Astral’s group gold resource jumps to 1.46moz off back of Feysville update

The company is now working on the pre-feasibilty study for Mandilla, which will include the higher-grade ore from Feysville. Pic: via Getty Images

- Astral Resources increases Feysville resource to 5Mt at 1.2g/t for 196koz

- Feysville set to contribute economic upside to Mandilla gold project production

- Mandilla PFS and further exploration underway

Special Report: Astral Resources has updated the resource at its Feysville gold project in WA to 5Mt at 1.2g/t for 196koz of contained gold – increasing the group’s total resources to 1.46Moz.

The company is focused on the development of its flagship Mandilla project, which hosts 37Mt at 1.1 g/t Au for 1.27Moz of contained gold, with its scoping study last year highlighting a standalone project comprising three open-pit mines feeding a 2.5Mtpa processing facility, producing 80 to 100koz per year, and incorporating a gold price of A$2,750.

And that did not include any contribution from the Feysville project, around 14km south of the KCGM Super Pit in Kalgoorlie, which has seen an almost 2Mt resource estimate jump thanks to this announcement.

The Mandilla scoping study included the processing lower grade material of approximately 4.5Mt of Mandilla ore grading less than 0.70 g/t during the first five years of operations.

The higher grade Feysville ore is now expected to displace this ore, contributing significant economic upside to the upcoming Mandilla Pre-Feasibility Study (PFS).

Essentially, this puts the company on track to demonstrate a development pathway for a sustainable and profitable gold business in the Kalgoorlie region based on both its Mandilla and Feysville projects.

Critical mass to support Mandilla

“When we returned to drilling at Feysville in November 2022, we did so with a view to building critical mass to support our flagship Mandilla gold project,” Astral Resources’ (ASX:AAR) managing director Marc Ducler said.

“As our understanding of Feysville increased, we formed the view that the highly underexplored Feysville tenement package had the potential to contribute several 100,000-ounce open pit opportunities to the broader Mandilla gold project as contemplated in the Mandilla scoping study.

“With today’s Feysville MRE announcement, Astral is well on the way to delivering on this potential.

“The mineral resource estimates across both Mandilla and Feysville are now consistently reported within pit shells incorporating a A$2,500 gold price and cut-off grades of 0.39g/t gold.”

