ASX miners bring shine back to South African gold

ASX developers are powering the rebirth of South African gold mines. Pic: Getty Images

- Rich in history, South Africa’s gold mining industry is being reborn under the watch of two ASX listed companies

- Theta Gold Mines is bringing one of South Africa’s most storied gold mines back to life

- West Wits Mining targeting first gold pour in 2026

As gold prices soar, ASX gold developers have emerged among the next generation of miners to restore and reinvigorate South Africa’s status as one of the world’s top gold jurisdictions.

In 1993, South African gold producers delivered close to 620t of bullion to global markets, as much as 49% of the world’s total.

Nowadays rising output from competitors like Australia, Russia, Canada and China has relegated the richest democracy in Africa to 12th place, producing under 100t in 2024.

But the outlook for gold developers in the Rainbow Nation is looking brighter, with prices in excess of US$3300/oz, paired with a weak Rand, leading many to recalculate their economics in updated studies.

On top of that, a tenuous coalition led by the country’s two largest political parties – the African National Congress and Democratic Alliance – has sharpened the tools of government after years of inertia under the long ruling ANC, promising to modernise its services and make its business environment more attractive.

Against that backdrop, mines that have laid dormant for years are now on a pathway to development.

Key among those is the Transvaal Gold Mining Estates project, where ASX-listed Theta Gold Mines (ASX:TGM) last month announced a decision to mine one of South Africa’s most historically significant gold fields.

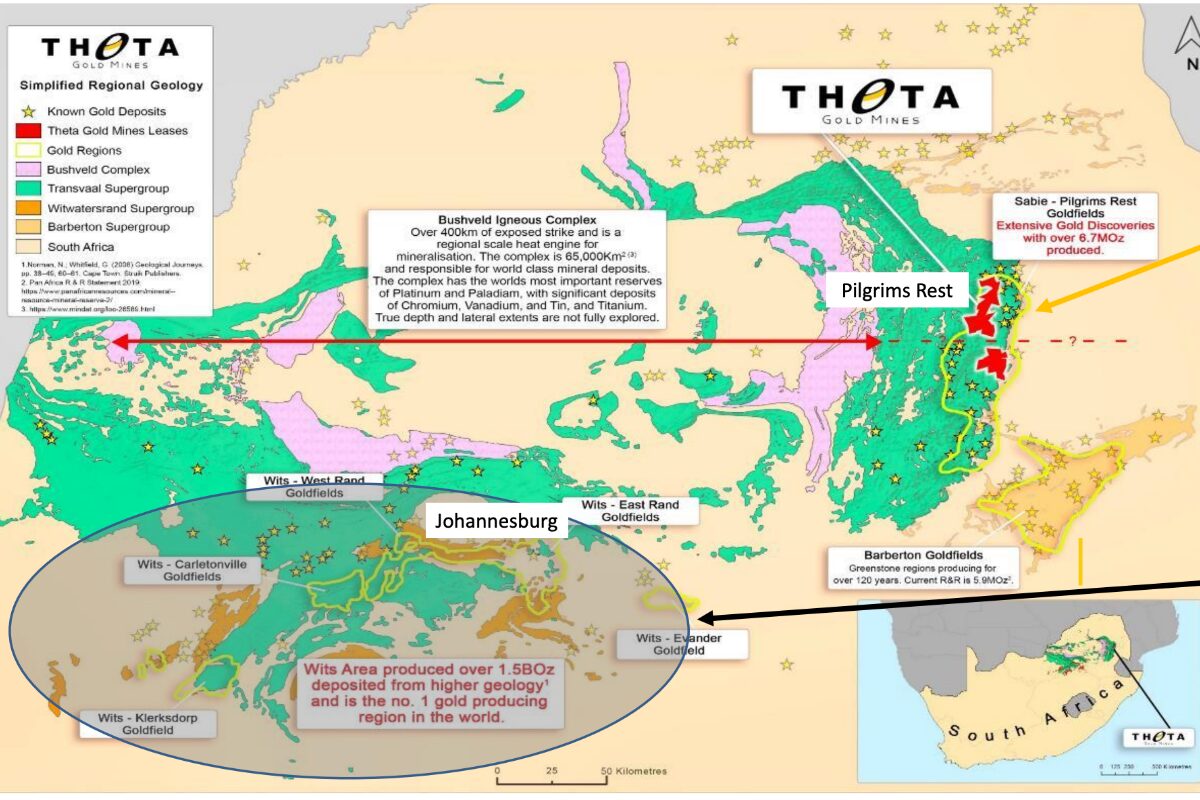

Located 370km east of Johannesburg in the Mpumalanga Province, the TGME project is not part of the Witwatersrand Basin, the famous 1.5Boz gold field from which more bullion has been sourced than any other in history.

Rather it is located near Pilgrim’s Rest, the site of South Africa’s first major gold rush in September 1873.

