Astute is unlocking Red Mountain’s true lithium scale

Big scale present at Astute Metals’ Red Mountain lithium project. Pic: Getty Images

- Astute Metals’ Red Mountain project is central to its lithium ambitions when the market turns

- Every hole drilled to date has returned +1000ppm lithium, highlighting project’s strong potential

- Mineralisation strike of more than 5.6km, with more likely to be found

Special Report: It is no secret that the lithium market is facing challenging times with prices hitting their lowest point since February 2021.

But the companies still in the lithium game are in for the long haul with global consultants Wood Mackenzie flagging the current oversupply situation could peak in 2027 and potentially shift to a deficit by the early 2030s.

Indeed, the longer prices remain depressed, the more violent the recovery is likely to be when it comes.

There are some analysts who have flagged that a recovery could occur sooner, with suggestions that higher cost producers have slashed output. Chilean lithium giant SQM’s chief executive officer Ricardo Ramos suggested in March 2025 that a positive trend could start in 2026.

Astute Metals (ASX:ASE) chief executive officer Matthew Healy agreed, saying that while lithium was going through a tough time at the moment, there is an increasing number of analysts who think a supply deficit could occur as quickly as the fourth quarter of this year.

“If that comes about, the lithium price can move very quickly. The last time it ran, no one saw it coming,” he told Stockhead in a video interview, adding that lithium carbonate prices once reached up to US$70,000-$80,000 per tonne against ~US$8500/t today.

“Whether it’ll do that this time, I don’t know. I can’t tell you that. But one thing I can say is it’s an immature market. Things can change very quickly.”

Red Mountain lithium project

Central to Astute’s lithium ambitions is the Red Mountain project in central-eastern Nevada.

It hosts broad mapped tertiary lacustrine (lake) sedimentary rocks known locally as the Horse Camp Formation and is connected to the regional mining towns of Ely and Tonopah via the Grand Army of the Republic Highway (Route 6).

Sedimentary rocks elsewhere in Nevada host large lithium deposits such as Lithium Americas’ 62.1Mt lithium carbonate equivalent (LCE) Thacker Pass project, American Battery Technology Corporation’s 15.8Mt LCE Tonopah Flats deposit and American Lithium’s 9.79Mt LCE TLC project.

Initially staked in 2023, surface sampling campaigns carried out by Astute indicated widespread lithium anomalism in soils and confirmed lithium mineralisation in bedrock.

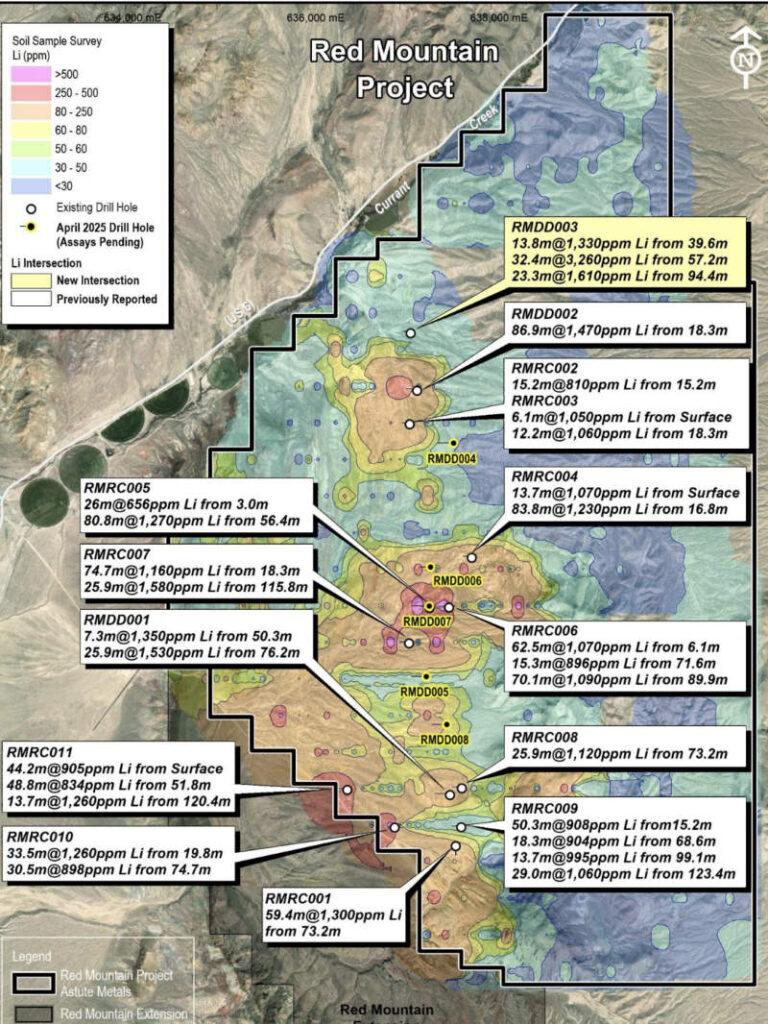

Its maiden drill program led to the discovery of high-grade lithium clay mineralisation, with every one of the 11 reverse circulation holes – totalling 1518m over a 4.6km strike –intersecting strong mineralisation.

Notable hits include 59.4m grading 1300 parts per million lithium (0.69% LCE) from a down-hole depth of 73.2m, 83.8m at 1230ppm lithium from 16.8m and 80.8m at 1270ppm lithium from 56.4m.

Scoping-level leachability tests on this material indicated high leachability of up to 98%, varying with temperature, acid strength and leaching duration.

More recently, the company’s diamond drill program in April this year has followed up on its initial exploration success with even more success.