Potential to increase Mandilla production target

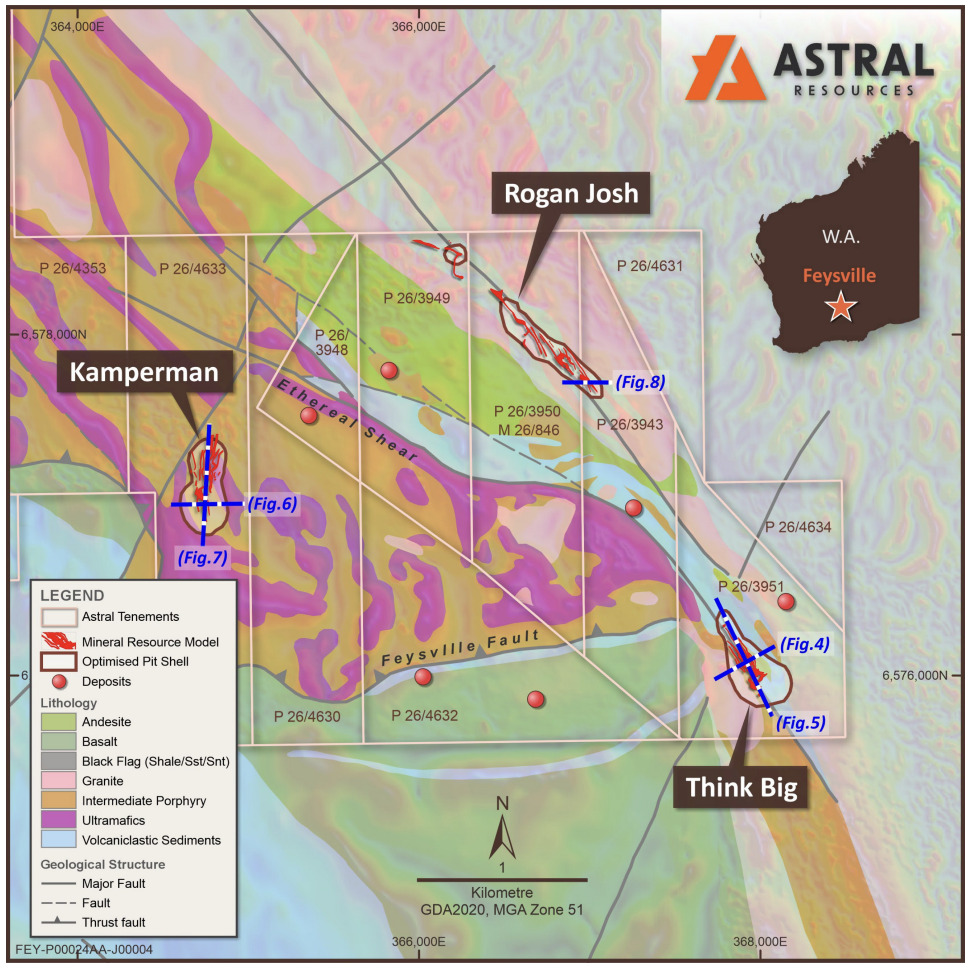

The Feysville update includes maiden resources for the Kamperman and Rogan Josh deposits plus an updated resource for the Think Big deposit.

The oxide and transitional deposits at Rogan Josh and Think Big total 1.6Mt at 1.3g/t for 68.2koz of contained gold.

When combined with the 2.0Mt at 1.3g/t for 83.8koz of contained gold at Kamperman, Astral considers there to be significant potential to increase the production target for the Mandilla PFS, with work well underway.

“While we acknowledge that using a gold price of A$2,500 to constrain the Feysville MRE is too conservative given the current spot gold price exceeds A$4,000, we intend to update the Group MRE using a more appropriate gold price and cost assumptions as the current data becomes available through advancement of the Mandilla PFS,” Ducler said.

“To adjust revenue pricing assumptions prior to gaining certainty over cost assumptions is not considered appropriate.

“Importantly, the maiden Kamperman MRE has yielded a 1.3g/t open pit resource with a 5.9:1 strip ratio.

“Given our intention is to use a gold price of at least A$2,600 for pit design for the Mandilla PFS, we are very confident that a strong conversion of this resource into the production target will be achieved and, hence, make a material contribution to the economics of the Mandilla PFS.”

More growth on the cards at Kamperman

Ducler also notes that the Kamperman deposit offers further significant growth potential based on the results of the recent 31-hole/3,834 metre reverse circulation (RC) drill program recently completed – with the results not included in the Kamperman resource estimate.

One of the reported intercepts in particular – 3 metres at 177g/t Au from 74 metres as part of a broader intersection of 25 metres at 24.3g/t Au from 68 metres (FRC3785) – suggests scope for considerable upside with further drilling.

“Similarly, the supergene deposits present at both the Think Big and Rogan Josh mineral resource estimates are also likely to have a very high conversion rate into a production target,” he said.

“Astral remains committed to further increasing the group mineral resource estimate through extensional drilling, as well as increasing the geological confidence levels – and, hence, categories – through further in-fill drilling.”

Exploration and PFS in the works

Two rigs are currently on site at Mandilla, a diamond drill (DD) rig and an RC rig, with the results will be incorporated into a revised Mandilla resource estimate.

The RC rig is then expected to relocate to Kamperman before the Christmas period for further in-fill and extensional drilling.

“Astral expects to report revised resource estimates for both Mandilla and Feysville in Q1 next year, ahead of the anticipated completion of the Mandilla PFS in Q2 2025,” Ducler said.

This article was developed in collaboration with Astral Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.