Theta’s local subsidiary – TGME – holds particular significance for the story of the country’s relationship with the yellow metal. It was the first listed gold mining company in South Africa and at over 130 years, among its oldest continuously running corporations.

TGM’s announcement that its board had approved the project’s redevelopment starts the latest chapter in the mine’s illustrious history.

“It does have a long history, 130 years of history and pretty consistent mining,” Theta Gold Mines’ executive chair Bill Guy said.

“And it had a lot of gold left behind. Historically they produced about 6.7 million ounces and we’ve got 6 million ounces on the book.

“We know there’s more gold than that but the board really had to make a decision about where do we stop exploring and when do we start mining and making some money.”

Return of the gold rush

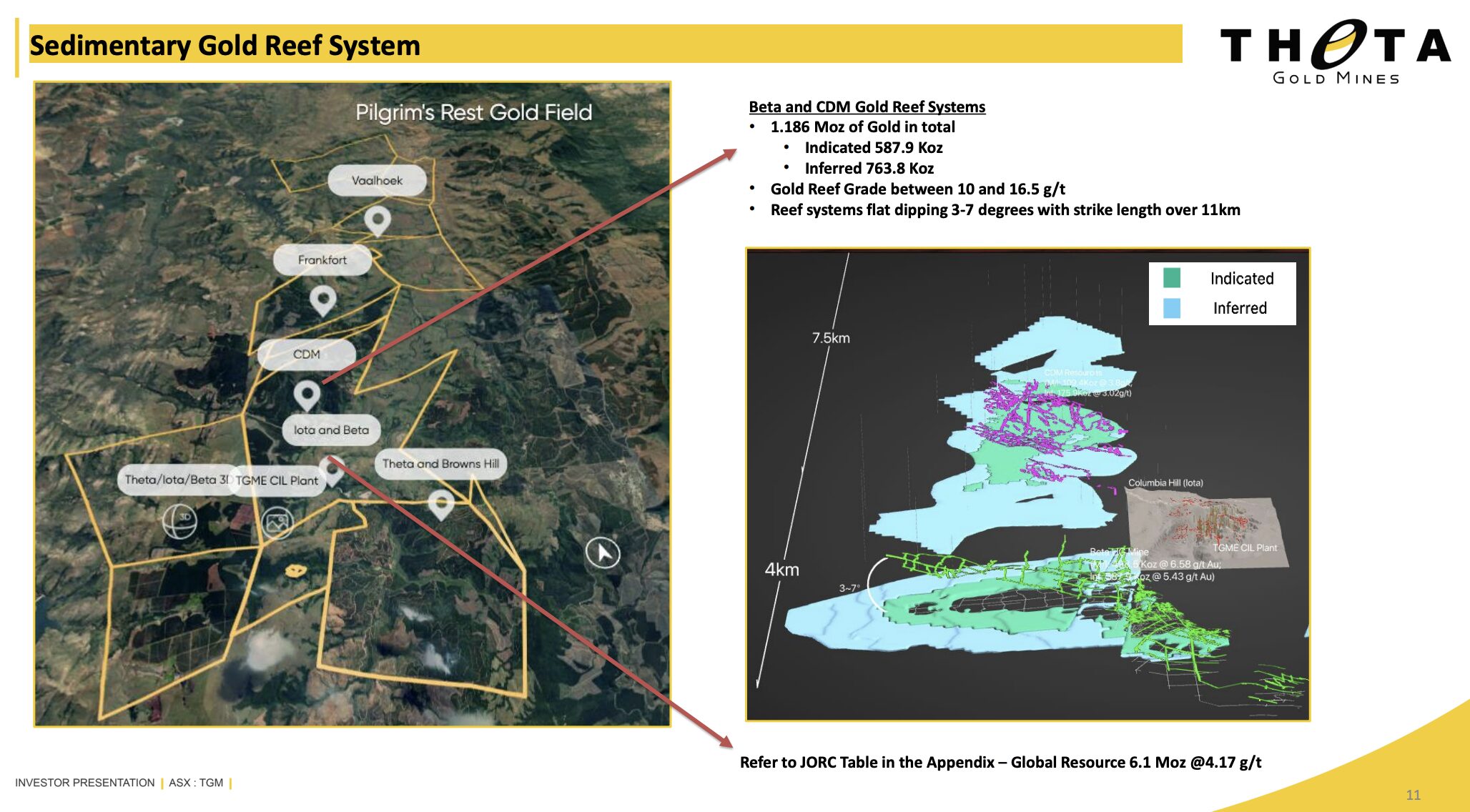

The key mine of the TGME in the early days was the Beta gold mine, which produced consistently from the early 1900s to the 1972, producing over 550,000oz at grades in the order of 21g/t – around two-thirds of a troy ounce.

Other, smaller mines, wound up operations during World War 2 due to a lack of manpower, but the project eventually found itself in the hands of a young Randgold Resources, which went on to develop major gold mines in West Africa and become a part of world class gold miner Barrick.

