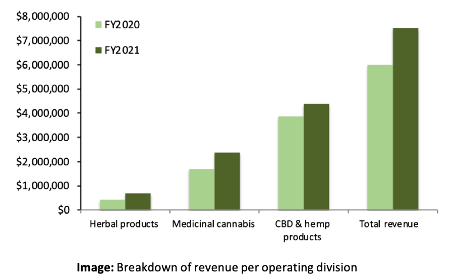

Leader of the pack among cannabis stocks today is BOD Australia (ASX:BDA) up 12% off the back of news of record revenue for FY21 of $7.52 million – up 25% on FY20.

Medicinal cannabis product sales were up 40%, accounting for $2.3 million in revenue which BOD said was underpinned by the sale by the sale of 12,187 MediCabilis product units – a whopping 212% increase on unit sales during FY20 of 3,907.

Plus, the company generated $4.39 million revenue from CBD wellness product sales.

BOD is confident that revenue will continue to increase in FY22 – driven by recurring sales orders for CBD wellness products, an ongoing upward trajectory in medicinal cannabis sales, range expansions across both operating divisions and international expansion opportunities.

“Bod now has two very strong business divisions with diversified revenue streams,” CEO Jo Patterson said.

“These provide the company with access to multiple markets, a growing portfolio of products and brands backed by scientific expertise and innovation and innovative product development.

“As such, we are well placed to capitalise during FY2022 and beyond and while organic growth will be a primary focus, we have a very strong balance sheet that allows the company to assess potential complimentary acquisitions.”

Other ASX listed pot stocks with news out today

Creso jumped 4% after announcing its wholly-owned psychedelics subsidiary Halucenex Life Sciences Inc. has commissed an extraction unit to progress product development and R&D.

The CO2 Supercritical Extraction System from Advanced Extraction Systems Inc. (AESI) is expected to assist with production of botanical psilocybe mushroom extract.

Halucenex is exploring several potential delivery methods, including tinctures, lozenges, nasal sprays and capsules.

And the company will also utilise the system to explore potential psychedelic substance combinations, with an initial focus on CBD, THC and botanical psilocybin.

Althea Group (ASX:AGH) unchanged

The company’s share price remains unchanged today even after Canadian subsidiary Peak Processing Solutions executed a manufacturing agreement with Supreme Cannabis Ltd – a subsidiary of Canopy Growth Corporation.

Peak will perform hydrocarbon extraction services to create various concentrate products for Supreme utilising their cannabis inputs with the agreement including minimum order quantities of approximately CAD$600,000 in the initial one- year term.

Peak generated $1.52 million of revenue in FY21 and is forecasting revenue in excess of $15m in FY22.

And AGH’s pharmaceutical cannabis business in Australia and the UK achieved revenue of $10.02 million in FY21 (around double that of FY20) and now has 20,322 registered patients.

“This is a determining year for AGH and while we anticipate exciting growth from our recreational cannabis business Peak, we also continue to see record sales from Althea,” AGH CEO Joshua Fegan said.

“Revenue from the sale of cannabis-based medicines has the potential to grow materially faster this year, particularly in Europe, where we see similar patterns to the Australian market in the early days.”

Cann Group (ASX:CAN) – 1.72%

The company’s FY21 financial report failed to impress today, will shares dropping 1.72% despite details of CAN’s new cultivation and manufacturing facility at Mildura and the purchase of the Satipharm business.

While sales revenue increased by $3.62 million to $4.29 million for the year, the loss for the group after providing for income tax was $25.10 million for the year.

At the Mildura facility pilot scale extraction equipment is scheduled to be installed and ready for Office of Drug Control (ODC) inspection (anticipated to occur in September) with cGMP qualification, inspection and certification expected to be complete by the end of 2021.

Large scale extraction equipment is scheduled to be installed in November, with cGMP certification expected to occur a month or two after.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.