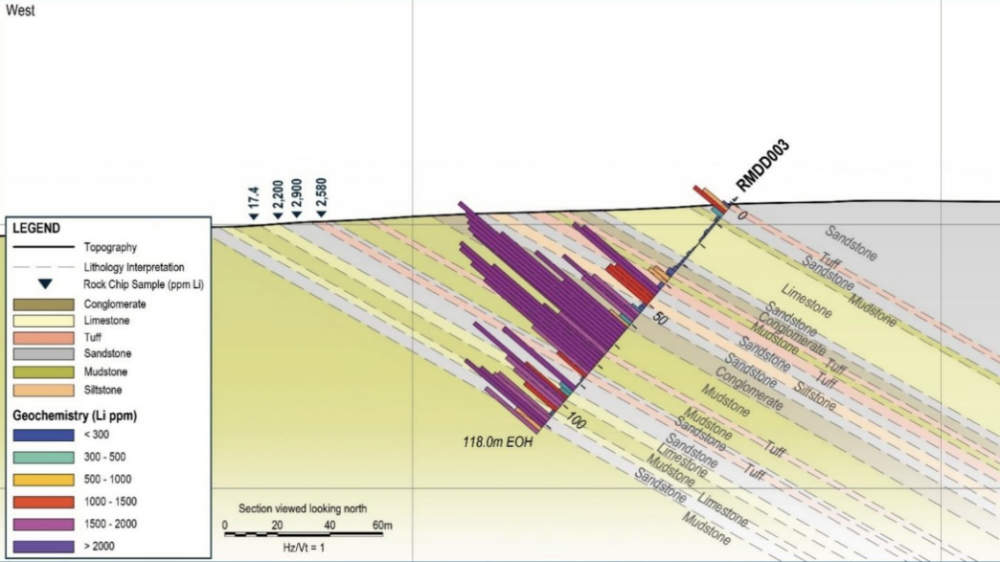

The first hole – RMDD003 – has extended the strike length to more than 5.6km while returning the highest-ever drill intersection to date of 8.6m at 5060ppm lithium (2.69% LCE) from 67.7m, within a broader 32.4m interval at 3260ppm lithium from 57.2m downhole.

RMDD003 is also the northernmost hole at Red Mountain and sits some 630m north of the previous northernmost intersection of 32.1m at 2050ppm lithium within a broader 86.9m zone at 1470ppm lithium in hole RMDD002.

Healy was excited about the result, amongst the best seen within the lithium clays in Nevada.

“We’ve drilled 14 holes at the project so far that we have assays for. We’ve got a few more in the pipeline. Those are drilled along a 5.6 kilometre strike now,” he added.

“We’ve intersected high-grade lithium over 1000ppm in every single one of those holes drilled. That’s pretty unique for an exploration project. You continue to drill and you just keep hitting grades. So that is pretty exciting.

“The mineralisation is thick – up to about 80 metres wide. And yeah, we’ve got a lot more results in the pipeline.”

The second hole delivered as well, hitting a zone of 9.1m at 1350ppm Li from 57.9m within a broader zone of 80.8m at 860ppm Li from 12.2m and 8.3m at 1210ppm from 240.8m to the end of hole in a broader strike of 15.9m at 955ppm Li from 233.2m to end of hole.

Critically, it’s the first diamond hole to successfully intersect blind mineralisation at Red Mountain, proving the geological model holds up under alluvial cover.

“This provides increased confidence in the geological model that underpins the Red Mountain exploration target as we rapidly advance towards the planned delivery of a maiden JORC mineral resource Estimate later this year,” ASE chairman Tony Leibowitz, a founding father of lithium giant Pilbara Minerals, said.

“Our exploration at Red Mountain to date indicates significant scale potential, with lithium mineralisation confirmed over a strike length of almost 6 kilometres. This latest drilling is continuing to firm-up these results and reduce risk, successfully intersecting lithium between holes to delineate an increasingly robust and coherent body of mineralisation.”

Assays from the remaining four wells in the drill program will come through over the next four or five weeks along with metallurgical results over the same timeframe.

This data will then be pulled together to update its exploration model.

Adding interest, proof of concept beneficiation completed on diamond core samples have successfully removed 36% of the dense material whilst increasing the lithium grade by 22% using a Falcon C concentrator.

The success of simple beneficiation techniques bodes well for future commercial development of the project.

Not the only project

Besides Red Mountain, Astute also holds the Needles gold project in Nevada about 100km southeast of the 15Moz Kinross-owned Round Mountain open cut gold mine.

Nevada itself is no stranger to gold with the state having produced over 215Moz of the precious metal since 1835.

The Needles project was historically mined for epithermal gold and silver mineralisation in the early 1900s.

Subsequent geophysical exploration has identified the potential to host an orebody of similar size and structure to the Round Mountain deposit.

Road ahead

Astute also plans to finish out the year with another drilling campaign and define a maiden JORC resource estimate in the fourth quarter of 2025 at Red Mountain.

Future drilling could test the potential of the northern zone where surface sampling has indicated that mineralisation could extend northwards by a further 410m beyond RMDD003.

Success here will underscore the potential scale of the lithium project.

The company will also carry out further Falcon C beneficiation testwork on average and high lithium grade samples while beneficiation testwork using attrition scrubbing will be carried out as well.

“We’re pretty confident with the results we’re seeing now that this project is going to be one of the top lithium clay projects in the state,” Healy said.

This could find ready buyers in the US, which is in the process of building a domestic battery supply chain to break or reduce reliance on Chinese supply.

This article was developed in collaboration with Astute Metals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.