The gold field now under Theta’s control includes 6.1Moz of resources at an average grade of 4.17g/t, over 1.6Moz of those in the higher confidence indicated category and over 1Moz at Beta alone.

Theta is aiming to revive the operations by scaling up production from four underground mines at Beta, Rietfontein, Frankfort and CDM, producing 1.1Moz over 12.9 years based on its current mining inventory at a head grade of 5.95g/t and underground production rate of 540,000tpa.

That would deliver 80-100,000ozpa within three years of the mine’s development, with average all in sustaining costs of ~US$900/oz, among the lowest in South Africa and some of the lowest in the world.

However, those numbers are largely based on a definitive feasibility study from 2022, using a base case gold price of just US$1642/oz.

With spot gold now double those levels, an updated study is due in the September quarter, likely to make the economics even stronger.

“I joined the company about six years ago (and) we’ve doubled the resource from 3Moz to 6Moz, we’ve restructured the company and we’ve got 30 guys on the ground now, so we effectively have an operating mine site. Everyone on that site is an experienced miner,” Guy said.

“We just feel we’re in a very good spot, ready to go. We’ve completed all our studies, we’ll have one updated feasibility study in August in terms of the much higher gold price.

“Our first feasibility was at US$1642/oz and even at US$1642/oz it was a very profitable mine.“

Strong support

The first three mines included in the development have already been approved, Guy said, with 11km of exposed reef system to tap into.

Stockpiles estimated to hold 174,000z of gold are already stacked up for potential processing alongside the underground development, with underground stocks also left behind by the old timers on account of the very high cut-off grades the project was mined at historically.

Guy said the +5g/t grade of the mining inventory would be considered “very high grade dirt” if it was in Australia.

TGM has already secured the support of the South African Government’s Independent Development Corporation, which has signed an agreed credit approved loan facility agreement for US$35m ($53.8m) to cornerstone its debt finance.

The agreement includes attractive terms including a seven year term from first drawdown and an 18-month capital and interest moratorium.

Legal, technical and environmental due diligence has also been completed, a reflection of the importance of ESG considerations to investing in South Africa.

Guy says the social licence to operate is a major factor in mining approvals in South Africa, with Theta anticipated to have 500 full time employees once the mine is up and running, making it the largest private employer and taxpayer in the Mpumalanga region.

On the jurisdictional front, power supply issues which have plagued South African industry and consumers have become less prominent in recent times, Guy said.

The expansion of standalone power plants and solar power in the country in recent years has helped take pressure off the national grid, with transport infrastructure around the TGME site also improving.

“You have to remember also as a miner you’re a strategic industry and, effectively, you’re the last one to have the power turned off,” Guy said.

“I was there for 6-8 weeks before Christmas and we didn’t have one load shedding event or one power blackout.

“Things have improved dramatically. When I was there 2-3 years ago I would expect to have a load shedding event at least twice a day. So the power’s improved a lot.“

Emerging trend

Theta isn’t the only ASX miner aiming to restore an historic South African gold mine.

West Wits Mining (ASX:WWI) also has the support of the IDC via a senior debt facility for around US$50m for its Qala Shallows development in Gauteng, where it’s aiming to pour first gold via a toll treatment deal with Sibanye-Stillwater in Q4 2025.

Qala Shallows holds an ore reserve of 351,424oz, with the initial plan to ramp up to a rate of 70,000ozpa by 2028.

With a broader mineral resource of 5.025Moz at 4.66g/t gold at the broader Witwatersrand Basin project, a study is under way to assess the potential expansion of the WBP operation to 200,000ozpa.

The Qala Shallows development is also, like TGME, being placed under the microscope via a feasibility study review, with the price of gold well above the US$1850/oz used in its last DFS update in 2023.

“Obviously with the rise in gold price there’s a lot of opportunity to optimise that cut-off grade, which will add a lot of reserves or (resources) which we excluded from our mining plan,” WWI CEO Rudi Deysel told Tylah Tully in a recent Stockhead TV interview.

“So the expectation is we can accelerate the buildup of the production profile, as well as increase our reserve base, which is a big thing, as well as increasing life of mine.”

West Wits recently raised $14m in a placement, of which US$5m will be used to buy back a 10% minority interest in the holding subsidiary for the WBP, taking its ownership at the mine level from 66.6% to 74%.

The rest will be used for the feasibility study review and optimisation, working capital and to commence operations at Qala Shallows.

“The intention is to mobilise and prepare for operations in the next two months and then early (H2 2025) we will start with our production,” Deysel said.

The plan is to build up a 30,000t stockpile for six months after mining begins before trucking to Sibanye’s Ezulwini plant, with a first gold pour expected early next year.

Away from gold but still in the realm of precious metals, the development landscape for Southern Palladium’s (ASX:SPD) Bengwenyama platinum and palladium mine is also looking brighter after platinum prices surged to an 11 year high of more than US$1400/oz in early July.

At Stockhead, we tell it like is it is. While Theta Gold Mines and West Wits Mining are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.